Welcome to US Crypto News Morning Briefing. A critical overview of the most important developments in cryptocurrencies of the day.

Grab a coffee and let’s analyze what rocked global markets this weekend. Silver soared, then fell sharply, and behind the scenes there were whispers of a collapse in leverage. While metals traders were panicking, Bitcoin quietly moved in the opposite direction, suggesting this was a change in liquidity rather than just volatility.

Today’s crypto news: Silver chaos, banking rumors, Bitcoin bidding — here’s what matters

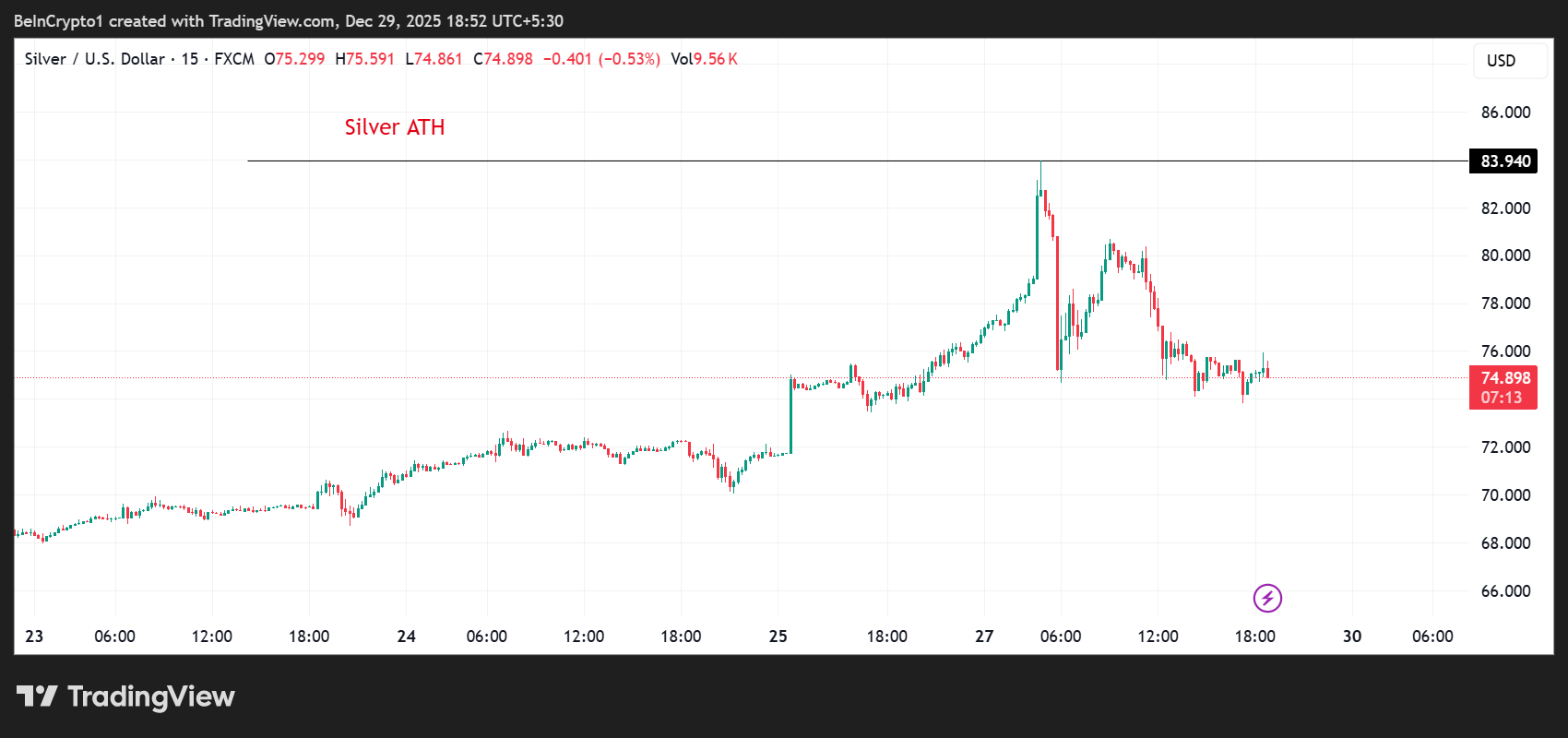

The silver market was in turmoil over the weekend, and Bitcoin traders were watching closely. In a wild move that exposed the massive leverage in commodity markets, silver soared to an all-time high near $84 before falling more than 10% in just over an hour.

The speed and scale of the reversal shook futures markets, triggered margin hikes and reignited concerns about systemic risk, while Bitcoin quietly gained bids.

At the heart of the turmoil was unconfirmed reports circulating on social media claiming that systemically important banks were forced into liquidation by futures exchanges in the early hours of December 28 after failing to meet huge silver margin calls.

the bank just went bankrupt

It was probably a short precious metal

Last time a bank failed, this was bullish for Bitcoin pic.twitter.com/P3eh99QJSM

— Crowted (@CloutedMind) December 29, 2025

The complaint alleges losses related to hundreds of millions of ounces of silver short exposure and more than $2 billion in emergency liquidity needs. As of Dec. 29, no major media outlets or regulators have confirmed the bank’s failure.

Still, the market reaction was undeniable.

Silver price fluctuations were extreme even by commodity standards. Silver prices soared to a record $83.75 shortly after futures trading began, but fell to $75.15 within 70 minutes.

Silver (XAG) Price Performance. Source: TradingView

“…watching $4 billion long silver evaporate in just over an hour…one of the fastest wipeouts I’ve ever seen. Liquidity appeared to completely disappear during the decline, and the price teleported lower as the bidding dried up,” wrote analyst Shanaka Anslem.

As volatility explodes, the CME Risk Management team announces significant increases in margin maintenance across nearly all precious metals products.

The CME Risk Management Team sends a letter announcing significant increases in margin retention for nearly all precious metal products after market close tomorrow 👀 pic.twitter.com/8B8SDI93Il

— Kevin Malone (@Malone_Wealth) December 29, 2025

The move suggested exchanges were moving quickly to rein in leverage following wild volatility. This pattern is well known and has often been seen in past stress events in commodities and cryptocurrencies.

Bitcoin takes over as metal prices break

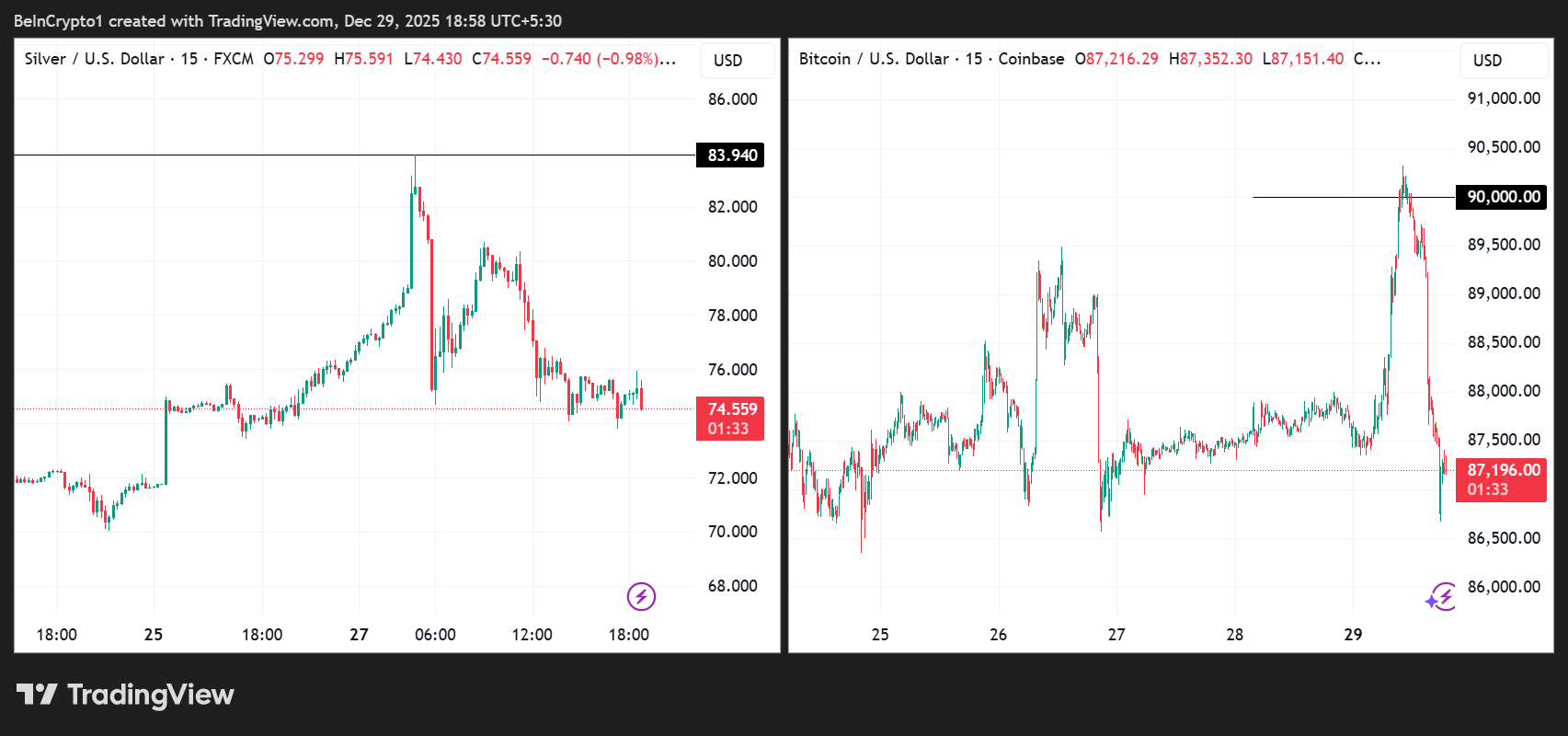

While metal traders were forced out, Bitcoin started moving in the opposite direction. Crypto Rover noted that silver fell by about 11% as crypto prices began to soar, suggesting a rotation rather than new capital flowing into the market.

💥Breaking news:

Silver has fallen 11% in the past few hours as cryptocurrencies have started to soar.

Money is circulating from silver and gold to Bitcoin and the broader crypto market. pic.twitter.com/7vtUhG0ZvT

— Crypto Rover (@cryptorover) December 29, 2025

In fact, when silver started rolling, Bitcoin prices took up bids and the pioneering cryptocurrency briefly tested the psychological level of $90,000. The similarities were striking:

- Highly leveraged positions are under pressure,

- The required margin increases,

- Forced liquidation is accelerating,

- Capital took refuge elsewhere.

Regardless of whether the rumored bank failures are true or not, the sequence of events is consistent with a pattern in which stress in traditional leveraged markets often precedes inflows into Bitcoin.

Some analysts urged traders to ignore the most sensational claims. Shanaka later highlighted verifiable data points that did not garner as much attention as the rumors of bankruptcy. JPMorgan disclosed nearly $4.9 billion in unrealized losses on silver, going from a huge short position to owning about 750 million ounces of physical silver.

“While the story of the collapse may be fiction, the reversal of position has been filed with the SEC,” he wrote.

This difference is important for crypto traders. The important signal wasn’t the headline. Rather, it was the speed of liquidity after leverage expired.

As the paper market for silver was occupied, Bitcoin acted less as a speculative asset and more like a pressure valve.

today’s chart

Silver and Bitcoin price performance. Source: TradingView

Byte size alpha

Here’s a rundown of US crypto news to follow today.

- Although the price of XRP appears to be breaking, investors are quietly doing the opposite.

- China’s digital yuan will become interest-bearing under the new framework in 2026.

- Ethereum staking entry queue exceeds exit queue after 3 months — what’s next for ETH?

- 3 gold market signals that suggest Bitcoin price may be near the bottom.

- Is America finally solving its crypto mess? Lummis’ bill could change everything.

- Hyperliquid drops hint at HYPE Unlocks — what will happen on January 6th?

Pre-market overview of virtual currency stocks

Crypto market open race: Google Finance

The post Bitcoin attracts capital flight as silver futures margin call crisis triggers liquidity shock | US Crypto News appeared first on BeInCrypto.