New on-chain analysis by TKResearch Trading shows that large holders are steadily gaining stronger control over Shiba Inu liquidity available on centralized exchanges.

TKResearch highlighted in its report that Shiba Inu is experiencing a supply crunch due to a sharp decline in the number of tokens held on exchanges.

Largest foreign exchange outflow since December 5th

According to the analysis, shiv has recorded continued net outflows from centralized exchanges since December 5th. During this period, investors withdrew approximately $80 trillion. shiv Due to the increase in tokens, the total exchange balance will plummet from approximately 370.3 trillion to nearly 290.3 trillion shiv.

As a result, sell-side liquidity has shrunk significantly. Typically, once a token leaves an exchange and moves into a private wallet, it becomes less available for trading. This behavior indicates that accumulation is occurring in advance of the next potential rebound.

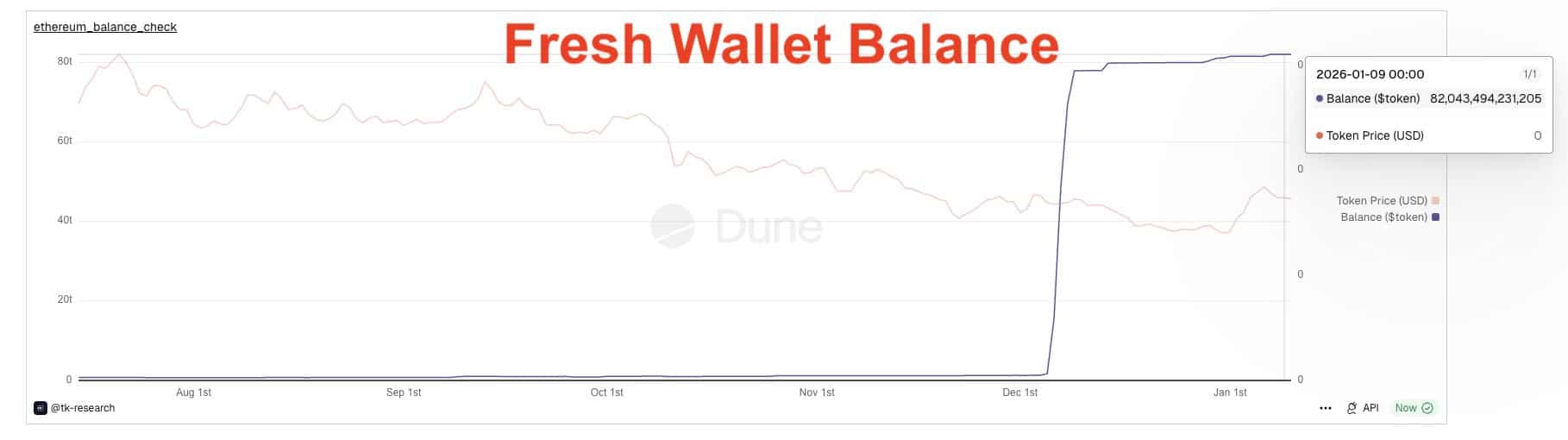

Fresh wallet absorbs most

Adding further context, TKResearch revealed that some newly created wallets withdrew approximately $82 trillion shiv Data from major centralized exchanges for the past 60 days.

Specifically, the data shows exactly 82,043,494,321,205 (82.04 trillion). shiv There have been exits from exchanges during this period, with Coinbase accounting for a significant portion of these outflows. The report showed that the accumulation occurred at a price level around $0.0000085.

Shiba Inu Fresh Wallet Balance

Notably, this analysis also examines the Shiba Inu supply structure, highlighting how it is becoming increasingly constrained. shivliquid supply. Out of 589 trillion 240 billion shiv Only about 290.4 trillion tokens in circulation remain on centralized exchanges. Therefore, less than half of the total circulating supply is available for immediate trading.

Shiba Inu distribution data confirms the advantage of major companies

Furthermore, TKResearch’s wallet distribution index supports the view that supply management is steadily increasing among large players. Specifically, the top 100 wallets hold 57% of the total supply, or approximately 831.8 trillion pieces. shiv. This figure represents an increase of 15.11% over the past 180 days.

Moreover, holdings in so-called “smart money” wallets have increased by 68.27% in the past six months to reach 10.01 billion, indicating increased interest from more sophisticated investors. Meanwhile, the whale stock has jumped 428% in the past 180 days, reaching 1.3 billion. shiv token.

Conversely, exchange holdings shiv It has fallen 23.91% in the same period, further reinforcing the accumulation story. moreover, shiv The balance associated with official figures decreased by 4.88% to approximately 399.92 billion tokens.

Shiba Inu Exchange Sanctuary

Based on this analysis, TKResearch concludes that the Shiba Inu is showing early signs of supply depletion. The float available for open market trading continues to shrink as investors continue to withdraw their tokens from exchanges and consolidate them into larger wallets. If this pattern continues, shivPrice trends can be sensitive to spikes in demand, as reduced liquidity often increases volatility.

Meanwhile, Shiba Inu is trading at $0.00000860, down 0.49% in the past 24 hours, extending its 7-day decline to 1.24%.