SharpLink CIO Matthew Sheffield had to set the record straight, addressing a news report on November 6 that went viral after blockchain analytics platform Arkham Intelligence incorrectly reported that a wallet linked to SharpLink Gaming had moved significant ETH to CEX.

The company has made a name for itself with its aggressive Ethereum (ETH) accumulation strategy, and any fallout from the sale would have called into question the health of its business and liquidity levels.

Mislabeling had far-reaching effects

According to a post shared by Lookonchain and based on data from Arkham, SharpLink had redeemed 5,284 ETH and deposited 4,364 ETH on the OKX exchange a few hours earlier. Historically, such moves typically occur before companies offload their tokens to the market.

All this attention has led to widespread speculation, with the consensus leaning towards SharpLink launching a large-scale ETH sale. The volatile price of Ethereum didn’t help matters, and the unrealized losses on the company’s holdings continued to increase.

What followed was a short-term market turmoil. But after Sheffield it all ended implicit The tweet said the wallet was incorrectly tagged with Arcam’s platform and not with SharpLink.

In response to his post, Arkham revealed “Labels are predictions from the AI model and are not Arkham-verified labels. AI-predicted labels are indicated with a purple outline and a question mark.”

The post went on to say that Arkham-verified SharpLink wallets appear under the SharpLink entity on Arkham, and the wallet in question is not one of them.

Sheffield acknowledged that the wallet no longer reflects the SharpLink label, but expressed appreciation for Arkham’s clarification.

“Predicting wallet ownership is an interesting problem,” he says. added. “Probabilistic assumptions, by definition, are never 100% accurate. But from what I’ve seen, this is a generally effective tagging algorithm. I’m a big fan of the Arkham product.”

This incident temporarily put selling pressure on the ETH price and SBET stock, and the stock price fell by 8% on November 6th. However, the market subsequently corrected as sentiment stabilized.

Sharplink raises $76.5 million through premium-priced stock deal

According to sources, Sharplink raised $76.5 million in a direct stock offering at an above-market price. press release I received this from my company last month. The company sold 4.5 million shares for $17 per share, a 12% premium over the Oct. 15 closing price of $15.15, according to the release.

This price reflects a premium to the net asset value of the 859,000 ETH held by the company and reflects “strong institutional confidence” in the company’s strategy.

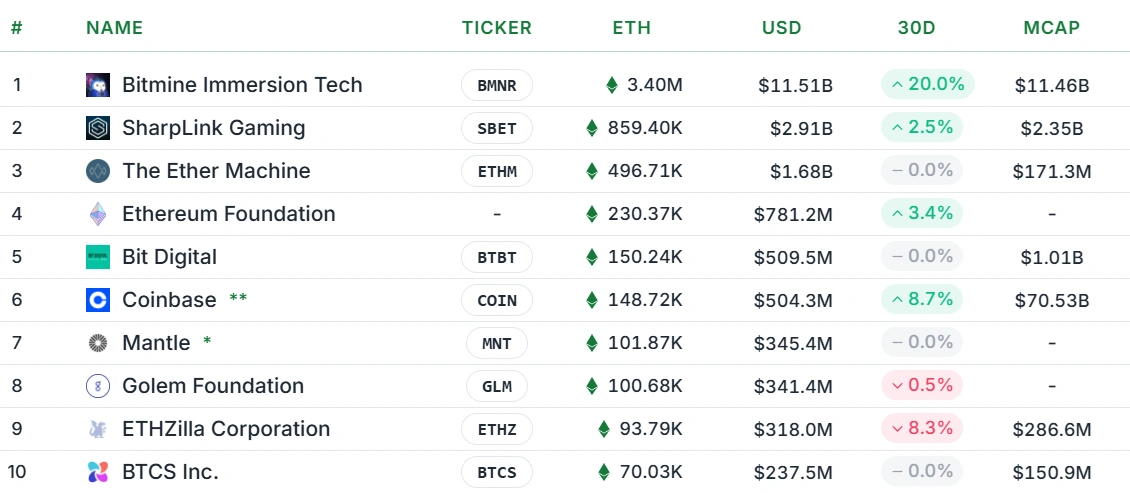

Top 10 companies holding Ethereum. Source: Strategic ETH Reserve

An anonymous institutional investor bought up the stock and received a 90-day option to buy an additional 4.5 million shares at a price of $17.50.

As of now, the company is second in ether holdings after Bitmine Immersion Technologies (BMNR), currently holding 3.4 million ETH.

They accomplished this by using equity issuance to fund purchases in self-reinforcing cycles during bull markets. While the strategy has worked so far, it still receives mixed reviews, with critics basing their arguments on factors such as excessive leverage and exposure to volatility.