Fidelity has filed with the US Securities and Exchange Commission (SEC) to enable FBTC redemption in physical form. Bloomberg Intelligence ETF Research Analyst James Seyffart has confirmed his X application.

Seyffart’s confirmation was countered by rumors that the FBTC is allowing current redemptions. Commentators say the SEC has not yet allowed this, despite the regulators expected to ultimately allow it.

He said:

“After seeing a lot of accounts reporting that fidelity can create/redemption in physical form with Bitcoin ETFs, the SEC has not yet allowed this… The SEC expects to approve this.

Beyond fidelity, several other publishers have submitted modifications to allow for redemption of this type of spot Crypto ETF products. These include Ark 21Shares, Galaxy, Wisdomtree, Vaneck and Invesco Galaxy.

Interestingly, it’s not just Bitcoin ETFs. The Eth Spot ETF has also submitted an amendment, with the CBOE exchange recently submitting five ETFs.

If approved, redemption of physical institutions allows authorized participants to create and redeem Crypto ETF shares directly in Bitcoin, rather than converting their digital assets into cash first.

Commentators like Seyffart say this will increase the efficiency of Spot and Futures Crypto ETFs, allowing them to trade in the same way as traditional ETFs. It is also expected to reduce costs by helping participants avoid taxes related to transactions.

This change, if approved, will affect only ETF institutional participants rather than retailers, but the idea of redemption in physical form remains something the crypto community is wary of. This is why the FBTC approval rumours quickly circulated on X.

Fidelity’s physical redemption approval is likely to arrive in October

Rumors of approval have been exposed, but Seifert pointed out that it is likely to arrive by October. He said this is because the first official deadline for the SEC to decide to correct the pending coefficients is around October 10th.

He said:

“The official deadline for the creation/redemption of all kinds of physical items is October (October 10th). Our basic case is that all of it will be approved by October.”

However, he acknowledged that the recent submission of amendments by the CBOE is a positive indication as it indicates that work is being done to finalize this decision.

Interestingly, this is not just a decision on the Crypto ETF before the SEC. The regulator has also made decisions ahead of hundreds of Spot Crypto ETFS applications and has yet to unlock two multi-set fund stay orders approved for conversion to ETFs.

Bitcoin ETF shows 3-day leaks

Meanwhile, Bitcoin ETF has seen three consecutive days of leaks this week, and is expected to continue selling to the underlying assets since it peaked above $123,000.

According to data from Farside Investors, the product has combined $285.2 million over the last three days, with ARK 21 shares ARKB responsible for most of the leaks. Interestingly, BlackRock IBit has not seen any spills during this period. Instead, there was a two-day flow, recording an influx of $142.6 million on Wednesday.

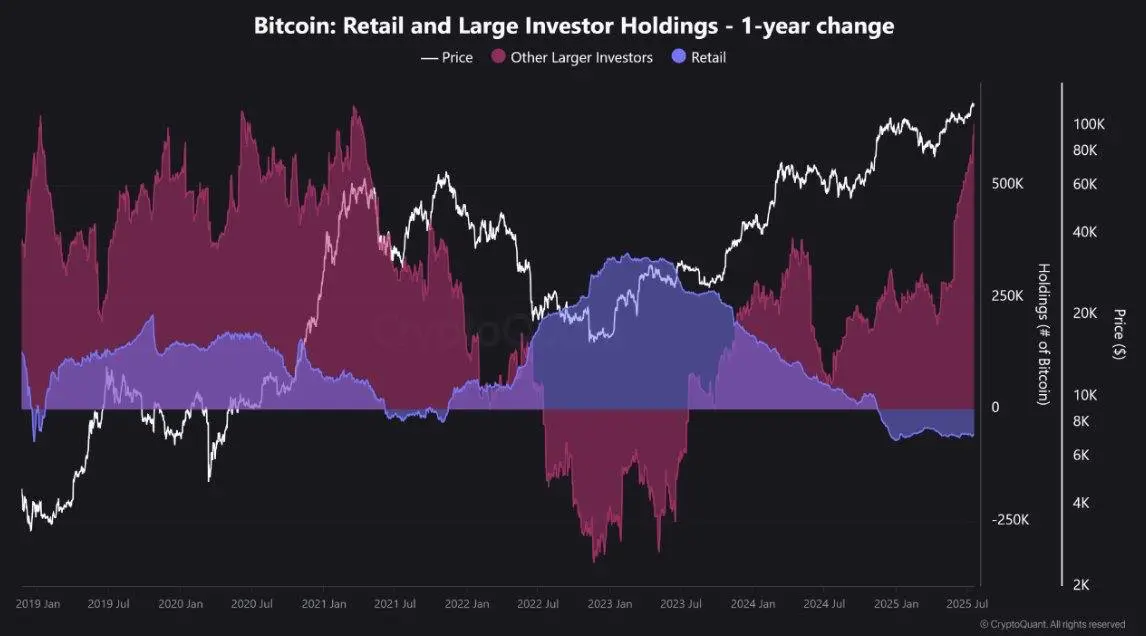

Despite the widespread outflow of Spot Bitcoin ETFs, analysts believe institutional investors remain behind the rally. Cryptoquanted verified analyst Burak Kesmeci noted that on-chain data and Google trends show that while retailers have been selling since early 2023, accumulation has been showing accumulation from large companies.

Big Bitcoin investors are pushing for price gatherings as retail holdings decline. Source: Cryptoquant

He said:

“The search for ‘Bitcoin’ has not been the lowest in the last five years, but it’s still pretty calm. So there is no retail FOMO or hype at this point. The crowd has not awakened yet. This cycle doesn’t look like the crazy 2021. ”

With no participation yet and BTC already scales multiple peaks, Kesmeci believes there may still be room for Bitcoin to rise. However, he pointed out that retail entries could mark the top of the market.