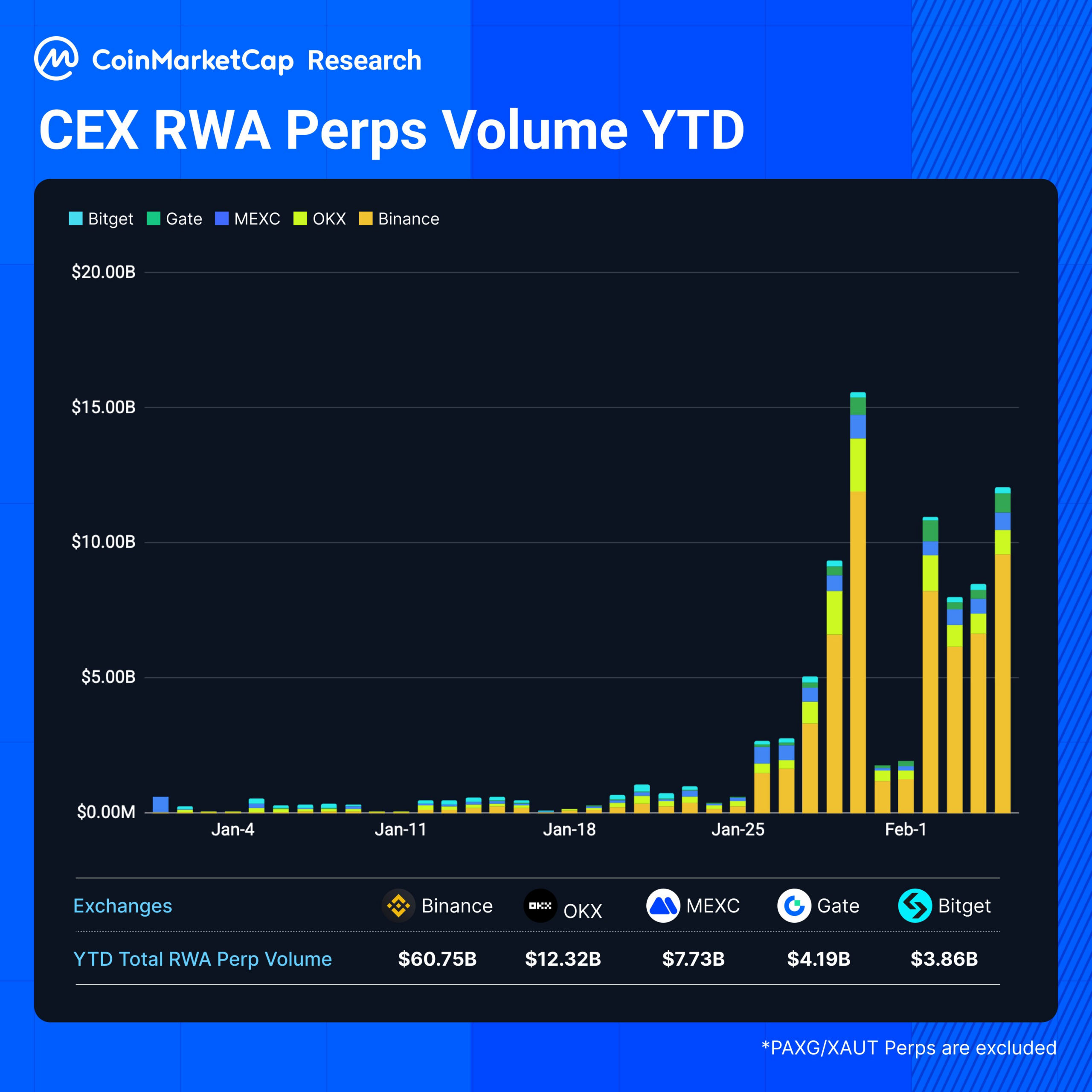

According to a recent X post on CoinMarketCap, there is a project that the RWA perpetual market is carving out a new sector in the wake of rising gold and silver prices. Over the past two weeks, there has been a significant increase in bets on real-world goods such as gold and silver using crypto derivatives.

Source: CoinMarketCap

Purps trading volume in RWA reportedly exceeded $15 billion as gold and silver reached an ATH of $5,500, or $121.64 per ounce, indicating that traders are not only testing these markets, but actively exploiting them.

RWA Perpetual is a crypto contract that allows users to bet on the price of RWA such as gold and silver 24/7 with no expiry date. Unlike buying digital tokens that represent real assets, traders simply trade based on price movements, similar to trading Bitcoin perpetual swaps.

On some crypto exchanges, the daily trading value of silver perpetual swaps is nearly as high as traditional COMEX silver futures. This shows that blockchain-based derivatives for real-world goods are gaining mainstream acceptance.

Related: Brazil leads global RWA revolution: reaching $100 million milestone in 2026

Expanding RWA with Gold and Silver

On January 5th and January 7th, Binance began allowing traders to speculate with gold and silver (XAU, XAG) perpetual contracts against USDT through authorized regulated entities on the Abu Dhabi Global Market. It is now the preferred platform for traders who use perpetual contracts to bet on gold and silver price movements.

Alongside Binance, several other crypto trading platforms also offer similar services. MEXC started offering gold and silver futures trading with no trading fees, HyperLiquid saw a surge in gold and silver trading activity, and Aster DEX had already listed metal perpetual trading and also had a rewards program incentivizing users to trade gold-silver perpetual swaps.

On Hyperliquid, the daily trading volume of the precious metal PERP exceeds $1.3 billion, making silver one of the most traded assets after Bitcoin.

Global economic factors caused significant fluctuations in gold and silver prices in early 2026. Unlike traditional markets that close overnight or on weekends, crypto perpetual trading allows traders to bet on and hedge against these price movements around the clock, making it attractive to a wide range of market participants.

Estimates suggest that the tokenized asset market could ultimately reach trillions of dollars by the end of the decade. In one of its older reports, global consulting firm McKinsey predicted that the market capitalization of tokenized assets could reach $2 trillion by the end of 2030.

Related: What are RWA’s performance and future prospects in 2026?

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.