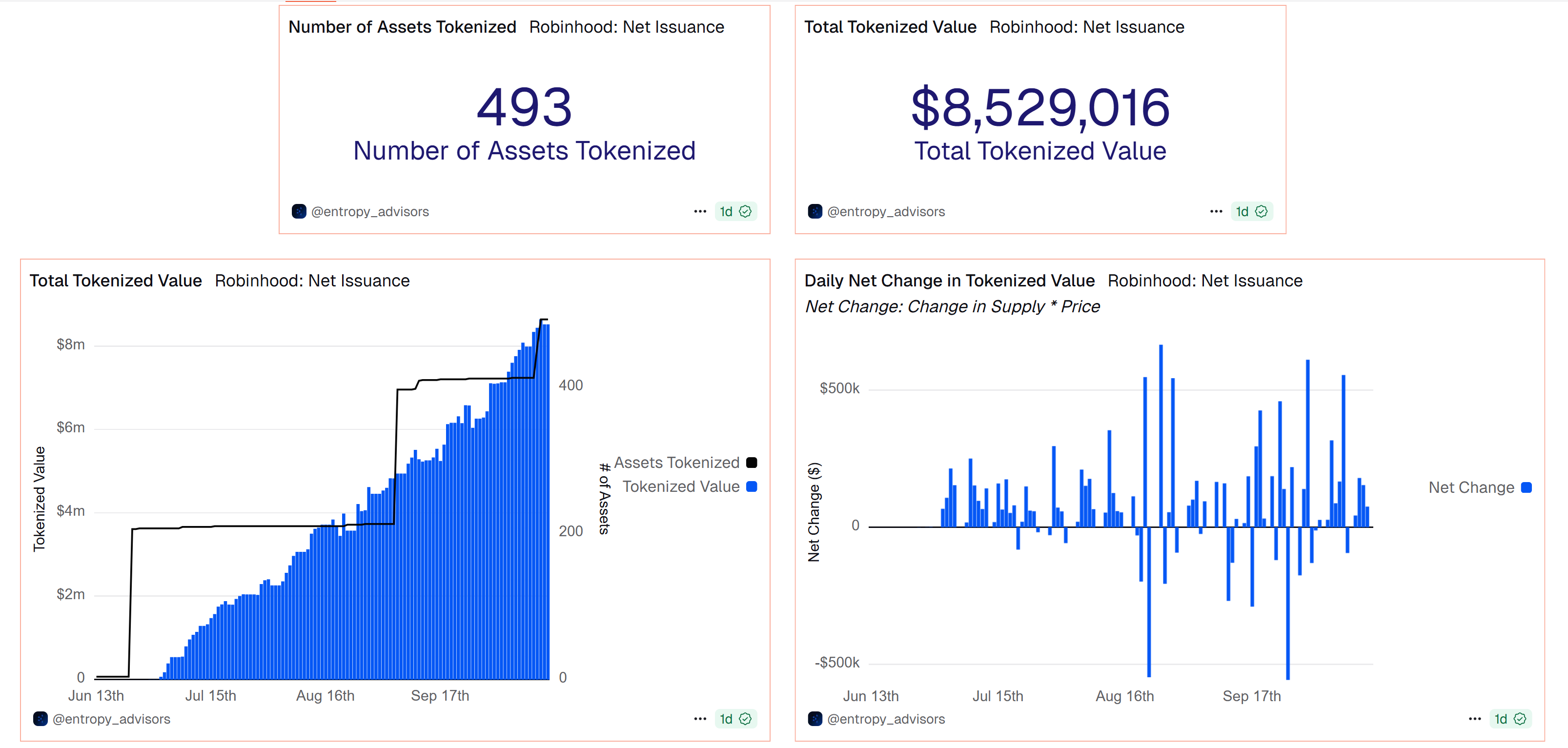

Robinhood has expanded its tokenization initiative on the Arbitrum blockchain, deploying 80 new equity tokens in the past few days, bringing the total number of tokenized assets to nearly 500.

According to data from Dune Analytics, Robinhood has tokenized 493 assets totaling more than $8.5 million. Cumulative mint circulation exceeds $19.3 million, offset by approximately $11.5 million in burning activity, indicating a growing but actively traded market.

Equities account for almost 70% of the total tokens deployed, followed by about 24% in exchange-traded funds (ETFs), with smaller allocations to commodities, crypto ETFs, and US Treasuries.

According to research analyst Tom Wang, the latest batch of tokenized assets includes Galaxy (GLXY), Webull (BULL), and Synopsys (SNPS). “Thanks to tokenization, Robinhood EU users can now own a wider range of US stocks, equities and ETFs,” he said.

Robinhood has tokenized 493 assets. Source: Dune Analytics

Related: Ondo Finance to SEC: Postpones Nasdaq’s tokenized securities plan

Blockchain-based derivatives instead of physical stocks

In June, Robinhood launched a tokenization-focused Layer 2 blockchain built on Arbitrum, allowing EU users to trade tokenized U.S. stocks and ETFs as part of its Real World Assets (RWA) expansion.

The company’s equity tokens reflect the price of U.S.-listed securities, but do not represent direct ownership of the underlying shares. The company says it is instead structured as a blockchain-based derivative regulated under MiFID II (Markets in Financial Instruments Directive II).

The company also claims that the stock token has 24-hour market access, no hidden fees beyond a 0.1% exchange fee, and you can start investing from as little as 1 euro ($1.17).

However, this development is being watched closely. In July, the Bank of Lithuania, which regulates Robinhood in the EU, asked for clarification on the structure of the token. Tenev said the company welcomed the review.

Related: After success in the U.S., Robinhood looks to expand overseas prediction markets

Robinhood ramps up crypto expansion

Robinhood’s tokenization rollout comes shortly after the brokerage launched micro futures contracts for Bitcoin (BTC), XRP (XRP), and Solana (SOL).

In early May, the company acquired Canadian cryptocurrency platform WonderFi in a $179 million deal, further expanding its global footprint. Robinhood is also pushing for clarity around tokenization regulations in the US, submitting a proposal to the Securities and Exchange Commission calling for a uniform national framework governing RWA.

magazine: Back to Ethereum — How Synthetix, Ronin and Celo saw the light