Ripple’s expanded efforts in integrated digital asset infrastructure signal an effort to anchor real-time global finance by merging financial intelligence, custody, liquidity, and payments into a single enterprise platform.

Ripple expands institutional finance ambitions

Increasing institutional demand for real-time financial infrastructure is reshaping the way enterprises design their digital asset systems. Ripple announced on December 4, 2025 that with its Insight series, it has expanded its plans to provide an end-to-end platform for managing and moving value across traditional and on-chain environments.

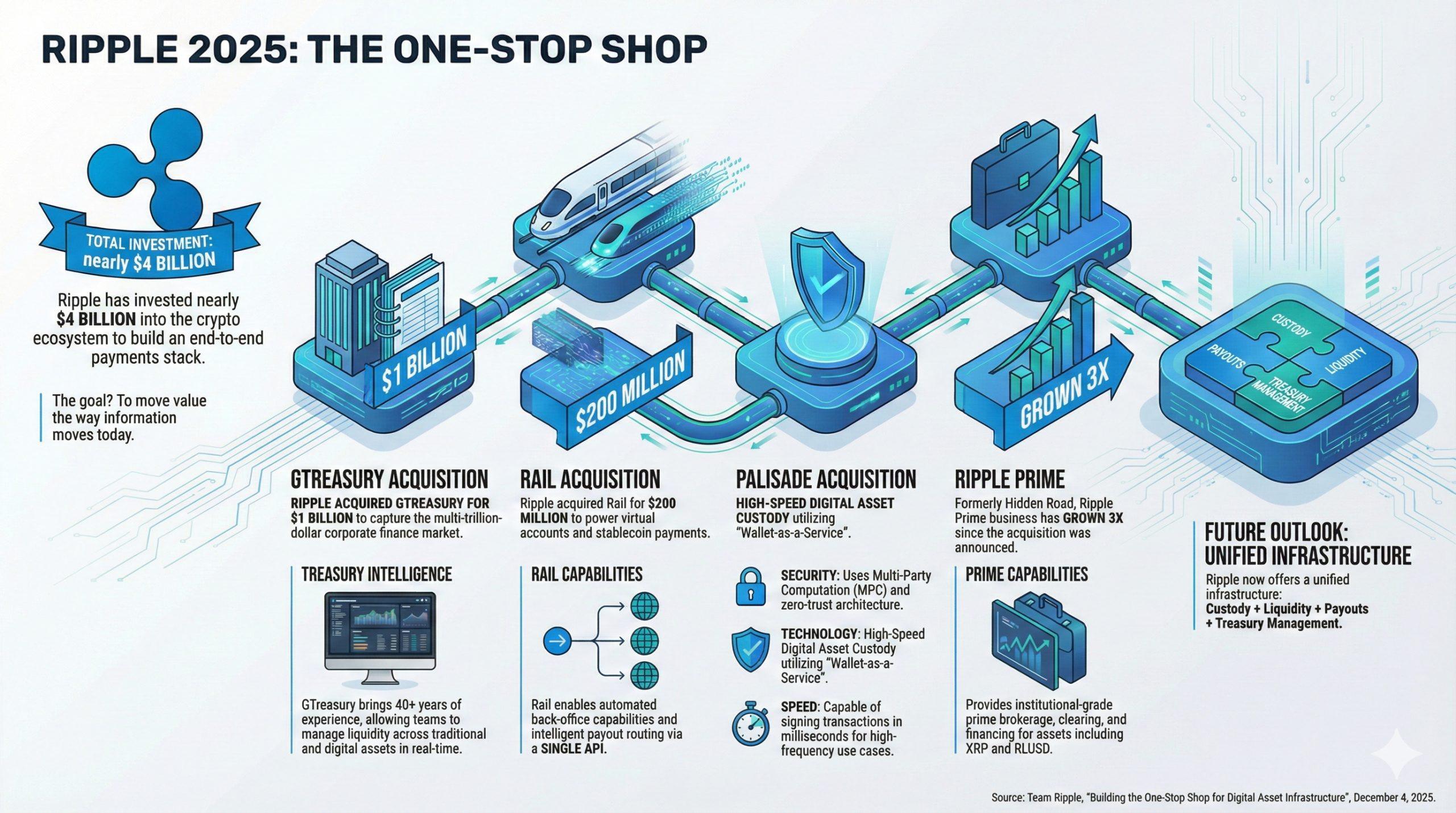

“Ripple has invested nearly $4 billion into the crypto ecosystem through strategic investments and acquisitions,” the crypto company said, adding:

But 2025 will be our most ambitious year yet, with four major acquisitions all aimed at one mission. It’s about becoming a one-stop infrastructure provider that moves value the way we move information today.

Insights detailed how GTreasury powers liquidity intelligence and access to global repo markets, Rail introduces virtual account and stablecoin payment capabilities, Palisade adds high-speed custody capabilities, and Ripple Prime supports institutional trading and finance.

“It’s a big day for the future of finance! With today’s addition of GTreasury (along with Rail, Palisade and Ripple Prime, which we already have), we have just completed four major acquisitions that make Ripple the first true one-stop shop for institutional digital asset infrastructure,” said Reese Merrick, Ripple’s senior executive officer and managing director for the Middle East and Africa, on social media platform X. The executive continued: “This is more than just adding more products for Ripple. It’s about removing friction, reducing counterparty risk, adding bank-grade security as an infrastructure, and ultimately giving treasurers, CFOs, and financial institutions the tools they’ve been looking for to scale their digital assets.”

read more: Ripple Payments accelerates XRP and stablecoins through NGN Lane

The company explained that by combining financial intelligence, custodial architecture, liquidity provisioning, and payment rails, companies can streamline operations and improve capital efficiency. Insight concludes:

Each of these acquisitions (custody, virtual accounts, financial intelligence, and prime brokerage services) adds significant capabilities to Ripple’s suite of solutions. But the real story is the sum of these parts. Ripple is building a one-stop infrastructure shop to power the next era of real-time global finance.

Some observers have warned that consolidation on this scale could increase reliance on a single provider, but proponents counter that a unified infrastructure could reduce friction, strengthen trust, and support broader institutional adoption of cryptocurrencies.

FAQ ⏰

- What core goals will Ripple’s 2025 acquisition support?

It aims to create an integrated end-to-end institutional digital asset infrastructure platform. - How does GTreasury fit into Ripple’s expanded ecosystem?

Enhance liquidity intelligence and provide access to global repo markets. - What role does Rail play in Ripple’s infrastructure stack?

Virtual accounts and stablecoin payment features are introduced. - Why do proponents think Ripple integration is beneficial?

They claim that a unified infrastructure will reduce friction, increase trust, and support institutional cryptocurrency adoption.