According to Jamie Elkaleh, Chief Marketing Officer of Bitget Wallet, while the decentralized exchange (DEXS) is rapidly gaining attention among retailers and Quant, the institutions continue to support a centralized platform.

Elkale told CointeLegraph that the most powerful adoption of platforms like Hyperliquid “is coming from retailers and para-experts.” Retail users are drawn in by Airdrop Cultures and Points Systems, but Quant supports “low rates, fast filling, programmable strategies.”

However, facility desks still rely on centralized exchange (CEXS) to help provide Fiat Rail, compliance services and prime brokers.

Elkare noted that the execution quality gap between DEXS and CEXS is rapidly closing. “Order book-based DEXs such as Hyperliquid, Dydx V4, and GMX provide the latency and depth that CEXS has been exclusive,” he explained.

Related: Bitwise file for Spot Hyperquid ETF in Perp Dex Wars

Dexs is trying to offer CEX speed trading with Onchain’s transparency

One of the leading persistent DEX platforms, Hyperliquid runs in its own chain and offers the Onchain Central Limit Order Book. “All orders, cancellations and fills are fully auditable,” Elkare said. “Perform without compromising decentralization.”

The platform aims to combine CEX-like speed with a self-supporting style, achieving a one-second finality without charging gas fees per trade. However, competition is intensifying. In the BNB chain, Aster has emerged as the top challenger.

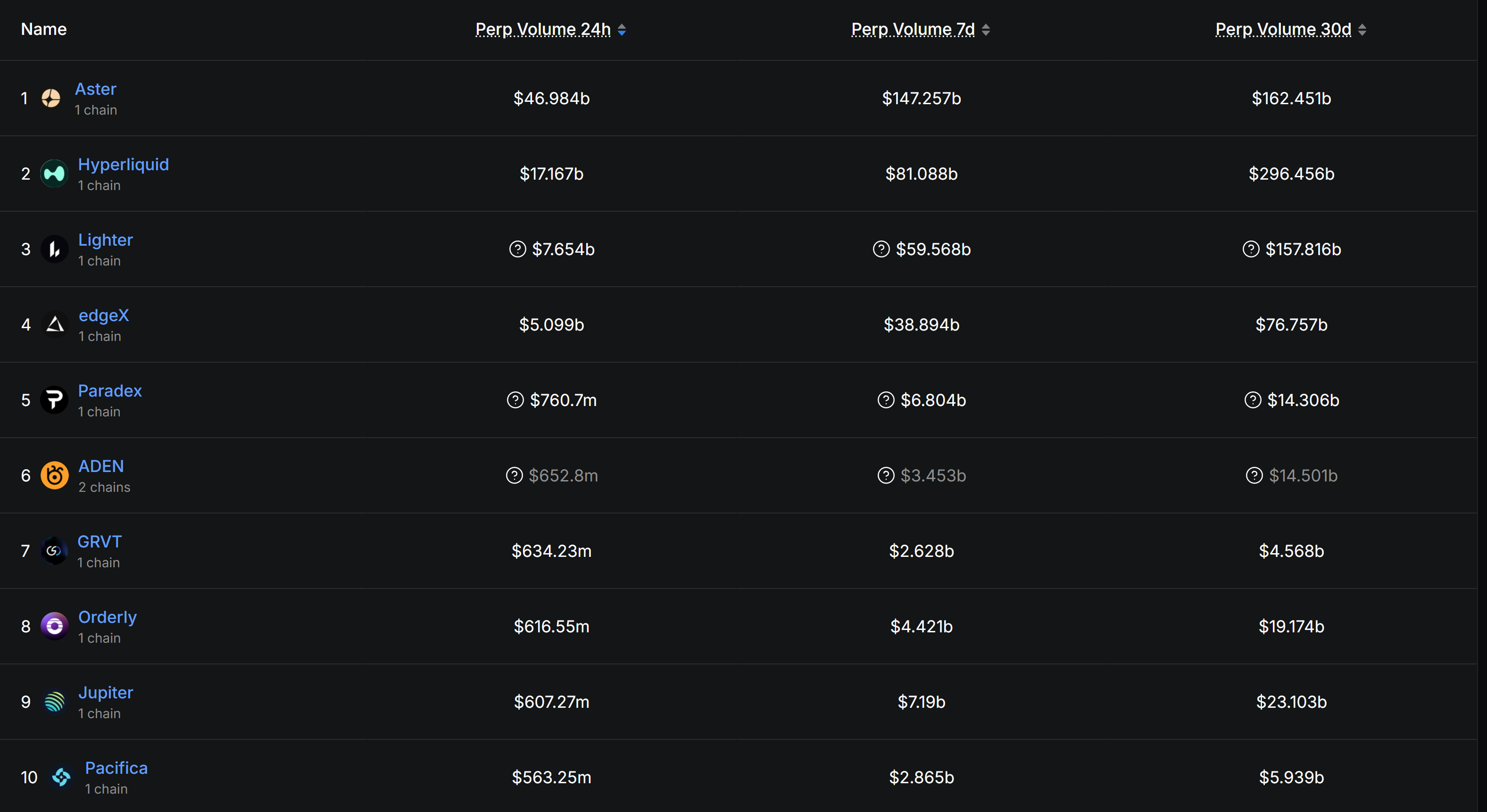

“Aster’s incentive campaign has recently pushed daily PARP volumes to record levels, even overtaking high lipids on certain days,” Elkare said. According to data from Defillama, Aster has registered about $47 billion in PARP volume in the past day.

Top 10 Dex Perps. Source: Defilama

The growth of BNB and Solana-based DEXS is noteworthy. The BNB PERP protocol has recently achieved sales of $6-70 billion each day, while Drift and Jupiter’s Purps are steadily gaining traction. According to Elkale, these ecosystems benefit from fast payments, smooth onboarding and incentives.

Still, Dex faces well-known risks. Elkale pointed to concerns about centralisation of validators or sequencers, Oracle failures, exploitable upgrade keys, and bridge vulnerabilities. He also flagged the challenge of maintaining a reliable liquidation engine during volatility.

On Friday, Aster refunded traders affected by the glitches in the permanent market of Plasma (XPL). The price surges have led to unexpected liquidation and fees.

Related: Aster tips the hype by market capitalization, collecting an additional 480%: Analysts

DEXS and CEXS coexist

Looking ahead, Elkare said he hadn’t seen Zerosum’s outcome. “Dex is definitely the future of trade rails from code,” he said. “At the same time, CEXS is essential for Fiat’s liquidity and onboarding.”

“We can see a hybrid model that combines both strengths over the next decade, creating a balanced ecosystem where coexistence, not displacement, drives the next stage of the crypto market,” he concluded.

magazine: 7 Reasons Why Bitcoin Mining is a Worst Business Ideas