Major public mining companies have been aggressively raising billions of dollars through convertible debt, making this the largest financing since 2021.

This could be a turning point for AI expansion, but it also risks diluting equity and increasing debt pressure if profits fail to accelerate.

A new wave of large-scale bond issuance

2025 will bring clear changes to the way Bitcoin miners raise funds. Bitfarms recently announced the issuance of a $500 million convertible note due in 2031. TeraWulf has proposed a $3.2 billion senior secured debt offering to expand its data center operations.

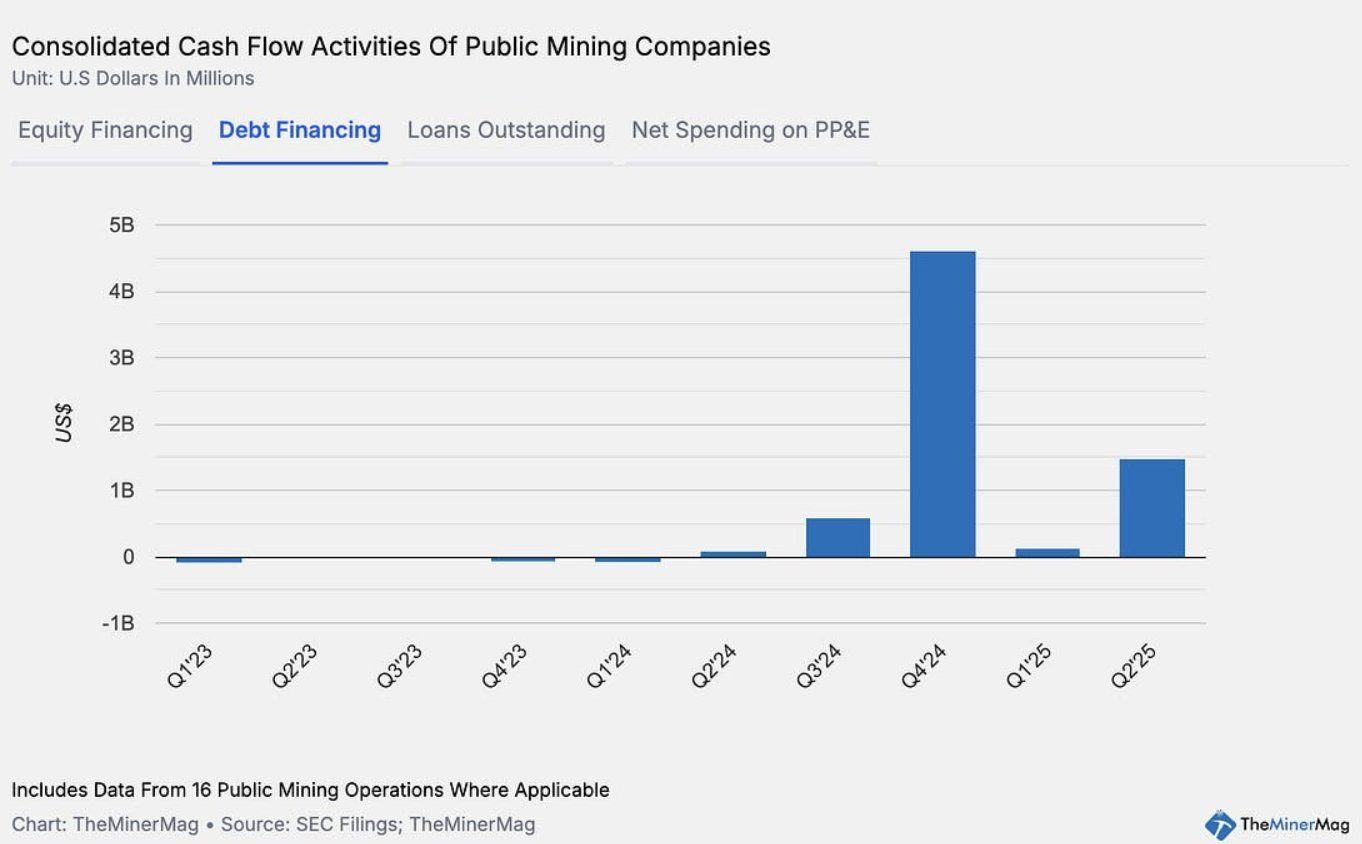

Total convertible and bond issuance by 15 public mining companies reached a record $4.6 billion in the fourth quarter of 2024, according to TheMinerMag. This number dipped below $200 million in early 2025, but jumped again to $1.5 billion in the second quarter.

Consolidated cash flow activities of public mining companies. Source: TheMinerMag

This capital strategy reflects MicroStrategy’s recent successes. However, today’s debt model is fundamentally different from the 2021 cycle in the mining industry. At the time, ASIC mining rigs were often used as collateral for loans.

Public mining companies are increasingly turning to convertible debt as a more flexible financing approach. This strategy shifts financial risk from seizing equipment to potential equity dilution.

This gives companies more room to operate and expand, but also requires stronger performance and revenue growth to avoid a decline in shareholder value.

opportunities and risks

These capital inflows can become powerful growth levers as miners pivot to new business models such as building HPC/AI infrastructure, providing cloud computing services, and leasing hashing power.

Diversifying into data services promises more long-term stability than pure Bitcoin mining.

For example, Bitfarms secured a $300 million loan from Macquarie to fund HPC infrastructure for the Panther Creek project. If AI/HPC revenues prove sustainable, this funding model could be much more resilient than the ASIC lien structure used in 2021.

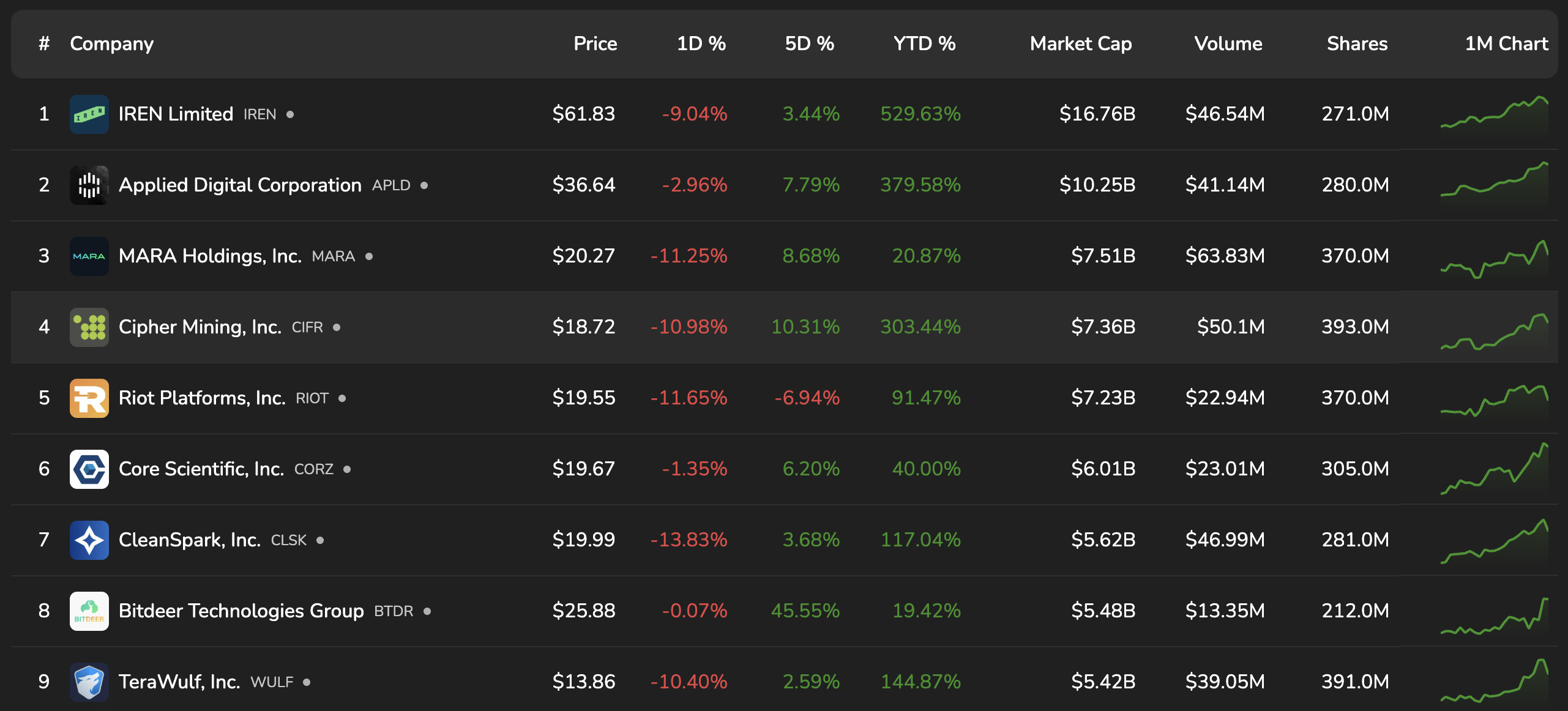

The market has seen a positive reaction to mining stocks when companies announce bond issuances, with stocks rising as expansion and growth stories are highlighted. However, there are risks if expectations are not met.

Stocks in mining companies. Source: bitcoinminingstock

Assume that the sector was unable to generate additional income to offset financing and expansion costs. In that case, equity investors would bear the brunt through significant dilution, rather than the seizure of equipment as in previous cycles.

This comes as Bitcoin mining difficulty has reached an all-time high, putting pressure on miners’ profits, while mining performance across major companies has been on the decline in recent months.

In short, the mining industry is once again testing the limits of financial engineering: the balance between innovation and risk, as it seeks to pivot from energy-intensive mining to public mining companies raise billions of dollars in debt to fund AI.Pivot appeared first on BeInCrypto.