Bitcoin has shown mixed price action in recent sessions, marked by sharp fluctuations and tentative attempts at recovery. BTC has rebounded after a brief decline, but momentum remains fragile.

The main concern is a decline in confidence in one of Bitcoin’s most influential groups, which could complicate efforts to maintain a broad price recovery.

Bitcoin holders witness a drop in profits

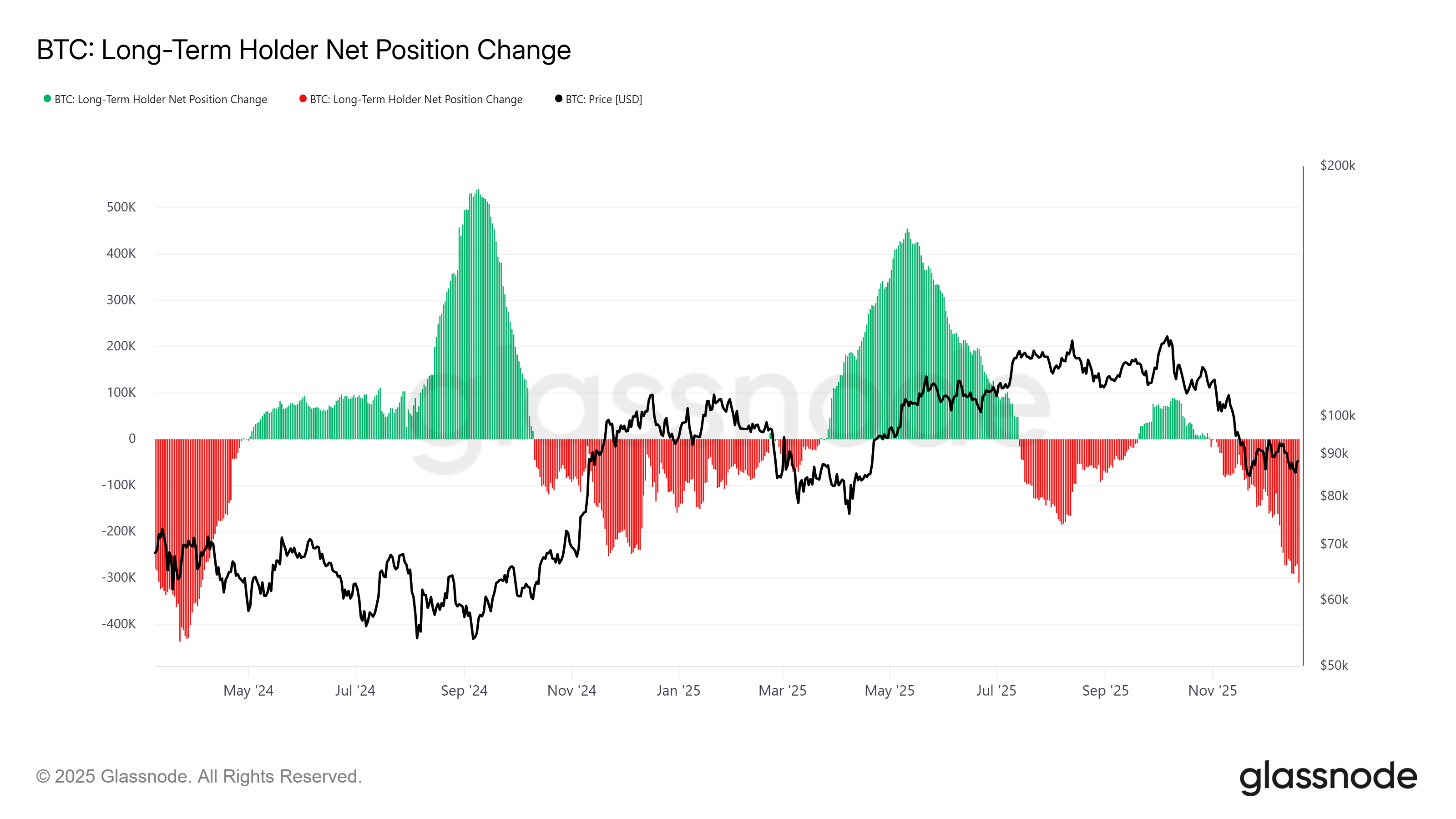

Long-term Bitcoin holders have increased their selling activity in recent days. On-chain data shows that the 30-day change in supply for long-term holders has fallen to a 20-month low.

Similar levels were last recorded in April 2024, indicating increasing distribution pressure.

This action suggests that long-term holders are reducing their exposure to protect their remaining interests. As unrealized gains shrink, selling accelerates in an attempt to avoid losses. Such measures often weigh on price recoveries, as supply increases without matching new demand increases.

Change of Bitcoin LTH position. Source: Glassnode

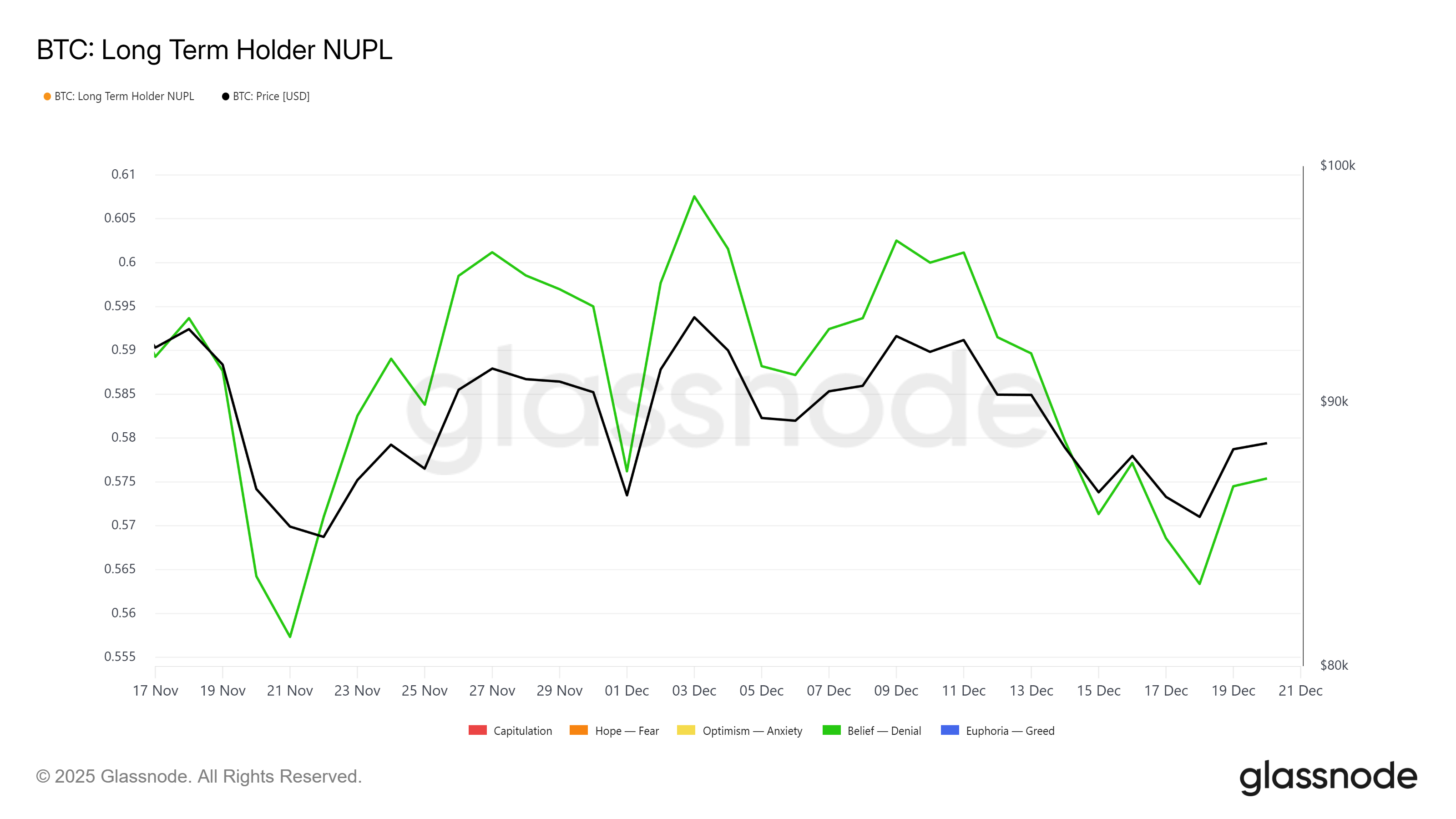

Macro indicators provide additional context. The net unrealized gain/loss indicator for long-term holders has fallen to its lowest level for the month. The decline shows that the group’s profits are being eroded, increasing its sensitivity to further declines.

Historically, a decline in LTH NUPL measurements triggers defensive selling. However, if the indicator falls further, the selling pressure often subsides.

At these levels, long-term holders typically suspend circulation, allowing Bitcoin prices to stabilize and potentially recover if demand improves.

Bitcoin LTH NUPL. Source: Glassnode

BTC price awaits stronger cues

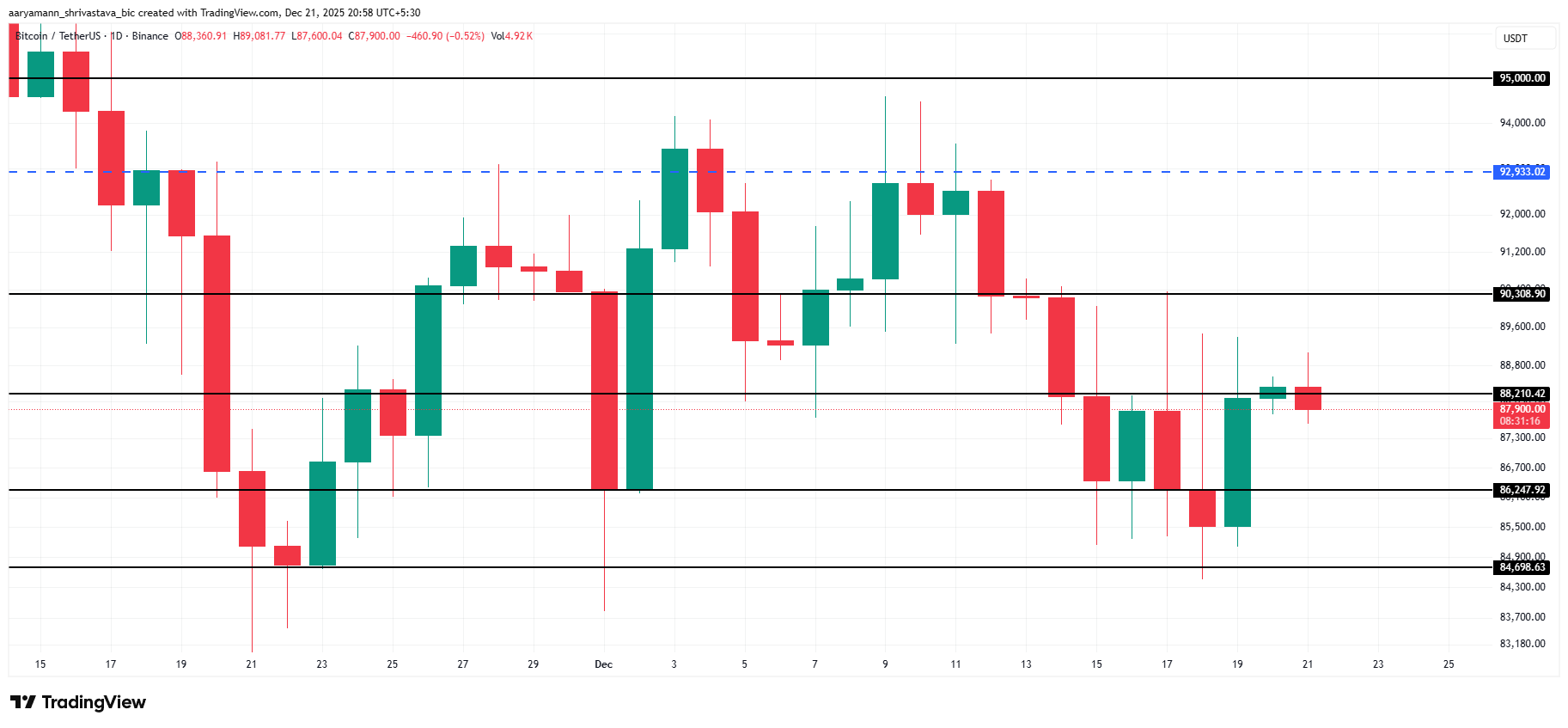

At the time of writing, Bitcoin is trading around $87,900 and remains below the $88,210 resistance. The asset briefly dipped below support at $86,247 before rebounding recently. This recovery indicates that buyers remain active at low levels, although confidence remains cautious.

A short-term rally towards $90,308 is still possible. However, resistance near that level could limit gains. Given the continued selling by long-term holders, Bitcoin is likely to continue consolidating around the $88,201 zone while the market absorbs the excess supply.

Bitcoin price analysis. Source: TradingView

If long-term holders change their stance, the upside potential will increase. Slower sales could ease overhead pressure.

In that scenario, Bitcoin could break above $90,308 and target $92,933. Such a move would invalidate bearish theories and signal renewed confidence among major market participants.