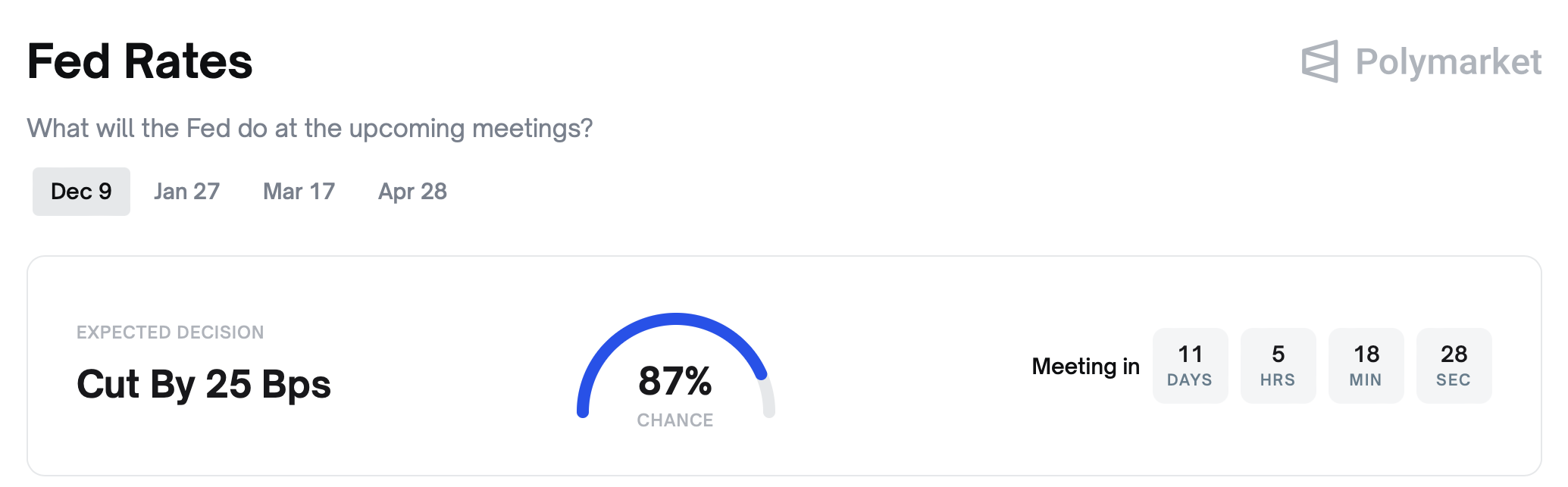

On Friday, several crypto-related stocks rose on Polymarket as the market odds of a December interest rate cut rose to 87%, the highest level this month.

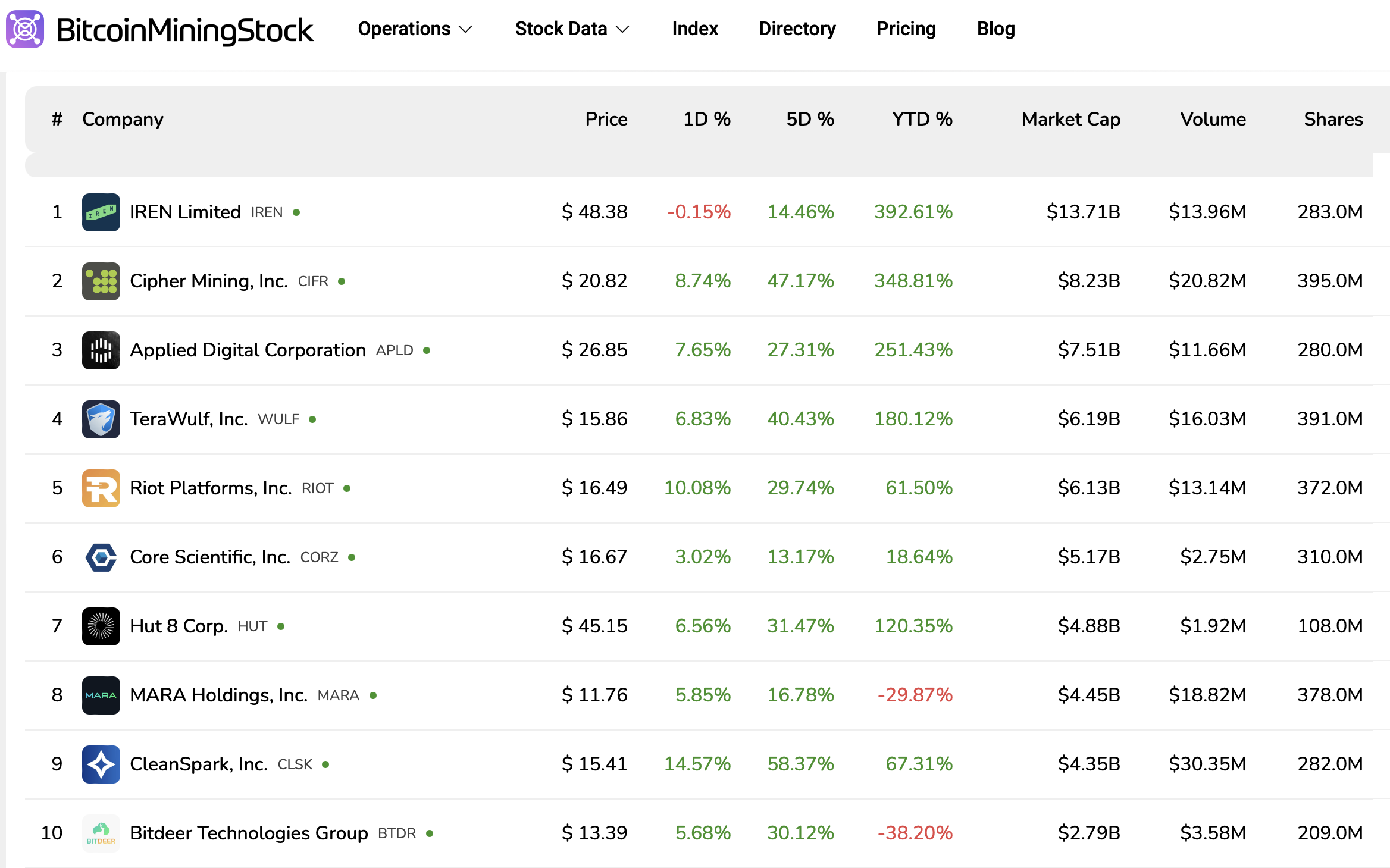

Three US-listed Bitcoin miners led the rally, with Cleanse Park, Riot Platform, and Cipher Mining all rising during the session, posting double-digit gains over the past five days.

The US may cut interest rates in December. sauce: Polymarket

USDC issuer Circle soared nearly 10% in early trading, while Michael Saylor’s Strategy and Coinbase posted more modest gains at press time, according to Yahoo Finance data.

Bitcoin (BTC) also rose about 7% this week after falling to around $82,000 on November 21, according to data from CoinGecko.

Top 10 Bitcoin Mining Stocks. bitcoin mining stocks

Much of this month’s movement in forecast market prices has been driven by comments from Federal Reserve officials.

On Oct. 29, Fed Chairman Jerome Powell said a December interest rate cut was “not a foregone conclusion,” a comment investors took as hawkish, meaning the Fed may delay cutting rates and keep conditions tight. Polymarket odds had fallen from 89% the day before to 22% by November 20th.

Sentiment shifted on November 17 when Fed Director Christopher Waller said that “the labor market remains weak and near stalling speed,” that inflation is currently “relatively close” to the Fed’s 2% target, and that the Fed should consider cutting interest rates next month.

Related: Carsi, Polymarket traders expect Supreme Court to curb Trump’s tariff powers

Prediction market expands as demand surges

Prediction markets such as Kalshi and Polymarket, which allow bettors to bet on the outcome of real-world events, have expanded their reach and influence this year.

On November 13th, Polymarket signed a multi-year agreement with TKO Group Holdings as the official predictive market partner of Ultimate Fighting Championships and Zuffa Boxing. This partnership comes on the heels of a partnership with North American fantasy sports operator PrizePix.

That same month, Kalshi raised $1 billion from Sequoia Capital and CapitalG, pushing its valuation to $11 billion, according to a TechCrunch report citing people familiar with the deal. This is the latest funding after raising $300 million in October.

Rumors that Coinbase is developing its own prediction market platform surfaced on November 19th after technology researcher Jane Manchun Wong posted a screenshot of an unpublished site. Wong’s image showed that the product will be offered through Coinbase Financial Markets and backed by Kalshi.

sauce: his freedom war

On Wednesday, Robinhood said more than 1 million users have traded 9 billion contracts since launching the product in March through its partnership with Calsi, making prediction markets one of its fastest-growing revenue drivers.

magazine: When privacy and AML laws conflict: Impossible choices for encryption projects