The online betting market went crazy after President Donald Trump dropped a tariff bomb. In response, the likelihood of a US recession in 2025 has skyrocketed, and crypto traders are priced it.

Polymarket, the wild west of the Crypto forecasting market, is currently blinking bright red warnings for the economy. Currently, the possibility of a recession in 2025 is at a 57% limit. After falling to 44% over the past week, the odds have just risen. However, the Crypto Linked Prediction Platform is nailing Trump’s 2024 victory.

Trump’s tariffs push the odds of the recession to 57%

Since returning to the office, Trump has promoted the Made-in-USA comeback and has called on countries who claim he has “ripped” America for years. In just a few weeks, the US has shifted from a stable economic force to a source of turmoil. Tariffs are almost everything, 25% are steel and aluminum, and 245% are slapped by Chinese imports.

Recession bets are currently trading at 57¢, while “no recession” is at 43¢, according to data shared by Polymarket. The rate peaked at 36 cents with a “no recession” at 64¢. The tracker recorded an odds on April 9th, reaching a 66% high. Shortly after the spike, emotions have declined, but uncertainty has spread and the odds have risen once more.

Source: Polymarket

Even the Giants feel the heat, but Goldman is seeing a recession risk of 45% and JPMorgan is seeing 60%. Meanwhile, Trump has not retreated as he recently called tariffs “drugs” and said the trade deficit would remain “climated.”

The probability of a US-China trade contract before June reached 38%. The chances of trading are traded at 38¢, while “no transaction” is 63¢. However, Polymarket traders believe there is a 91% chance that the Fed will not change prices, with only 8% expecting a 25 bps cut.

Economists reduce our growth to 1.4%

The fear of the recession is currently knocking hard at the US door, with new Reuters polls showing economists are nearly 50% likely to have a US recession over the next 12 months. It has skyrocketed from just 25% a month ago. In this scenario, Trump’s 90-day suspension on new tariffs is not much.

Inflation expectations skyrocketed, and economists reduced their growth forecasts. The US economy is currently expected to increase by just 1.4% in 2025, down from the 2.2% forecast last month. This is the most sharp downgrade since mid-2022. Economists say that real damage is caused by uncertainty and no one wants to invest or hire if the rules of the game can change overnight. This is becoming a critical feature of Trump’s economic policy.

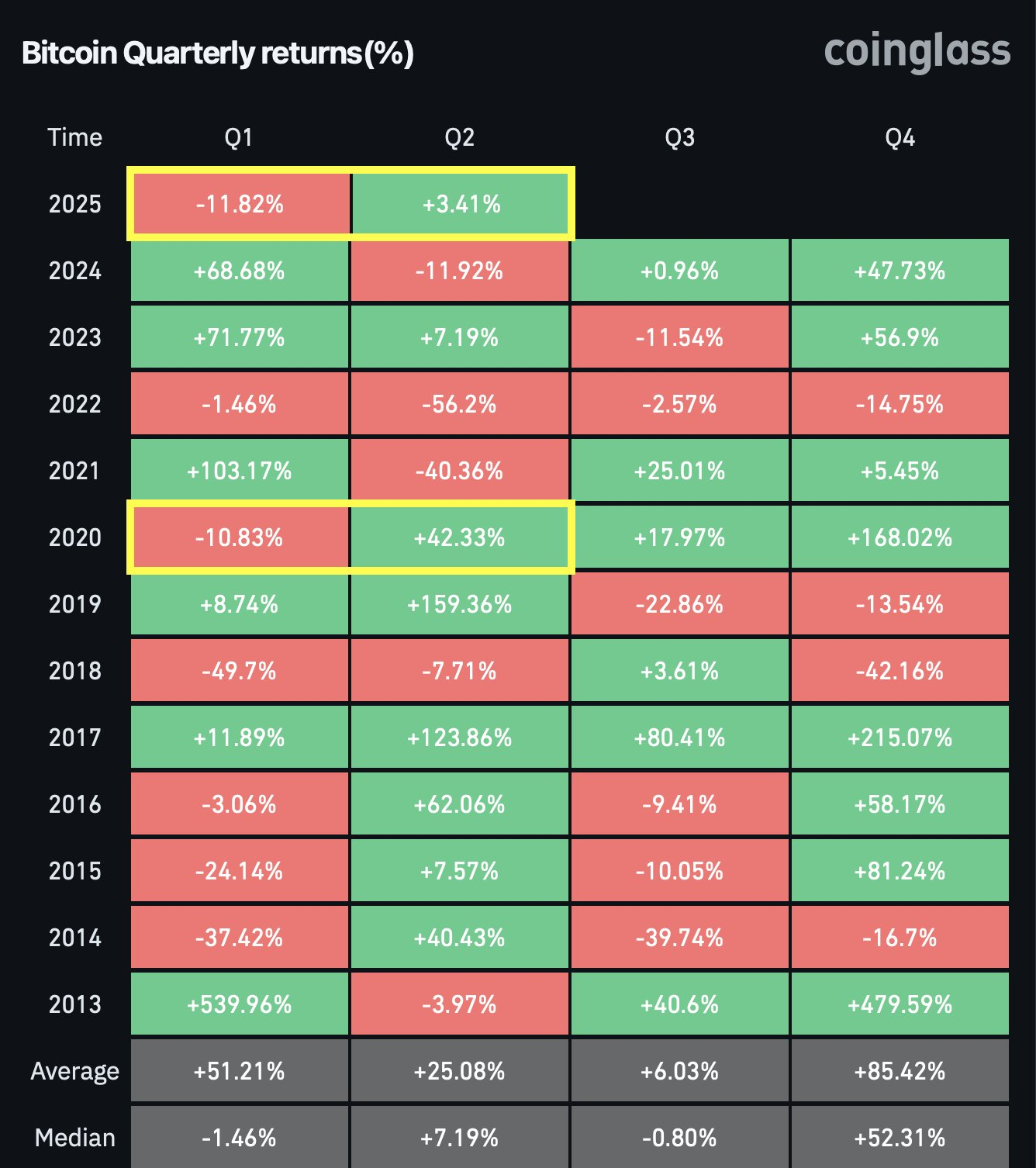

The global digital asset market, which had crossed the moon when Trump stepped into the White House, is also struggling. The cumulative crypto cap rose slightly on Saturday to $2.69 trillion. So far, Bitcoin, the largest crypto, has dropped by more than 11% over the past 60 days. BTC trades at an average price of $85,273 at press time. The 24-hour trading volume fell 32% to $12.4 billion.