Bitcoin closed the July month at $115,000. This is a $8,000 jump from the end of June, the highest end of each month in its history. According to analyst Planb, this record-breaking move is in line with his model. This suggests that the market is in the middle of a slow, stable bull market and is a long way to go.

On-chain data supports BTC Bull theory

According to on-chain metrics, the market is in the middle of a slow, stable bull market. Bitcoin’s current cycle continues longer than its previous cycle, and is still rising, despite already 18 months in length. Past bull markets have seen explosive price movements (100 times in 2013 and 10 times in 2017), but the current cycle has seen a triple rise so far.

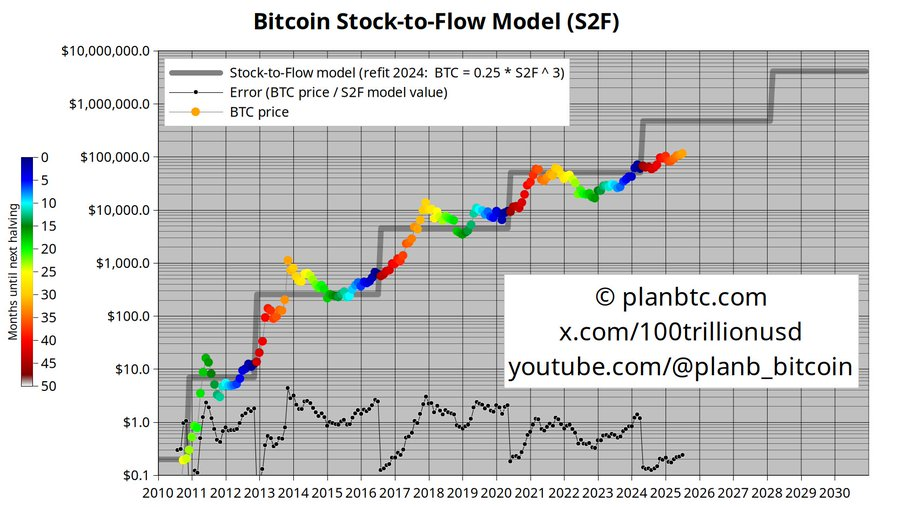

Based on his famous Stock-to-Flow (S2F) model, he said Bitcoin could average $500,000, with the widest possible range, ranging from 250,000 to 1 million dollars.

Source: planb

So why aren’t prices high, especially with a huge influx from companies like ETFs and MicroStrategy? Plan B explained that many investors are moving Bitcoin from their own obligation to ETFs and public finance companies. He did the same, partly for convenience and diversification.

Technical indicators are preferred

Technical also points out more upside down. The momentum indicator, the relative strength index (RSI), is currently 72.5, indicating strong upward momentum. Plan B expects RSI to rise towards the 80+ range, a typical zone for a stronger bull market.

Related: Crypto Market hits $3.8 trillion before abrupt rejection. What’s next?

Other indicators such as moving averages and realized prices also support bullish outlook. Bitcoin’s six-month perceived price just exceeded $100,000 for the first time, and the average cost base for Bitcoin holders is steadily rising.

What’s next for BTC? (short term)

The current price structure of Bitcoin is a bit troubling, but it could potentially provide more benefits in the short term. The important level to look at is $116,220.

Related: The US Dollar Index (DXY) plunge pushes Bitcoin to $115,000 when Fed rate cut speculation gets hot

If Bitcoin is able to penetrate above this, it could move to the current trending channel limit of $119,200. If that level is cleared, your next goal is about $126,000.

Source: TradingView

However, experts still believe that recent DIP may not be completely finished, and are looking at the confirmation. Overall, as long as Bitcoin retains its current support zone and continues this upward path, the outlook remains bullish.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.