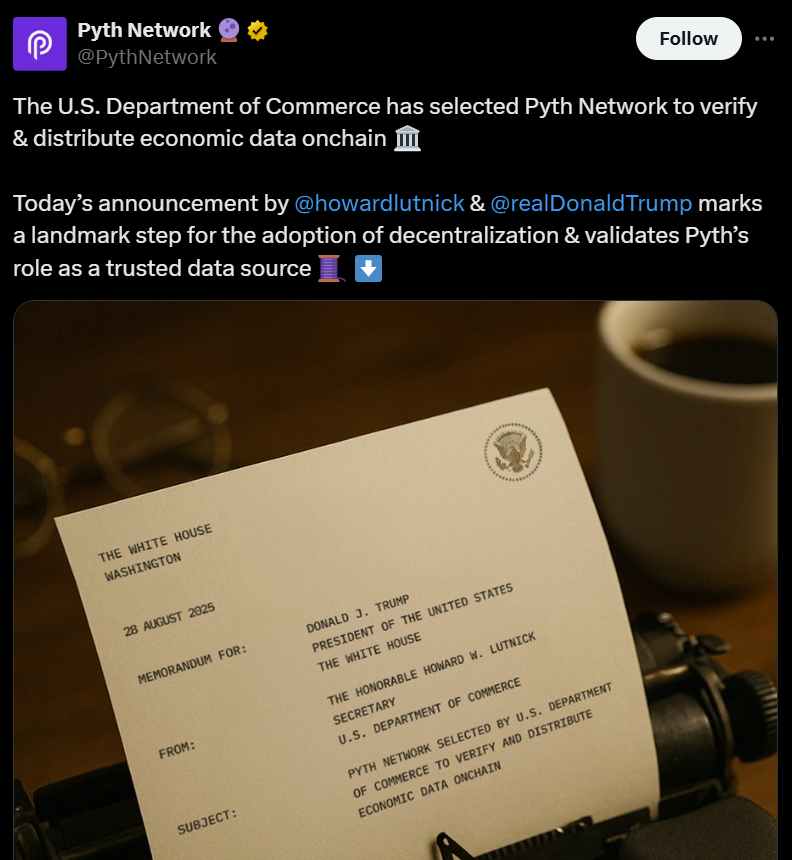

Pyth Network’s native tokens surged Thursday after confirming that the project was selected by the US Department of Commerce and validated and distributed an on-chain of economic data.

According to Coinmarketcap, the Pyth tokens were just above $0.20, marking daily gains of over 70%. The last trade was just below $0.19, but it still rose about 62% that day.

The rally has raised Pyth to its highest level since February, lifting its market capitalization by over $1 billion, but trading volumes have skyrocketed by more than 2,700% over the past 24 hours.

Pyth Network (Pyth) prices are vertical. sauce: coinmarketcap

Despite the Commerce Department’s announcement confirming that quarterly GDP figures will be published on nine blockchains, including Bitcoin, Ethereum, Solana, Tron, Stars and Avalanches, Piss was the only token to record such a massive profit. ChainLink, along with Pyth Network, has also been named as the leading Oracle partner in data dissemination.

When Pyth and Chainlink stand out, they have a coordinated role as Oracle, ensuring that government-published data is further spread and protected across the blockchain network.

sauce: Pyth Network

Pyth Network is a decentralized Oracle system that provides real-time financial market data directly to the blockchain. Like ChainLink, it offers an infrastructure that brings off-chain data such as stock prices, forex rates, and products.

Related: The US government taps chain link to publish economic data Pyth Onchain

Trump administration’s pro-crypto push intensifies

President Donald Trump’s embrace of blockchain technology comes amid acute criticism of official government statistics, particularly job market data published by the Bureau of Labor Statistics (BLS).

That tension peaked after a massive downward revision in employment earlier this month. This led Trump to claim that the numbers were “equipped” for political purposes. Shortly afterwards, Trump fired BLS Commissioner Erica Mantelfer.

sauce: Trumptruthonx

The administration’s blockchain initiative is part of a broader effort to prioritize digital assets adoption and innovation. The agenda has already produced the recent passing of the Genius Stubrecoin Act and approval in both the comprehensive market structure bill and the anti-CBDC bill currently heading to the Senate.

In parallel, Trump has been significantly pro-cryptic Securities and Exchange Commission main side. The agency has approved funds (ETFs) traded on multiple cryptocurrency exchanges, revealing that certain liquid staking activities are outside of jurisdiction. In other words, it should not be treated as a securities.

magazine: Can privacy survive the US crypto policy after the conviction of the Roman Storm?