Internet service providers (ISPs) in the Philippines have begun blocking major crypto trading platforms as regulators move to enforce local licensing rules for crypto service providers.

Users reported that global cryptocurrency exchanges Coinbase and Gemini were no longer accessible in the Philippines as of Tuesday. Cointelegraph has independently confirmed that both platforms are inaccessible from multiple local ISPs.

Manila Bulletin reported that the blocking of the ISPs followed an order by the National Telecommunications Commission, which directed providers to restrict access to 50 online trading platforms that the central bank, the Bangko Sentral ng Pilipinas (BSP), reported to be operating without authorization.

The central bank has not published the complete list of platforms targeted by the order. However, the change marks a continued shift by local regulators from informal tolerance to enforcement, with local licenses becoming the determining factor in crypto market access in the Philippines.

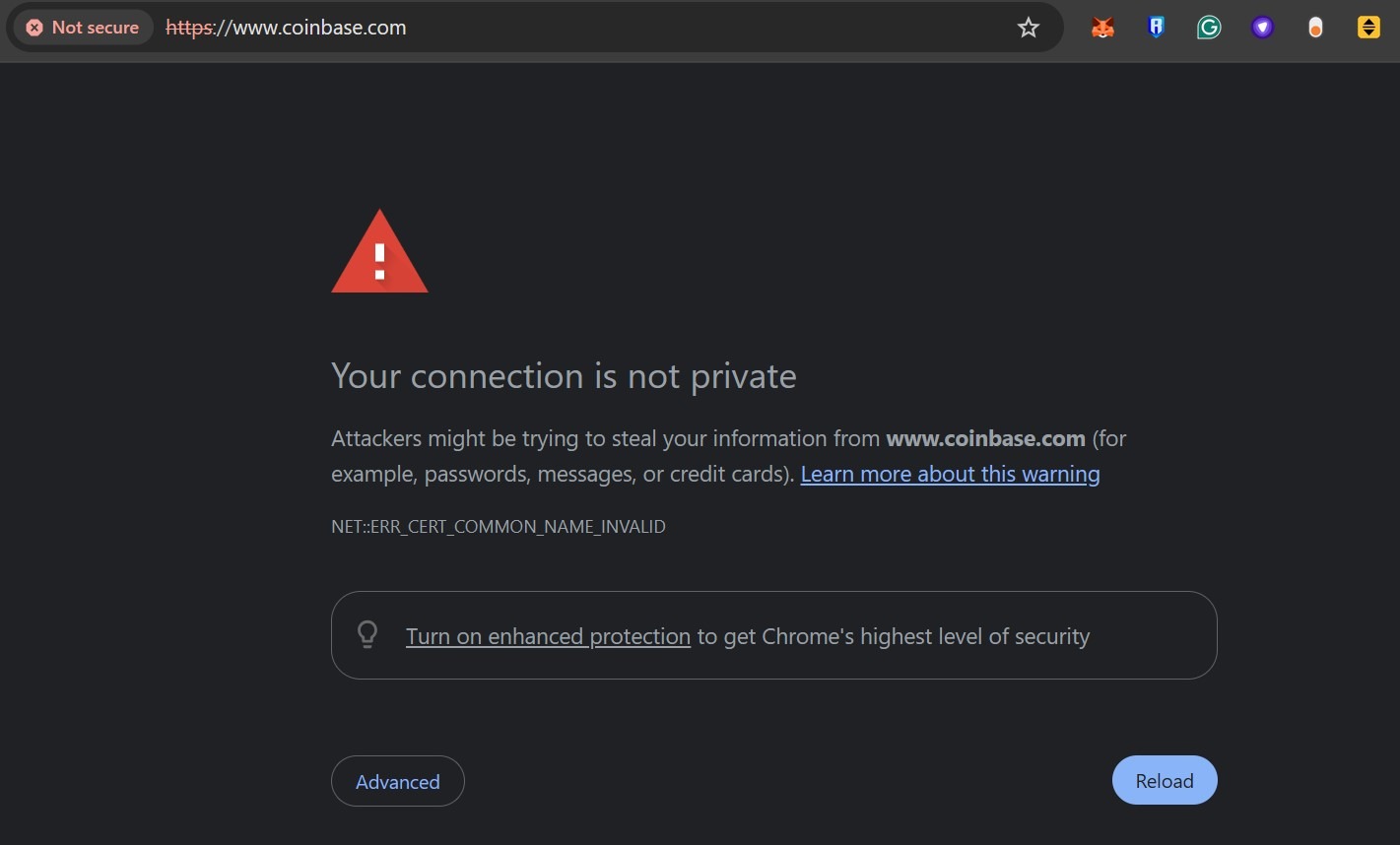

Cryptocurrency exchange Coinbase is currently inaccessible in the Philippines. Source: Cointelegraph

Coinbase, Gemini join Binance in blocking Philippine access

The Philippines recently blocked Coinbase and Gemini, but has taken enforcement action against unlicensed crypto exchanges in the past.

In December 2023, the country began a 90-day countdown to give Binance time to comply with local regulations before enforcing a ban on crypto trading platforms.

The Philippine Securities and Exchange Commission (SEC) said this period is aimed at allowing Filipinos to remove their funds from exchanges.

On March 25, 2024, the NTC ordered local ISPs to block Binance. Almost a month later, the SEC ordered Apple and Google to block the exchange’s applications from their stores.

After the ban was implemented, the Philippine Securities and Exchange Commission said it could not support any method for Filipinos to recover their funds.

Most recently, the SEC identified 10 exchanges operating without licenses, including OKX, Bybit, and KuCoin.

Related: Grab strengthens stablecoin push with StraitsX Web3 wallet and payments

Regulated players deploy crypto products

While the country is cracking down on unregulated platforms, compliant companies are deploying crypto-related infrastructure in the country.

On November 19, regulated cryptocurrency exchange PDAX partnered with payroll provider Toku to allow remote workers to receive their paychecks in stablecoins. This will allow workers to convert their earnings into pesos without wire fees or delays.

On December 8, digital bank GoTyme rolled out its encryption services in the Philippines following a partnership with US fintech company Alpaca. The rollout will enable the purchase and storage of 11 crypto assets through the platform’s banking application.

magazine: Xiaomi’s Say Wallet, Solana’s Bhutanese Gold: Asia Express