PancakeSwap ended 2025 on an exceptional note, with record trading volumes, rapid user growth, and major protocol upgrades that reshaped its position in decentralized finance.

According to the platform’s official blog, the decentralized exchange has not only expanded at an unprecedented pace, but also strengthened its leadership across the global DeFi landscape.

Record trading volumes fuel a breakthrough year

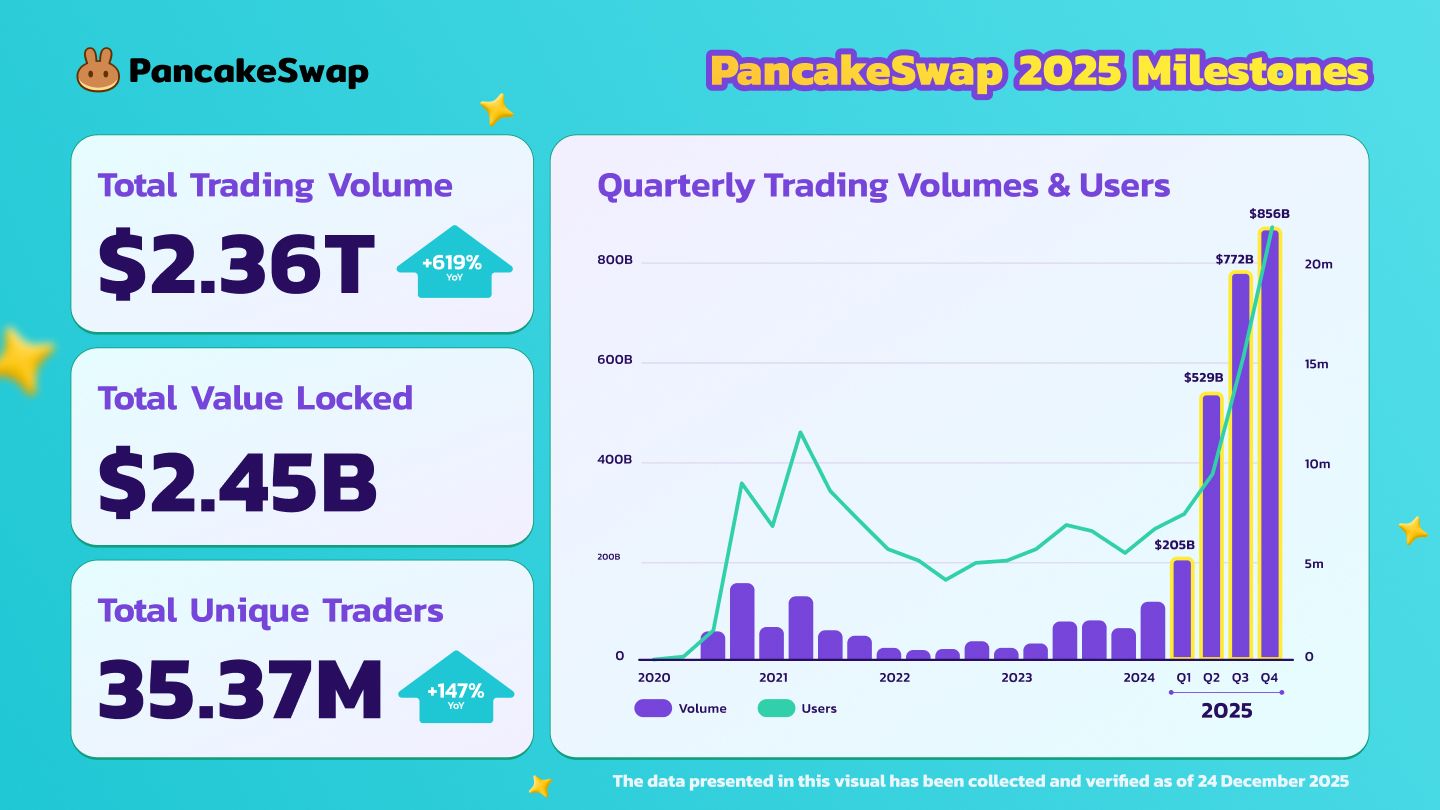

Trading activity was central to PancakeSwap’s 2025 performance. The platform processed a total transaction volume of $2.36 trillion during the year. This is a 619% increase compared to 2024.

Momentum picked up sharply in the final quarter. On October 10th, PancakeSwap hit an all-time high of $26 billion in daily trading volume, followed by a record monthly total of $492 billion in October.

Together, these milestones bring cumulative lifetime trading volume to $3.33 trillion, highlighting PancakeSwap’s growing influence in the DeFi market.

Consistent quarterly growth sets new standards

Beyond the headline numbers, trading activity remained strong throughout the year. PancakeSwap hit new highs in each quarter of 2025, demonstrating steady, sustained growth rather than isolated spikes.

Trading volume increased from $205 billion in the first quarter to $529 billion in the second quarter, then further accelerated to $772 billion in the third quarter and $856 billion in the fourth quarter. The team attributed this steady progress to growing user trust and deepening long-term engagement.

PancakeSwap claims top spot among DEXs

As trading volume increased, PancakeSwap became more competitive. In 2025, the platform surpassed all other decentralized exchanges to become the largest DEX in terms of both trading volume and market share.

This change became apparent in May 2025, when PancakeSwap began ranking #1 on a rolling 30-day basis. It maintained its lead until the end of the year, ending 2025 with a 37.84% share of total DEX trading volume.

User growth and liquidity expand in parallel

The increase in trading volume roughly coincides with the expansion of participants. PancakeSwap reports that there will be 35.37 million unique traders in 2025, more than double the number recorded the previous year. The platform has 36.16 million unique users, reflecting widespread adoption across multiple products.

At the same time, capital commitments increased significantly. By the end of the year, PancakeSwap had locked a total of $2.45 billion, strengthening its position as a leading liquidity hub within DeFi.

CAKE tokenomics shifts towards deflation

Alongside the growth of its operations, PancakeSwap continued to improve its token economy. In 2025, the platform launched CAKE Tokenomics 3.0, a redesigned framework designed to increase efficiency and foster sustainable supply dynamics.

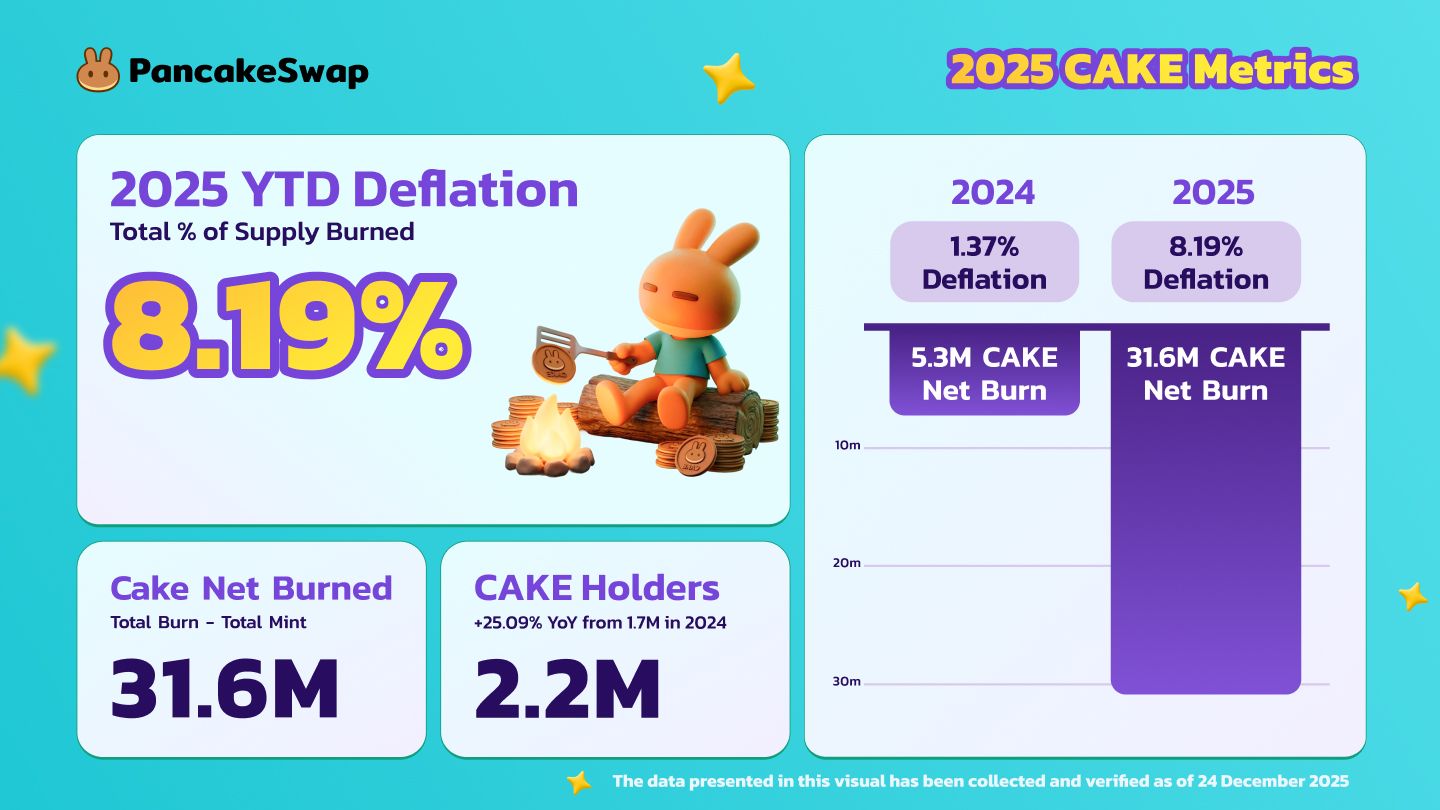

The impact was immediate. CAKE experienced deflation of 8.19% for the year, marking a notable year-on-year increase. The total number of net burns was 31.6 million CAKE, and the cumulative number of burns since September 2023 exceeded 37.6 million tokens.

Meanwhile, token adoption steadily increased due to deflationary mechanisms. PancakeSwap reported 2.2 million CAKE holders by the end of 2025.

According to the project, reduced supply, improved utility, and expanded holder base worked together to support the long-term sustainability of the CAKE ecosystem.

Binance Wallet Partnership Expands Access to Token Launching

PancakeSwap has expanded its role in on-chain funding beyond its core exchange operations. In partnership with Binance Wallet, the platform supported 43 token generation events on the BNB chain throughout 2025.

PancakeSwap v3 integration allows users to provide liquidity directly via Binance Wallet and earn incentives linked to early-stage projects. As a result, this collaboration aimed to simplify access to new releases while increasing on-chain participation.

Memecoin-led initiatives also contributed to the year’s activity. The liquidity program with BNB Chain and ecosystem partners will deploy up to $1 million to support USD1 trading pairs.

In parallel, the Meme2Million campaign spotlighted projects that achieved a market capitalization of over $1 million after migrating to PancakeSwap. This effort resulted in more than $615,000 in wasted trading fees and directly linked speculative interest to deflationary outcomes.

CAKE.PAD debuts as early access platform

PancakeSwap has introduced CAKE.PAD, which serves as a simplified early access platform based on its expansion to token launch. This system allowed users to participate in token sales without staking requirements or lockups, while reducing the supply of CAKE.

In 2025, CAKE.PAD hosted three token sales: Sigma.Money, WhiteBridge Network, and LeverUp, all of which were oversubscribed, highlighting strong demand for streamlined access to new projects.

PancakeSwap Infinity marks major protocol upgrade

Additionally, infrastructure development was another key pillar of progress this year. PancakeSwap has announced PancakeSwap Infinity, formerly known as v4, representing its most significant protocol upgrade to date.

Specifically, this release introduces modular architecture, customizable rates, and gas efficiency improvements. Infinity launched with BNB Chain and Base, has an open source model, and supports a bug bounty program powered by Cantina for added security.

Looking to 2026

As 2025 ended, PancakeSwap began focusing on new use cases beyond traditional exchange services. For example, the platform fosters Probable, a prediction market built on the BNB chain.

Launched in December 2025, Probable allows users to trade based on real-world outcomes. According to PancakeSwap, this effort reflects its broader strategy to expand its DeFi footprint and explore new product areas in 2026.