Optimism’s OP token has struggled to rise in value, with DAO members divided over the buyback vote.

Operating profit has fallen more than 93.7% from its peak, hitting a low of $0.2519 last month. This marked the lowest price level for the token in December.

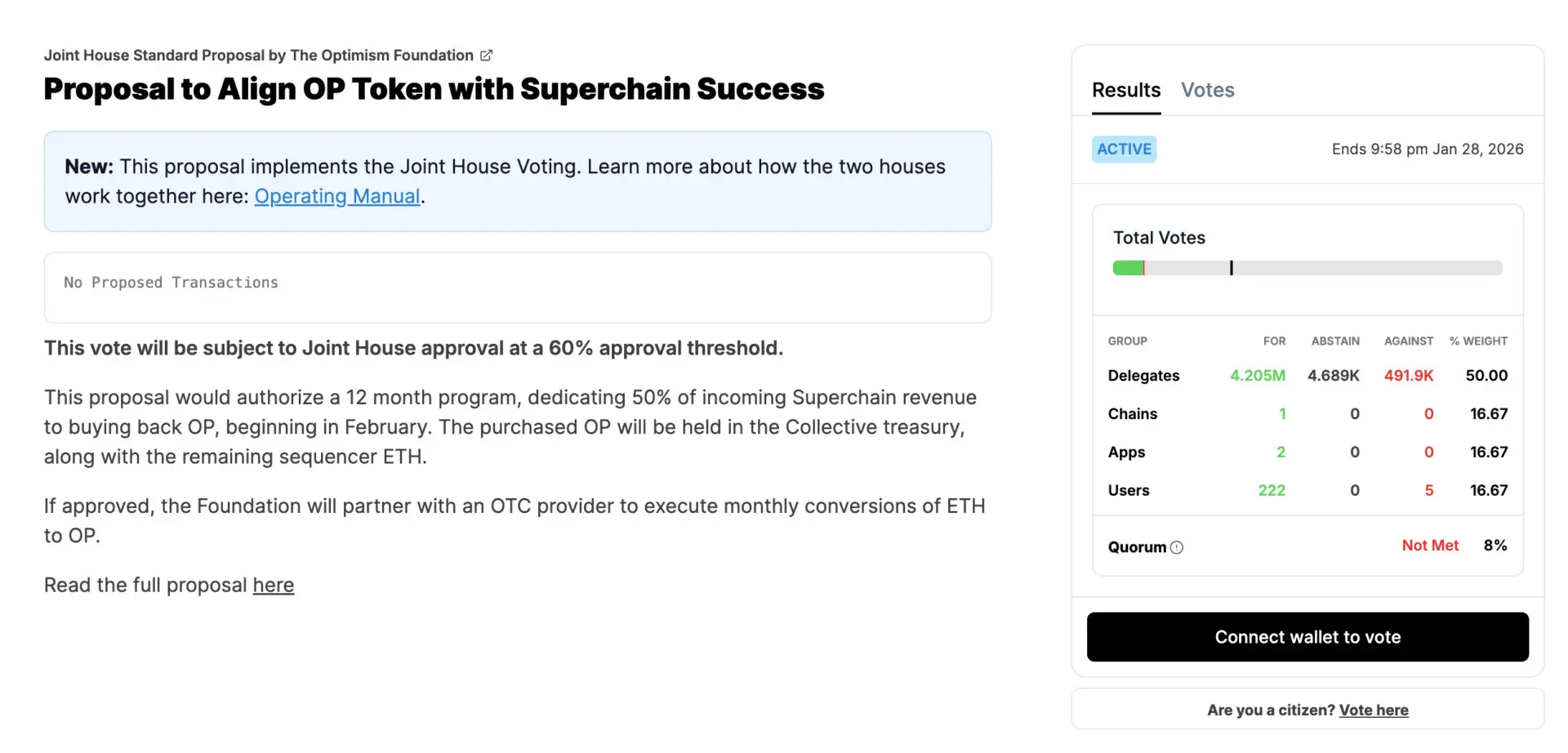

In response, Optimism DAO representatives are voting on a proposal to use protocol proceeds to buy back OP tokens. Voting begins on Thursday and will last for six days, ending on January 28th.

As of this writing, delegates have cast more than 4.2 million votes in favor of the proposal, compared to just over 491,900 votes against. Voters have the option of yes, no, or abstain.

If the “yes” votes exceed a quorum and the “yes” votes exceed the approval threshold relative to the total number of votes, the buyback proposal will pass. The quorum for this proposal is 30% and the approval threshold is 94.40%.

If the proposal is approved, the Optimism Foundation would be required to spend half of the supermarket chain’s monthly income on purchasing OP.

As revenues increase, the Foundation will require more purchases OP token monthly. Proponents argue that this mechanism could help support the price of the token.

Voting on OP token buyback is live. Source: Optimism website.

DAO members are divided over OP’s buyback plan

However, this proposal caused the DAO to split. Some delegates support the plan, while others believe it wastes money and weakens Optimism’s financial strength.

Critics point out that optimism is currently selling OP short.

Optimism DAO representative PaperImperium believes that OP holders should vote against this buyback proposal. he think It is illogical to use valuable assets to buy back OP while continuing to sell tokens, especially when shortening the project’s runway.

PaperImperium is also concerned about implementing OP buybacks. He said, “…instead of using Optimism’s own chain, this proposal uses an OTC desk, which doesn’t look good.”

The program will be conducted over-the-counter (OTC) rather than in the open market. This means that your purchase will not directly affect the OP market price.

Optimism DAO representative Michael Vander Meyden warned in a forum post that over-the-counter buybacks could allow employees and investors to sell unlocked tokens back into the program.

he said“This is concerning as unlocks are currently occurring at a much higher rate than planned buybacks, which defeats the purpose of aligning incentives.”

The Optimism Foundation said it chose OTC enforcement to simplify the process. It has committed to publicly reporting all OTC transactions on stats(dot)optimism(dot)io or governance forums.

This debate comes despite the growing role of optimism in blockchain technology. Its OP stack powers over 50 blockchains, including Uniswap’s Unichain, Coinbase’s Base, Kraken’s Ink, Zora Network, Sam Altam’s World Chain and other blockchains.

Can buybacks solve the token collapse?

Skepticism about share buybacks exceeds optimism.

Messari researchers say stock buyback strategies often waste money. They will divert funds from marketing and growth, and the overall impact of the buyback on the token price will be minimal.

Several crypto projects have considered ending their token buyback programs.

Jupiter DEX founder Siong Ong asked community members whether the exchange should stop buying back JUP tokens as there is no price benefit. DEX spent more than $70 million on share buybacks last year, but the price didn’t move much.

In a forum post, GFXlabs argued that optimists should prioritize creating and sharing business plans for long-term financial sustainability. He added that share buybacks would not solve the problem and could make the situation worse. Several DAO members agree with these points.

Supporters of the proposal see it as a sign of progress.

Milo Bowman, president of Optimism DAO, said it was acceptable to carry out buybacks in tandem with emissions, even if they were partially offset. He added that the buyback framework allows participants to better model the outcome of the superchain’s potential 100x growth.