Written by Omkar Godbole (all times Eastern Time unless otherwise noted)

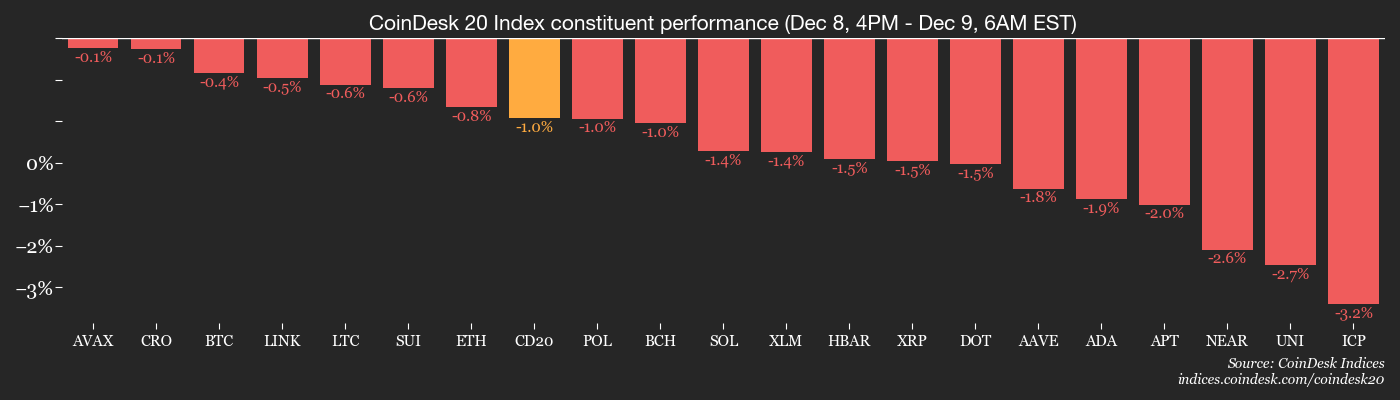

The cryptocurrency market has no clear direction. Bitcoin BTC$90,576.06 remains in a boring range between $90,000 and $95,000, and there is little cheer in the broader market, as evidenced by the more than 2% decline in the CoinDesk 20 (CD20) and CoinDesk 80 (CD80) indexes. ZEC is the only major token to rise more than 3% in 24 hours.

This lackluster performance may be due to traders holding off on their plans for bullish bets until after tomorrow’s Fed interest rate meeting, which could lead to volatility.

“Given the potential for significant two-way volatility around the FOMC event, clients seeking increased upside exposure into the first quarter of 2026 have expressed a desire to defer executions until after the event, and we expect this trend to increase significantly later this week,” Dick Loh, founder of TDX Strategies, said in a market note.

The Fed meeting opens today and concludes tomorrow, with a 25 basis point rate cut priced in. Some traders are concerned that the decision could come with hawkish forward guidance pointing to slower easing in 2026.

These expectations could set the stage for a bull market, according to CF Benchmarks.

“Looking at today’s Federal Funds futures, the market is pricing in Wednesday’s rate cut, but no further rate cuts until June. We believe there is upside potential here if the Fed signals further rate cuts are possible before its June meeting. That becomes even more likely if the labor market continues to soften and inflation expectations remain in the 2-3% range,” the index provider said in an email to CoinDesk.

Key indicators such as Cumulative Volume Delta (CVD) indicate the continued dominance of sellers in the spot market.

“Spot flows remain soft. Spot CVD has fallen from -$40 million to -$111 million, indicating continued selling flow even as prices hold at $90,000,” said BRN head of research Timothy Misiel.

In other news, Ethereum founder Vitalik Buterin’s proposal to make Ethereum trading more predictable and create a trustless on-chain gas futures market is gaining attention.

Crypto exchange KuCoin has released its Post-Quantum Cryptography (PQC) Gateway Proof of Concept, an experimental prototype gateway system designed to integrate quantum-resistant cryptographic algorithms.

In traditional markets, the yield on 10-year U.S. government bonds continued to rise, hitting a three-month high, and the yen traded lower despite expectations for a rate hike from the Bank of Japan. Be alert!

More information: For an analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today.

what to see

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- cryptography

- December 9: Twenty One Capital begins trading on the NYSE under the ticker XXI following a business combination with Cantar Equity Partners (CEP).

- macro

- December 9th, 7am: Mexico’s November inflation rate. The headline year-over-year estimate is 3.69%, and the month-over-month estimate is 0.56%. Core YoY forecast 4.34%, Eastern MoM. 0.10%.

- Dec. 9, 8:15 a.m.: ADP weekly employment change (previously -13.5K).

- Dec. 9, 10 a.m.: Job Openings and Turnover Survey (JOLTS) Report. The number of job openings scheduled for September is 7.2 million, and the number of job resignations in September (previously 3.091 million).

- revenue (estimated based on FactSet data)

token event

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- ENS DAO is voting on a “temperature test” to commission an independent review of its operations and spending over the past two years. Voting ends on December 9th.

- The CoW DAO is voting at CIP-76 to approve a 2026 budget of 13.8 million USDC and replenishment of 100 million COW tokens for core team operations and incentives. Voting ends on December 9th.

- GnosisDAO is voting on GIP-144 to update Blockscout’s hosting and SLA services for calendar year 2026. Voting ends on December 9th.

- unlock

- Activate token

- December 9: HumidiFi’s WET token claim period begins and liquidity pool goes live.

conference

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- Day 2: Bitcoin MENA 2025 (Abu Dhabi)

- Day 2: Blockchain Association Policy Summit 2025 (Washington)

- Day 2 of 4: Abu Dhabi Financial Week 2025 (Abu Dhabi)

market movements

- BTC has fallen 1.27% to $90.255.53 since Wednesday at 4:00 PM ET (24h: -2.09%).

- ETH fell 0.84% to $3,106.60 (24h: -1.73%)

- CoinDesk 20 fell 0.87% to 2,877.34 (24 hours: -2.11%)

- Ether CESR comprehensive staking interest rate increases by 3bps to 2.81%

- BTC funding rate is 0.0068% (7.46% p.a.) on Binance.

- DXY has almost no change even at 99.05

- Gold futures rose 0.37% to $4,233.50.

- Silver futures rose 1.14% to $59.07.

- The Nikkei 225 closed 0.14% higher at 50,655.10.

- The Hang Seng fell 1.29% to close at 25,434.23.

- FTSE rose 0.13% to 9,657.24.

- The Euro Stoxx 50 fell 0.16% to 5,716.21.

- The DJIA closed 0.45% lower at 47,739.32 on Monday.

- The S&P 500 index closed 0.35% lower at 6,846.51.

- The Nasdaq Composite fell 0.14% to close at 23,545.90.

- The S&P/TSX Composite Index closed 0.45% lower at 31,169.97.

- S&P 40 Latin America Index ended unchanged at 3.127,62

- US 10-year government bond interest rate fell 1.4bps to 4.158%

- E-mini S&P 500 futures rose 0.08% to 6,861.25.

- E-mini Nasdaq 100 futures rose 0.04% to 25,673.25.

- E-mini Dow Jones Industrial Average index futures rose 0.11% to 47,846.00.

bitcoin statistics

- BTC Dominance: 59.24% (unchanged)

- Ether to Bitcoin ratio: 0.03444 (no change)

- Hashrate (7-day moving average): 1,042 EH/s

- Hash Price (Spot): $38.26

- Total fees: 2.61 BTC / $237,648

- CME futures open interest: 121,520 BTC

- BTC Gold Price: 21.4oz

- BTC vs. Gold Market Cap: 6.04%

technical analysis

This is a daily chart of BTC. (Trading View)

- The chart shows the daily price movements of BTC in candlestick format.

- BTC has recorded higher lows and highs since November 21st, carving out a mini-upward channel within a broader downtrend.

- In other words, the recent rally represents a temporary relief rally that needs to expand above $96,600. If this happens, a break from the downtrend will be confirmed and the bullish outlook will be restored.

crypto assets

- Coinbase Global (COIN): Monday’s closing price was $274.2 (+1.66%), pre-market down 0.71% to $272.26.

- Circle Internet (CRCL): $83.96 (-1.94%), -0.98% to close at $83.21

- Galaxy Digital (GLXY): $26.09 (+2.27%), +0.8% to end at $26.3

- Bullish (BLSH): Ended unchanged at $45.93 (-1.12%)

- MARA Holdings (MARA): $12.05 (+2.64%), -1.24% to close at $11.9.

- Riot Platform (RIOT): $14.96 (unchanged), -0.87% to end at $14.83

- Core Scientific (CORZ): $17.69 (+3.39%), -0.17% to close at $17.66

- CleanSpark (CLSK): Closed at $13.89 (+1.28%), -0.43% at $13.83

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Ended at $46.43 (+1.98%)

- Exodus Movement (EXOD): Closed at $14.84 (+1.57%)

crypto asset company

- Strategy (MSTR): Closed at $183.69 (+2.63%), -1.05% at $181.77

- Semler Scientific (SMLR): Ended unchanged at $19.77 (+5.89%).

- SharpLink Gaming (SBET): $11.06 (+3.17%), -1.45% to close at $10.90.

- Upexi (UPXI): $2.61 (-1.88%), +1.53% to close at $2.65

- Lite Strategy (LITS): Closed at $1.72 (+2.99%)

ETF flow

Spot BTC ETF

- Daily net flow: -$60.4 million

- Cumulative net flow: $57.54 billion

- Total BTC holdings ~1.3 million

Spot ETH ETF

- Daily net flow: $35.5 million

- Cumulative net flow: $12.93 billion

- Total ETH holdings ~6.25 million

Source: Farside Investors

while you were sleeping

- Bitcoin traders aim for a $20,000 Bitcoin strike as deep out-of-the-money options gain momentum (CoinDesk): Traders are rushing for cheap long-term contracts that can yield huge profits on extreme price movements, and their focus on distant price movements is high, reflecting a preference for volatility exposure over directional bets.

- Thaler’s strategy will not issue preferred stock in Japan, giving Metaplanet a 12-month head start (CoinDesk): Metaplanet plans to introduce two new digital credit products, Mercury and Mars, to Japan’s perpetual preferred market, aiming to significantly improve yields compared to traditional bank deposits.

- USDC Issuer Circle Secures ADGM License for Abu Dhabi in Middle East Expansion (CoinDesk): This approval will enable the company to provide locally regulated money services capabilities and expand the use of USDC in payments and settlements in the region as authorities develop a broader framework for digital assets.

- Malaysian royal family introduces ringgit-backed stablecoin for payments (Bloomberg): Ismail Ibrahim’s bullish Aim is introducing a token built on the Zetrix network and backed by cash holdings and Malaysia’s short-term sovereign instruments for digital payments applications.