The non-fungible token (NFT) market showed early signs of recovery after Friday’s crypto market crash wiped out about $1.2 billion in market capitalization due to the sharp drop.

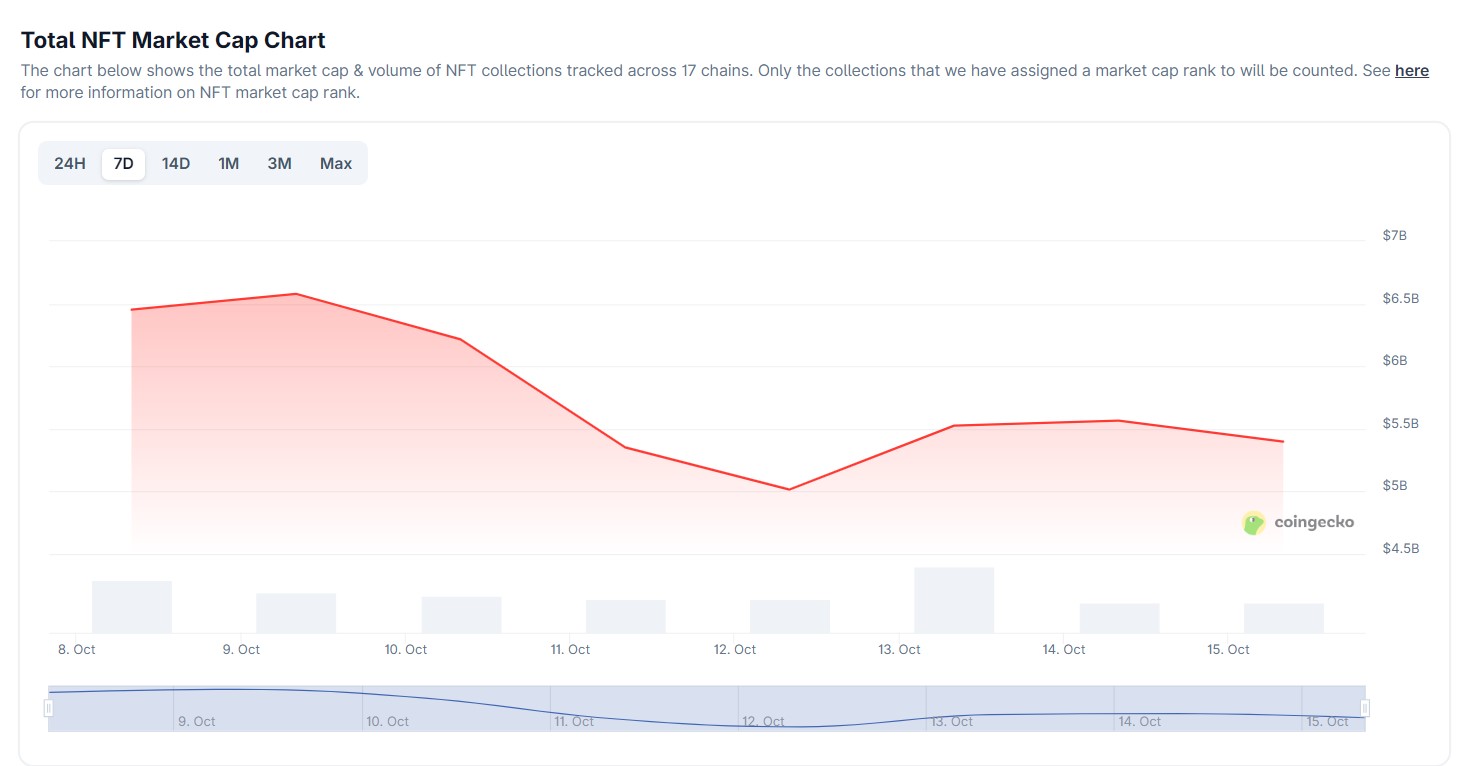

The overall valuation of the sector fell from $6.2 billion on Friday to $5 billion on Saturday, according to CoinGecko data. This wiped out nearly 20%, or approximately $1.2 billion, of the market capitalization of digital collections across all blockchain networks.

With the recovery of the cryptocurrency market, the sector has experienced a rapid recovery. On Sunday, NFTs reached $5.5 billion, a 10% increase after the crash. At the time of writing, the overall market capitalization was approximately $5.4 billion.

This decline highlights the NFT sector’s sensitivity to increased cryptocurrency volatility. As the market plummeted on Friday, the price floor for NFTs followed suit as liquidity dried up and speculative demand declined.

Graph of NFT market capitalization. Source: CoinGecko

Top NFT collections remain in the red

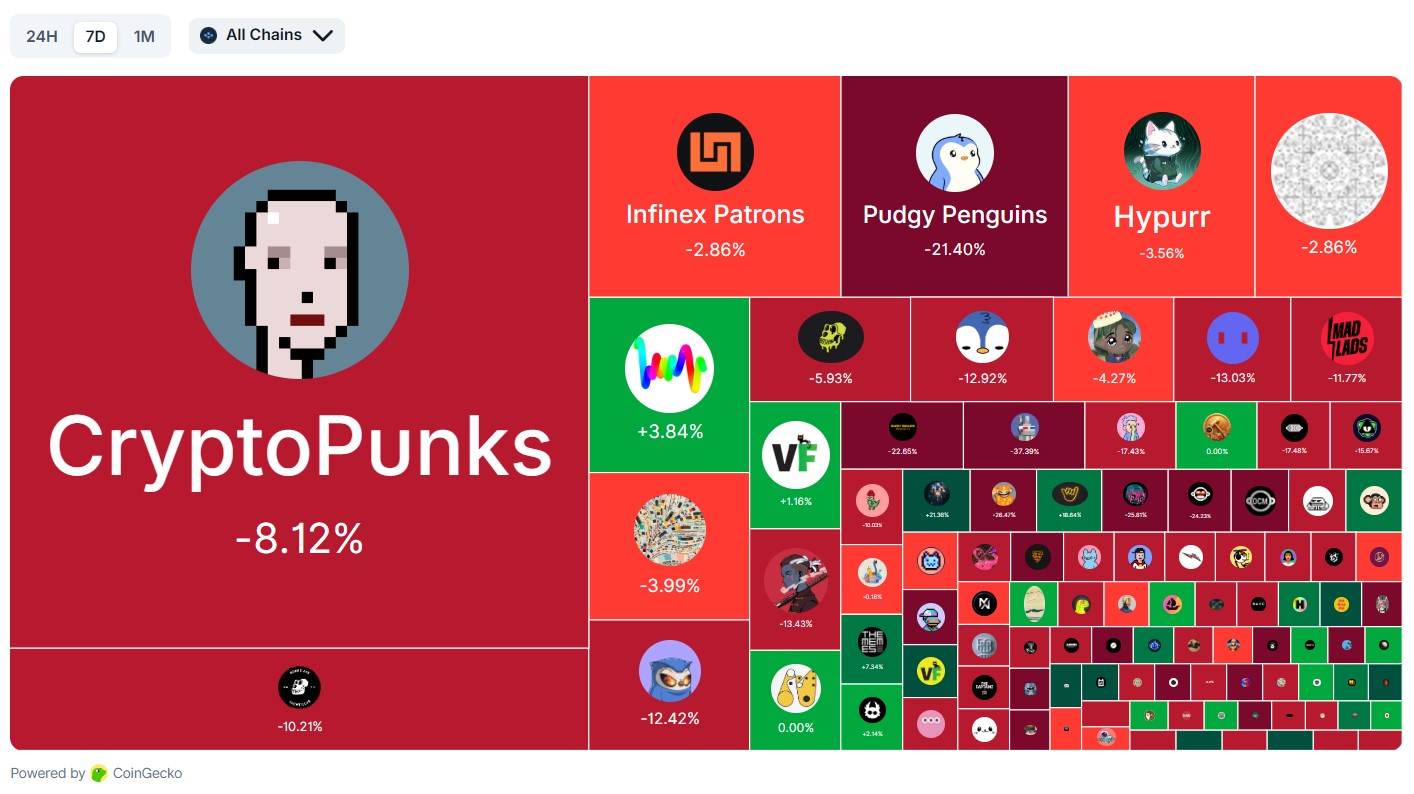

Despite a partial recovery, many top NFT collections have declined over 7 and 30 days.

Top Ethereum-based projects such as Bored Ape Yacht Club (BAYC) and Pudgy Penguins are still down 10.2% and 21.4%, respectively, over the past week. Collections like Tyler Hobbs’ “Infinex Patrons” and “Fidenza” posted double-digit losses on the monthly charts.

CryptoPunks, the top NFT collection by market cap, is down 8% on the weekly chart and nearly 5% on the 30-day NFT performance chart.

Most of the top 10 NFTs are down, but some collections showed a slight recovery on the 24-hour chart. This includes Hyperliquid’s Hyperr NFT, which has gained 2.8% in the past 24 hours, and the Mutant Ape Yacht Club (MAYC) collection, which has registered a 1.5% gain.

The slight recovery suggests that buyers may be selectively returning to the market despite the crash.

7-day NFT collection heatmap. Source: CoinGecko

Related: Judge dismisses lawsuit against Yuga Labs for failing to meet Howey test

Cryptocurrency products recover after Friday’s market crash

Bitcoin plummeted to $102,000 on Binance’s perpetual futures pair on Friday after US President Donald Trump announced 100% tariffs on China as the country seeks to impose export restrictions on rare earth minerals.

The market crash resulted in up to $20 billion in liquidations in the sector, surpassing previous crypto market crashes, including the FTX collapse.

The total market capitalization of the crypto market fell from $4.24 trillion on Friday to $3.78 trillion on Sunday, wiping out nearly $460 billion in two days, according to data from CoinGecko.

On Monday, the market’s valuation had recovered to $4 trillion. As of this writing, the cryptocurrency market is worth $3.94 trillion.

Despite the market crash, billions of dollars have flowed into crypto investment products.

On Monday, CoinShares reported $3.17 billion in inflows into its crypto exchange traded products (ETPs) last week despite Friday’s flash crash. This highlights the fund’s resilience to market panic caused by liquidations and sales.

magazine: Digital art “ages like fine wine”: Inside Flamingo DAO’s 9-figure NFT collection