The NFT lending market has collapsed to single-digit millions in total value lock (TVL), levels last seen in 2022. According to DefiLlama data, the sector’s TVL is currently around $8.3 million, down about 97% from the sector’s all-time high of over $300 million in March 2024.

NFT lending TVL. Source: Defilama

Arcade, the Pantera Capital-backed NFT financing startup that secured a $15 million Series A in December 2021, currently has only about $300,000 in TVL left, down more than 98% from its peak of $21.5 million in March 2024.

But even protocols that once seemed more resilient are feeling the pain. The TVL of Blur’s lending arm Blend, which was founded in partnership with crypto VC giant Paradigm, is currently around $3 million, down more than 90% from more than $115 million in early 2024.

Nicolas Larmento, co-founder of NFT Pricefloor, an NFT analysis website that tracks more than 1,750 collections, told The Defiant that the March 2024 peak was largely driven by Blur’s incentives.

“Blend (Buller’s lending arm) absolutely dominated the market at the time, and its growth was largely driven by Buller’s agricultural meta. As those incentives tapered off, Blend’s volumes and debt balances fell off a cliff, and the broader sector reverted with them. So the chart looks like a peak on which a crash continues,” Lament said.

The market has since moved to a “more stable model” led by Gondi, a non-custodial peer-to-peer lending protocol for NFTs, Lament said. He explained that the type of collateral used has also changed, as most of the blended loans were tied to profile picture NFTs and popular IP collections like Pudgy Penguins, which are highly speculative and event-sensitive.

“To me, it’s a healthy transition. NFT art behaves like a traditional collectibles market, and that stability creates better lending behavior,” Lallement explained.

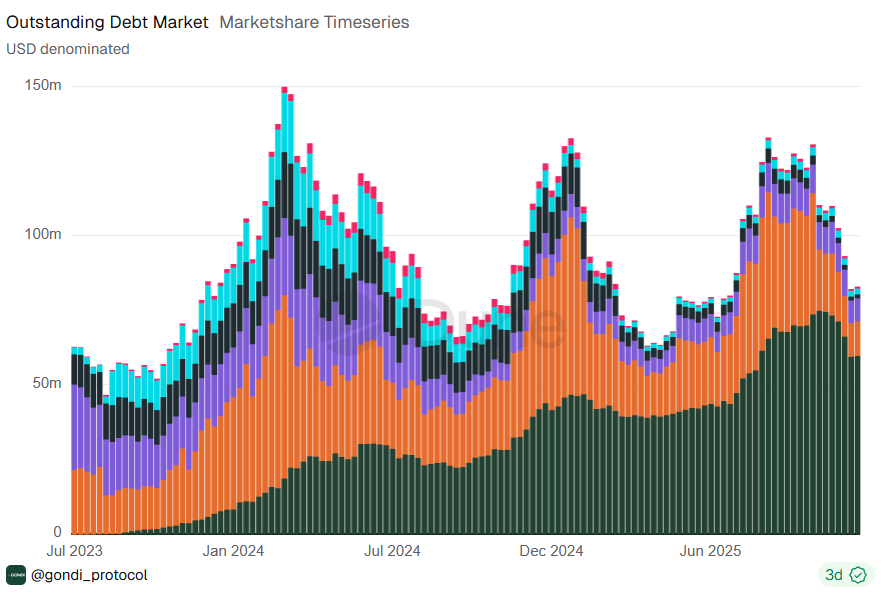

Commenting on the declining TVL across lending protocols, Lallement suggested that outstanding on-chain debt would be the “best lens through which to understand the NFT lending market” at this time, as NFT collateral is “very illiquid.”

NFT debt balance

Data compiled by Gondi on Dune shows that despite the liquidity crunch, outstanding debt has declined more slowly, down about 45% from $150 million in March 2024 to $83 million now, suggesting that people are still taking out loans even as total capital in the market declines.