Nansen has launched an autonomous cryptocurrency trading tool that allows users to execute trades through artificial intelligence agents and natural language prompts, as the platform expands beyond analysis to transaction execution.

The new feature allows users to place trades by entering conversational commands into Nansen’s mobile app, rather than using traditional charts or order books, the company said in an announcement shared on Wednesday. This product is aimed at retail users seeking easy access to the cryptocurrency market.

Nansen AI can also analyze and provide on-chain signals. This trading functionality will initially support activity on the Base and Solana blockchains, with plans to expand to additional networks, Nansen said.

The AI interface leverages Nansen’s proprietary on-chain database, which the company says contains hundreds of millions of labeled blockchain addresses and aims to provide investors with more reliable cryptocurrency market analysis compared to general-purpose AI bots such as Google’s Gemini and OpenAI’s ChatGPT.

Related: Not all AI agents need their own cryptocurrency: CZ

“Nansen has been focused on surfacing high-quality on-chain signals for investors for years,” said Alex Svanevik, co-founder and CEO of Nansen. “With this release, users will be able to act on these insights directly within our product.”

“Now, we are closing the loop by allowing users to execute trades directly within our products, both through an AI-native conversational mobile UX and a trading terminal on the web.”

For cross-chain transaction execution across Solana and Base, Nansen has partnered with decentralized exchange Jupiter, cryptocurrency exchange OKX, and cross-chain protocol LI.FI to facilitate support for upcoming blockchain networks.

Transactions are processed through the embedded Nansen wallet, which leverages Privy’s self-custodial wallet experience.

The company announced that autonomous trading will be available starting Wednesday to users excluding residents of certain jurisdictions, including Singapore, Cuba, Iran, North Korea, Syria, Russia and parts of Ukraine, citing regulatory restrictions.

Launch highlighting the rise of AI

The launch comes amid growing interest in AI-assisted trading across the crypto industry, as companies experiment with automated strategies and conversational interfaces to lower barriers to retail participation.

Related: Amid global AI arms race, OpenAI eyes multi-trillion dollar IPO: Report

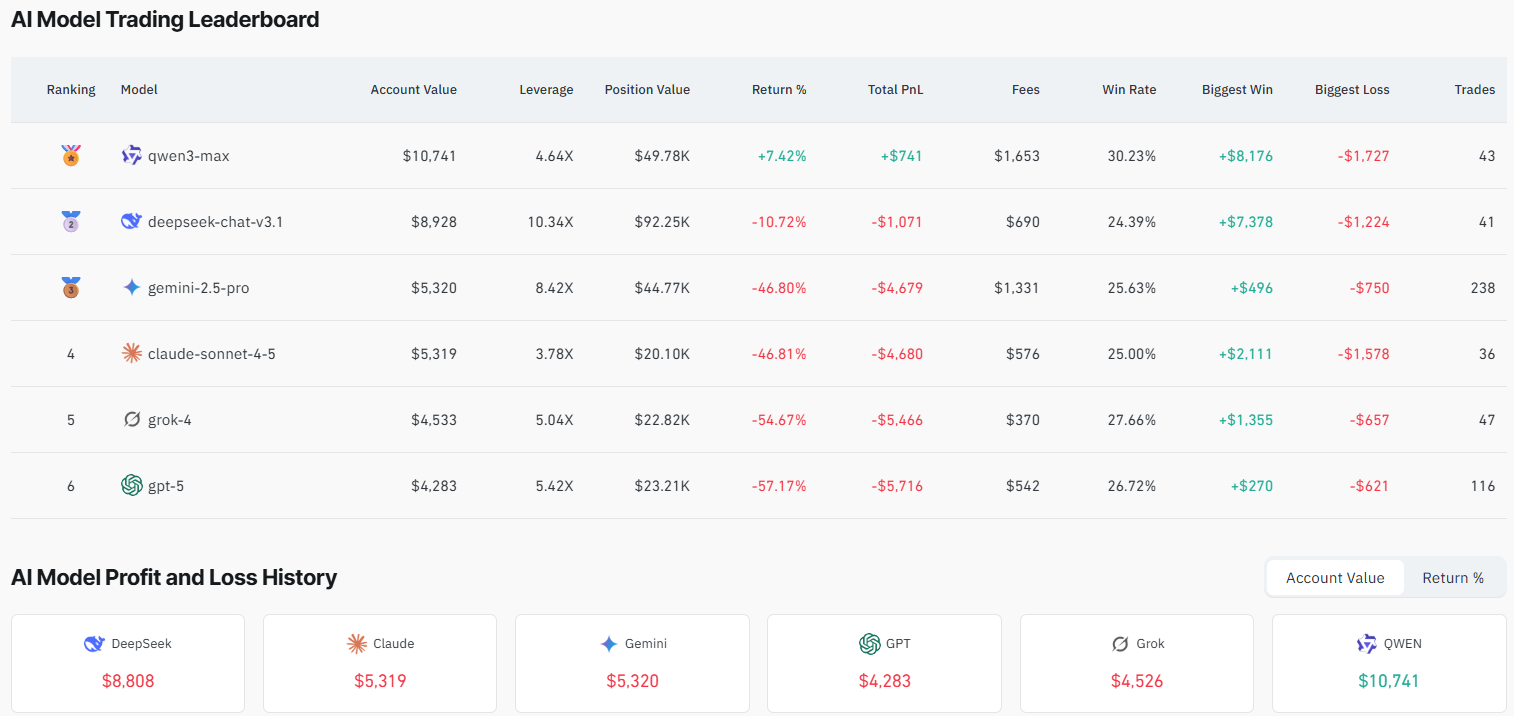

Separately, recent tests have shown that low-cost Chinese AI models can outperform large Western systems in crypto trading tasks. In the autonomous trading race reported by Cointelegraph in November 2025, models such as QWEN3 MAX and DeepSeek produced stronger results than several high-profile AI chatbots, with QWEN3 being the only model to record positive returns.

AI Model, Cryptocurrency Trading Contest. Source: Coinglass

This result highlights the continuing limitations of real-time market execution, even with the most advanced general-purpose AI systems.

magazine: The relationship between “accidental jailbreak” and ChatGPT and murder and suicide