MSTR stock continued its recent downward trend on Monday as volatility in the cryptocurrency market remains.

summary

- MSTR stock continued its strong downward trend this week.

- MicroStrategy continued its Bitcoin accumulation strategy.

- According to technical analysis, MSTR could crash to $100 soon.

MicroStrategy has fallen 75% from its all-time high to $136. It then stabilized at $145 as Bitcoin ($BTC) cut some of its previous losses to more than $78,000.

The strategy also stabilized as the company revealed last week that it had acquired 8,555 coins worth over $75 million. This was the smallest purchase in the past three weeks.

Strategy scored 855 $BTC Approximately $75.3 million at about $87,974 per Bitcoin. As of February 1, 2026, it has 713,502 people. $BTC It was acquired for approximately $54.26 billion at approximately $76,052 per Bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

The company currently has 713,502 coins, which were purchased at an average price of $76,052. At Monday’s low point, Strategy’s unrealized losses soared to more than $900 million.

You may also like: Bitcoin insider faces fallout from Epstein-era emails over Ripple and Stellar feud

The strategy now has access to more cash to continue buying up Bitcoin. The company has access to $8 billion worth of MSTR stock that it can sell to raise capital, according to its purchasing report. It also owns $20 billion worth of STRK preferred stock, $4 billion worth of STRD stock, $3.6 billion worth of STRC stock, and $1.6 billion worth of STRD stock.

Therefore, Saylor may continue to accumulate by taking advantage of the drop in Bitcoin prices. His view is that Bitcoin will eventually rebound and hit new all-time highs.

History shows that every time Bitcoin enters a bear market, it always rebounds. for example, $BTC The stock has plunged more than 35% between its high in January and its low in April last year. It then hit a record high in May.

Bitcoin also fell by more than 70% between its 2021 high and 2022 low. After that, it skyrocketed from less than $16,000 in 2022 to $126,200 in 2025. Therefore, the most likely scenario is that Bitcoin rebounds later this year.

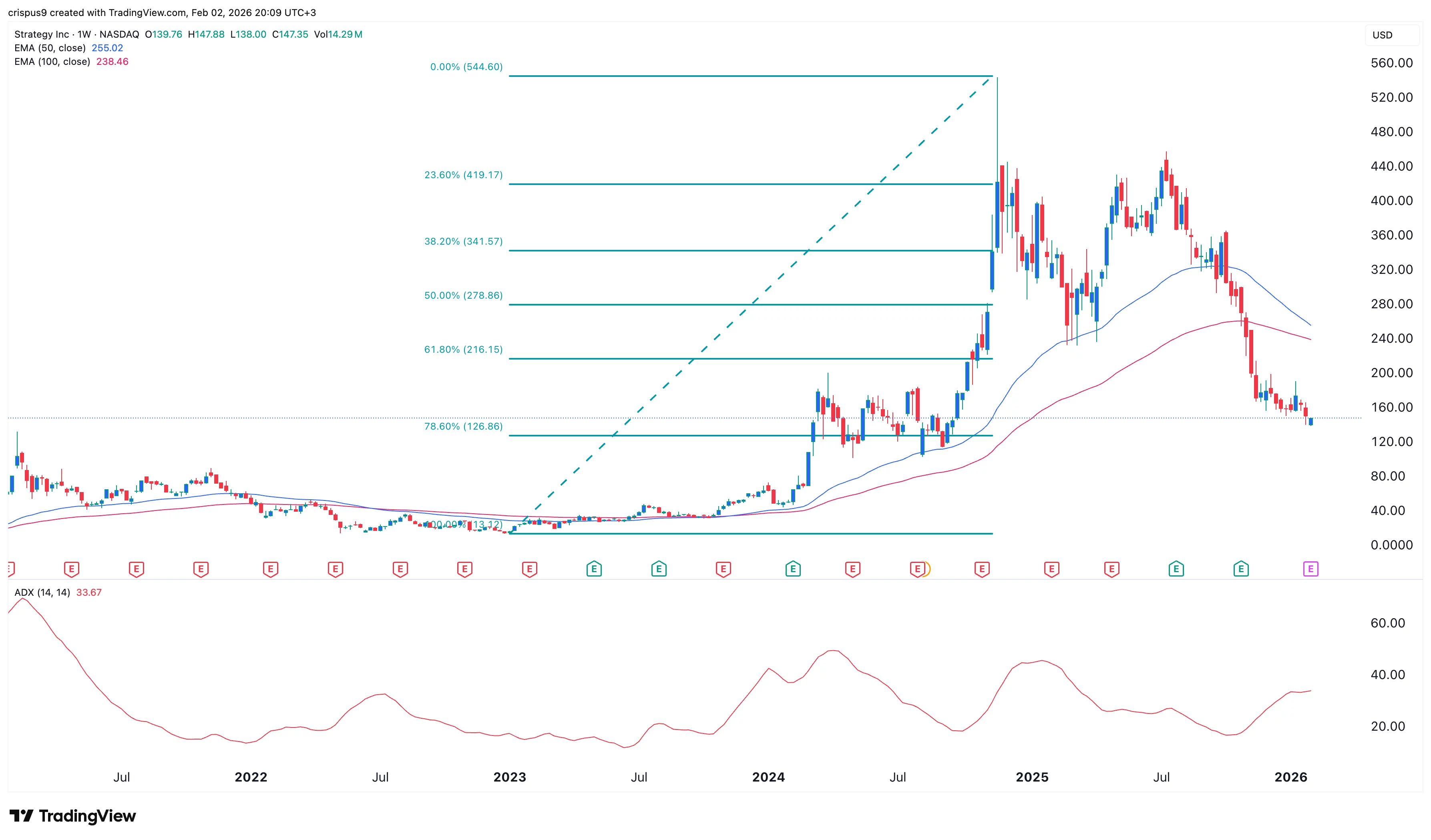

MSTR stock price technical analysis

Strategy Stock Chart |Source: TradingView

The weekly chart shows that the MicroStrategy stock price is in a significant downtrend. It is currently below the 61.8% Fibonacci retracement level, confirming a downtrend.

The average directional index rose to 33, the highest level since March last year. A sharp rise in the ADX indicator indicates that the downtrend is gaining momentum.

The stock price fell below all moving averages and supertrend indicators. Therefore, the most likely scenario is a 35% decline to $100 and then a return to the downtrend.

read more: Despite positive fourth-quarter forecast, Palantir stock forms an alarming pattern