River says individuals still own most of the Bitcoin.

The US-based Bitcoin Financial Services company revealed its ownership distribution research in a recent post on X dated August 25, 2025. The research group provided each with river attributes, using public applications, custody address tagging, and previous blockchain research, showing river attributes for each.

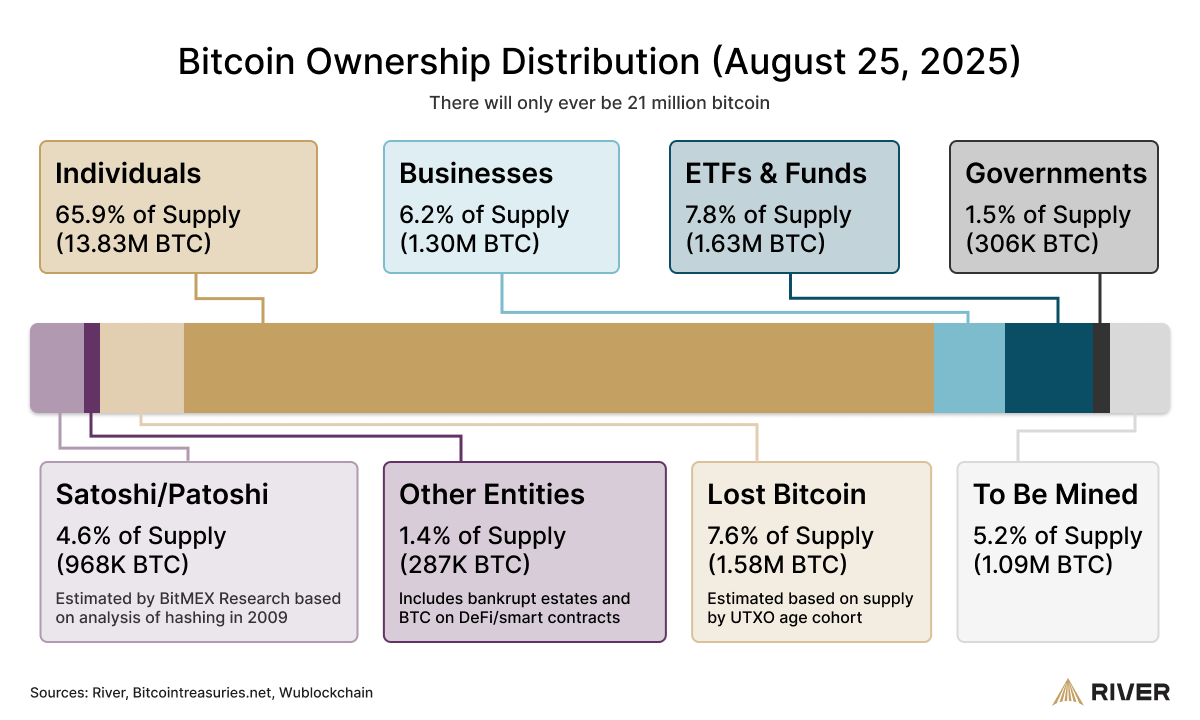

River estimates that individuals control about 65.9% of the circulation BTC, or 1383 million coins. This bucket contains a freestanding wallet, and the exchange account river is classified as an individual.

On the institutional aspect, River divides its possessions into businesses, ETFs and funds.

- Companies – Bitcoin Holdings – Global category covering finance and traditional companies – accounting for approximately 6.2% of the supply, or 10 million BTC.

- ETFs and Funds – Spots of ETFs and investment instruments detained for clients – controls about 7.8%, or 1.63 million BTC.

The government is shown at about 1.5%, or 306,000 BTC, based on river tracks from public sources.

Two special categories conclude the distribution.

- Lost Bitcoin accounts for around 7.6%, or 1.58 million BTC. River says this is inferred from a heuristic of age that indicates coins that have not moved for many years and are likely to be irreparable.

- Satoshi/Patoshi Holdings is fixed at approximately 4.6%, or 968,000 BTC, based on early studies of early ERA mining patterns.

Finally, about 5.2% of the supply, or 1.09 million BTC, has yet to be mined by the time it reaches a hard cap of 21 million.

River’s survey estimates as of August 25, 2025, individuals hold 65.9% of BTC. Fund 7.8%

Clearly, River’s research is an attempt to map people who hold Bitcoin today, rather than predicting future prices. The estimates are inconclusive as custodians aggregate many clients, so some wallets are misclassified and ownership can be opaque.

River’s conclusion is that although individuals still dominate their holdings, the system’s share is growing and is helping to grow ETFs and businesses that now treat Bitcoin as a balance sheet asset.