Important points

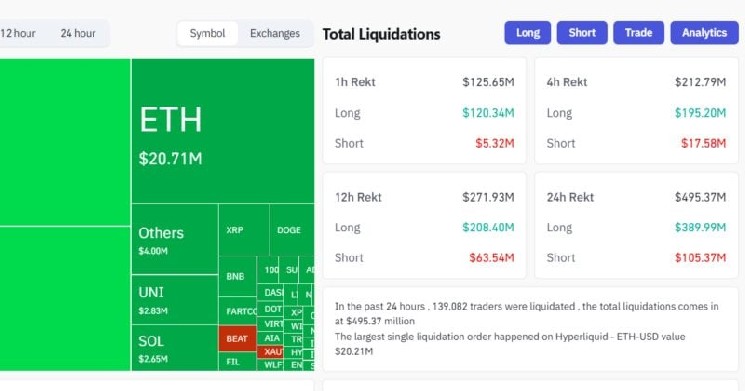

- When Bitcoin fell below $103,000, over $120 million of long positions were liquidated.

- Major exchanges such as Binance and Bybit have forced the closing of leveraged long positions.

Bitcoin fell below $103,000, causing more than $120 million in liquidations and widespread forced closures of leveraged long positions across major exchanges.

The drop in prices caused a chain liquidation effect, amplifying the downward movement. Exchanges such as Binance and Bybit reported significant long position extinctions during price sweeps.

Cryptocurrency markets have seen increased volatility in recent sessions, with liquidation events creating further downward pressure on digital assets. A real-time liquidation heatmap from major exchanges highlighted the dominance of long position liquidations as Bitcoin retreats from high levels.

The liquidation means exchanges are forced to close trading positions that were betting on price increases to unwind leveraged positions amid market volatility.