With the intensification of network competition and the deterioration of the profit situation, the profitability of the entire Bitcoin mining industry is facing new strains.

Bitcoin miners are facing new pressure as the network’s hash rate – a measure of the total computing power competing to secure the Bitcoin network – rose to a record 1.16 ZH/s in October, while the price of Bitcoin (BTC) has fallen towards $81,000 since the start of November, The Miner Mag reports.

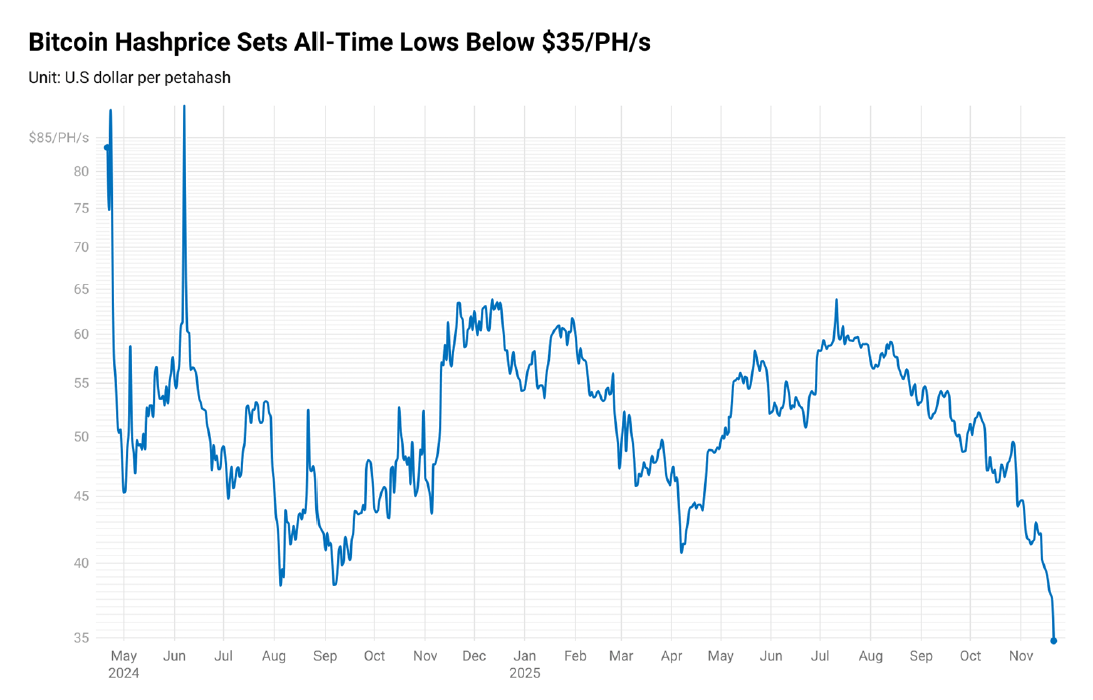

Hashprice, which tracks miner revenue per unit of computing power, was below $35 per hash and below the median total hash price reported by public mining companies of $45/PH/sec. This decline is pushing some operators closer to breaking even.

The report noted that recovery periods for mining rigs have exceeded 1,200 days, while financing costs continue to rise across the sector, creating an additional burden.

sauce: minor mug

A relatively stable third quarter was followed by a slump, with hash prices averaging around $55/PH/sec during this period with BTC trading near $110,000. Increasing competition on the network and the drop in Bitcoin prices since the beginning of November have pushed mining profitability to record lows.

The financial strain also coincides with a surge in miner borrowing, initially sparked by a wave of near-zero-coupon convertible bonds in the past quarter.

The report says that while miners are accelerating their focus on AI and high-power computing (HPC), revenues from these services remain too small to meaningfully offset the sharp decline in Bitcoin mining revenue.

Stock prices soar after JPMorgan’s price target

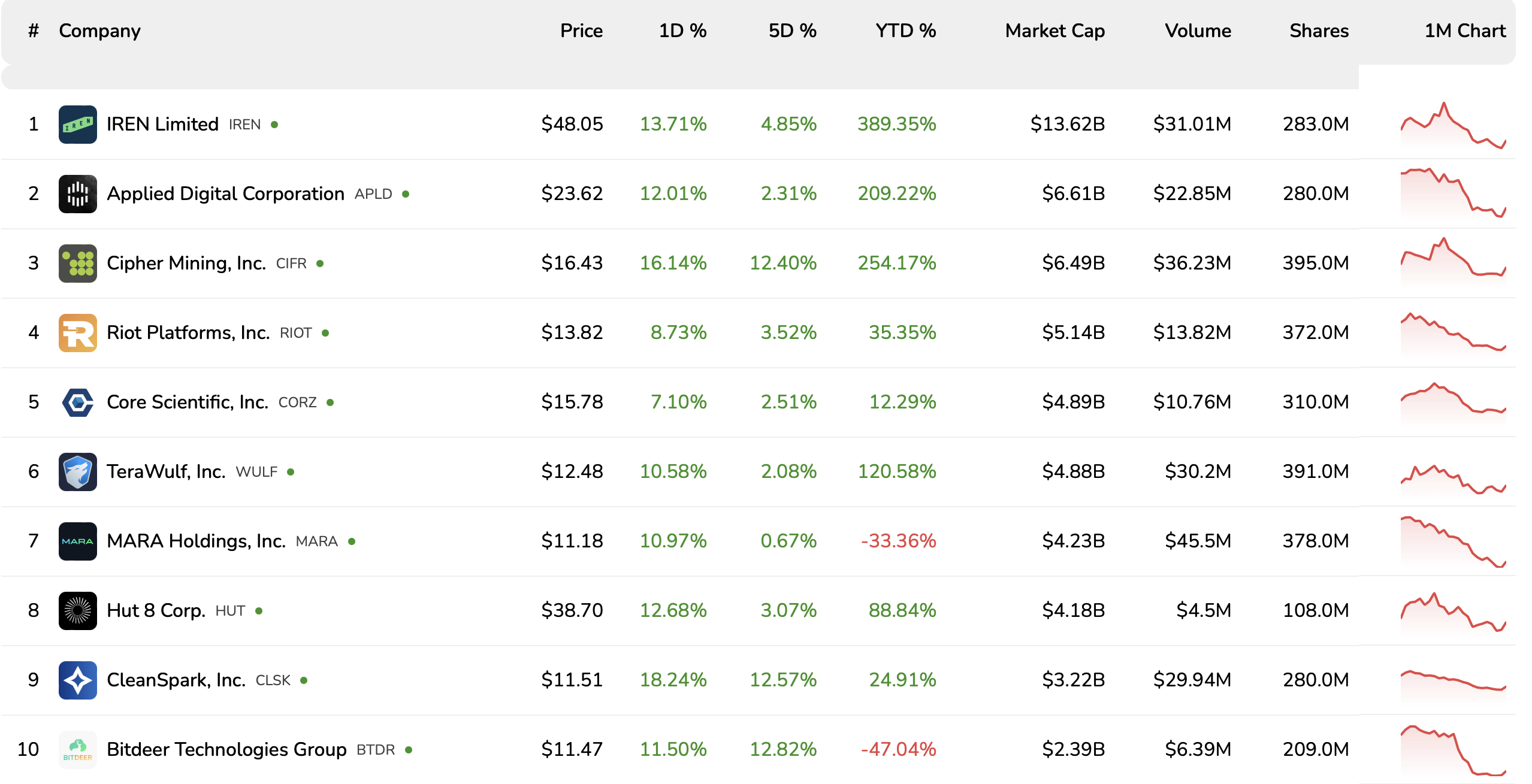

Despite the sector’s tight economic conditions, the top 10 listed miners have all increased in the past 24 hours, with CleanSpark, Cipher Mining and IREN posting double-digit gains on Monday.

The surge reflects a surge in long-term HPC and cloud deals across the sector after a JPMorgan research note raised price targets for three miners.

Bitcoin miners listed by market capitalization. sauce: bitcoin mining stocks

JPMorgan said Cipher’s stock price has fallen about 45% from its all-time high, creating a more attractive entry point, and noted that the company is “well positioned” to enter into additional deals with HPC tenants.

In November, IREN signed a five-year, $9.7 billion GPU cloud services agreement with Microsoft, giving the tech giant access to Nvidia GB300 GPUs hosted in IREN’s data centers.

The bank lowered its forecasts for Marathon Digital and Riot, arguing that falling Bitcoin prices and increasing share counts are weighing on both miners’ large coin inventories.

The rise in miner stocks has also coincided with a gradual rebound in bitcoin prices, which at the time of writing were up about 2% in the past 24 hours and trading at around $89,000, according to CoinGecko data.