Bitcoin has fallen more than 20% this month, marking its worst monthly reading since 2022, and the network’s hash price has fallen to levels miners haven’t seen in years. With just over a week left in November, mining revenues appear to be heading into territory not seen since last year.

November is troubling for Bitcoin miners

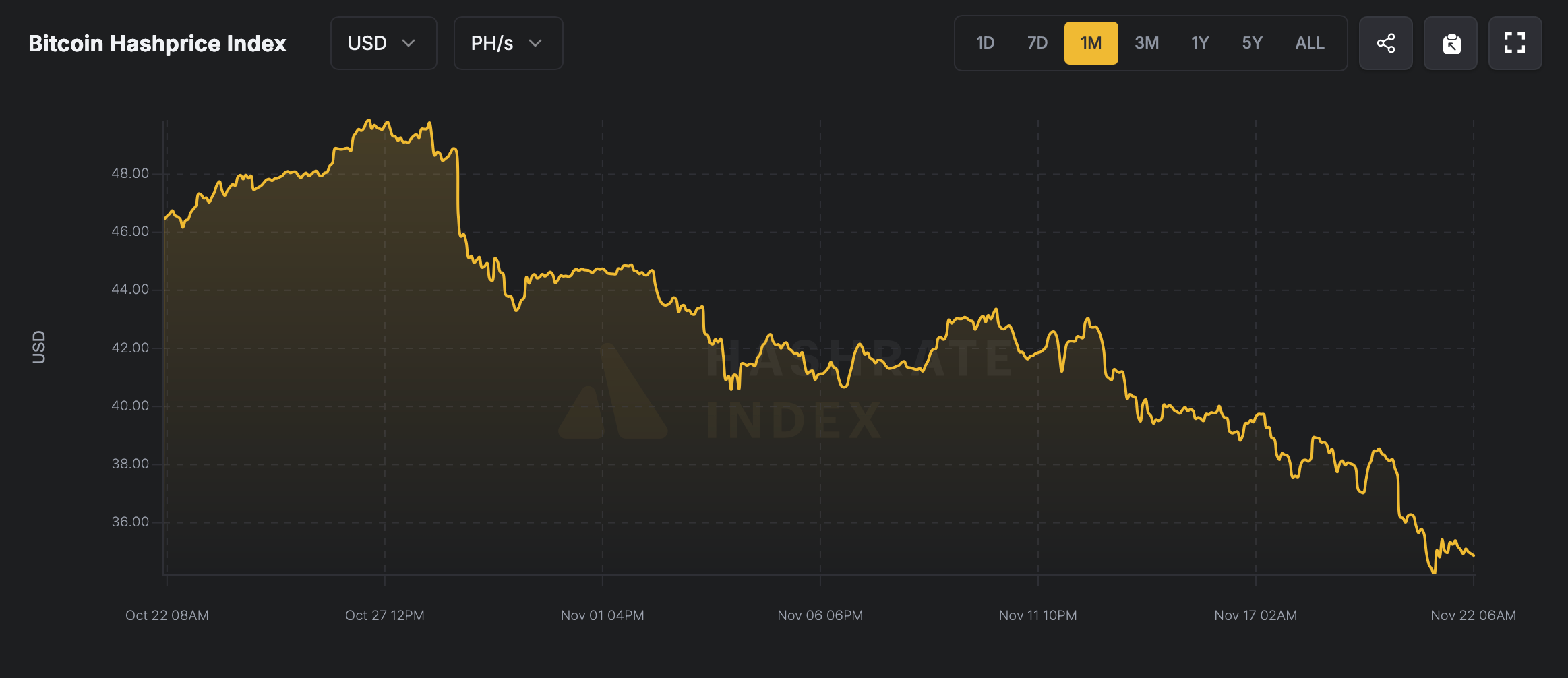

Bitcoin miners are likely dreaming of a turnaround right now, as the revenue graph paints a…less-than-flattering picture. The plummeting price of BTC has pushed HashPrice into dangerous waters.

So what exactly is hash price? Think of it as a payment that miners get for each unit of hashing power they put into the network. It can be calculated using TeraHash, Petahash, and Exahash. Please choose according to your preference.

As of this writing, the network hash price in petahash per second (PH/s) is $35.33 per PH/s, according to hashrateindex.com. To put it another way, a miner operating 1 Equahash (EH/s), which is equivalent to 1,000 PH/s, would earn approximately $35,330.

Bitcoin hash price on November 22, 2025.

The hash price fell to $34.21 on November 21st, marking the lowest payout for miners in more than five years, at a time when Bitcoin wasn’t trading anywhere near its price tag today. The story hasn’t changed. Miners are feeling the immediate pain of BTC price volatility, with fees still accounting for just 0.77% of each block reward.

read more: Bitcoin Price Monitoring: Daily Downtrend Increases Influence on Price Trends

If prices remain fixed, Bitcoin miners could be staring at their lowest monthly income since last year. So far, according to data from newhedge.io, miners have collected $953 million in both fees and block rewards, with about $946 million of that coming from subsidies alone.

There are still eight days left in November, and conditions are shaping up to be the toughest of the year. Bitcoin miners are going through tough times, and the data doesn’t necessarily bring reassurance. Once momentum returns, miners may shift out of survival mode to get some breathing room, but until then, things look pretty bad.

Frequently asked questions ❓

- What is Hash Price? This is the amount of money miners earn for each unit of hash power they contribute to the Bitcoin network.

- Why is mining income decreasing? The fall in the price of Bitcoin has pushed hash prices to multi-year lows, causing miners around the world to pay less.

- How low are miners’ incomes currently? Hashprice has recently fallen to nearly $34 per PH/sec. This is the lowest level miners have seen in more than five years.

- Why is November so rough? This is shaping up to be the toughest month for miners since last year, with revenue sluggish and fees contributing little.