The odds that the U.S. Federal Reserve will cut the federal funds rate at the Federal Open Market Committee (FOMC) jumped on Tuesday, showing futures traders and prediction markets are all but flagging a quarter-point cut as the expected outcome.

The market is all-in on quarter-point trim.

Most of Wall Street’s major indexes flashed green on Tuesday, with gold and silver a little brighter, and the crypto market followed suit.

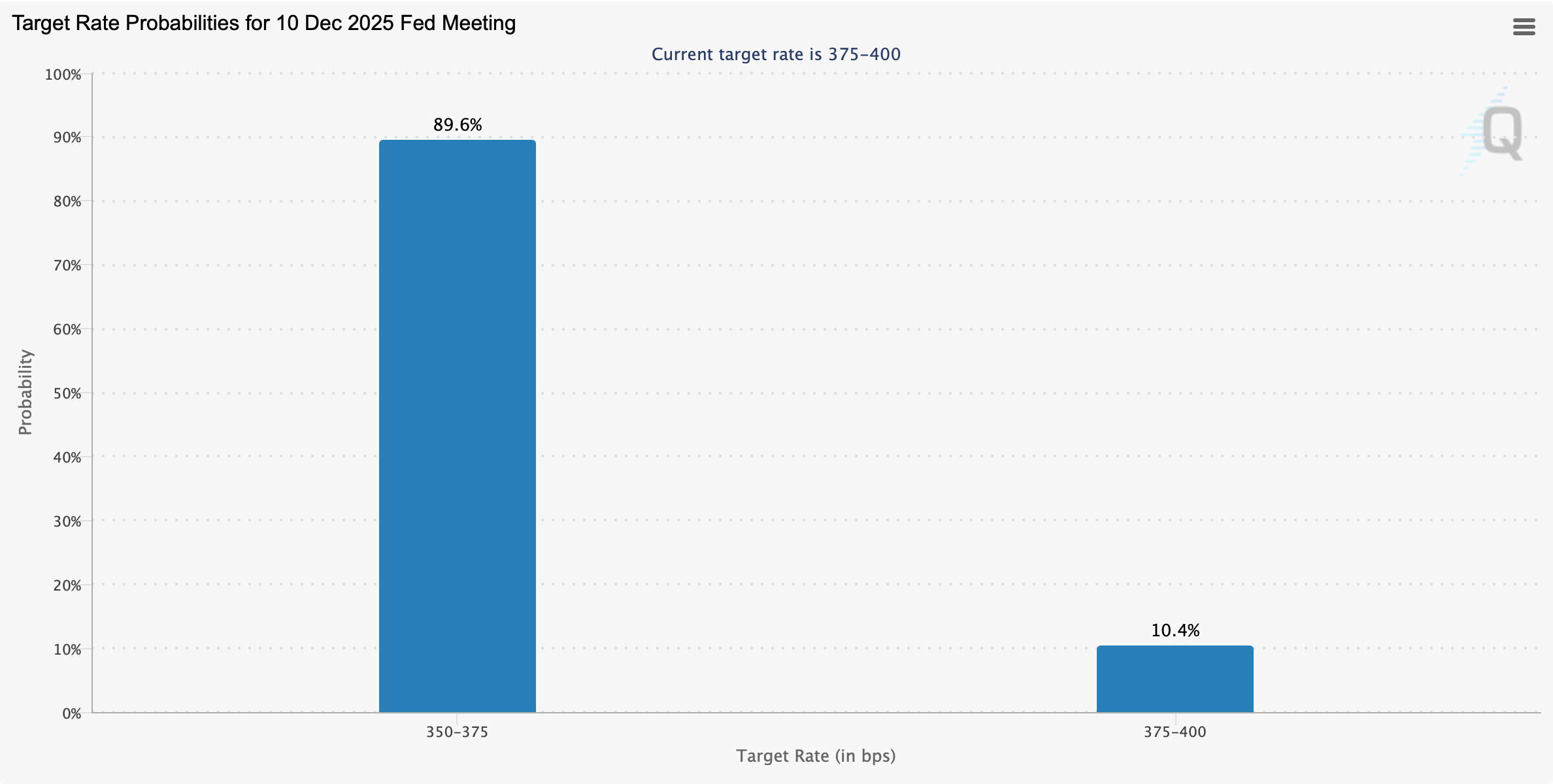

CME FedWatch data added further color to the rate cut frenzy on Tuesday, showing that traders had mostly made their decisions before the FOMC met. The tool has an 89.6% chance of locking in a rate cut to the 350-375 basis point range, and only a 10.4% chance that officials will maintain their current 375-400 basis point target.

CME Fedwatch Tools December 9, 2025.

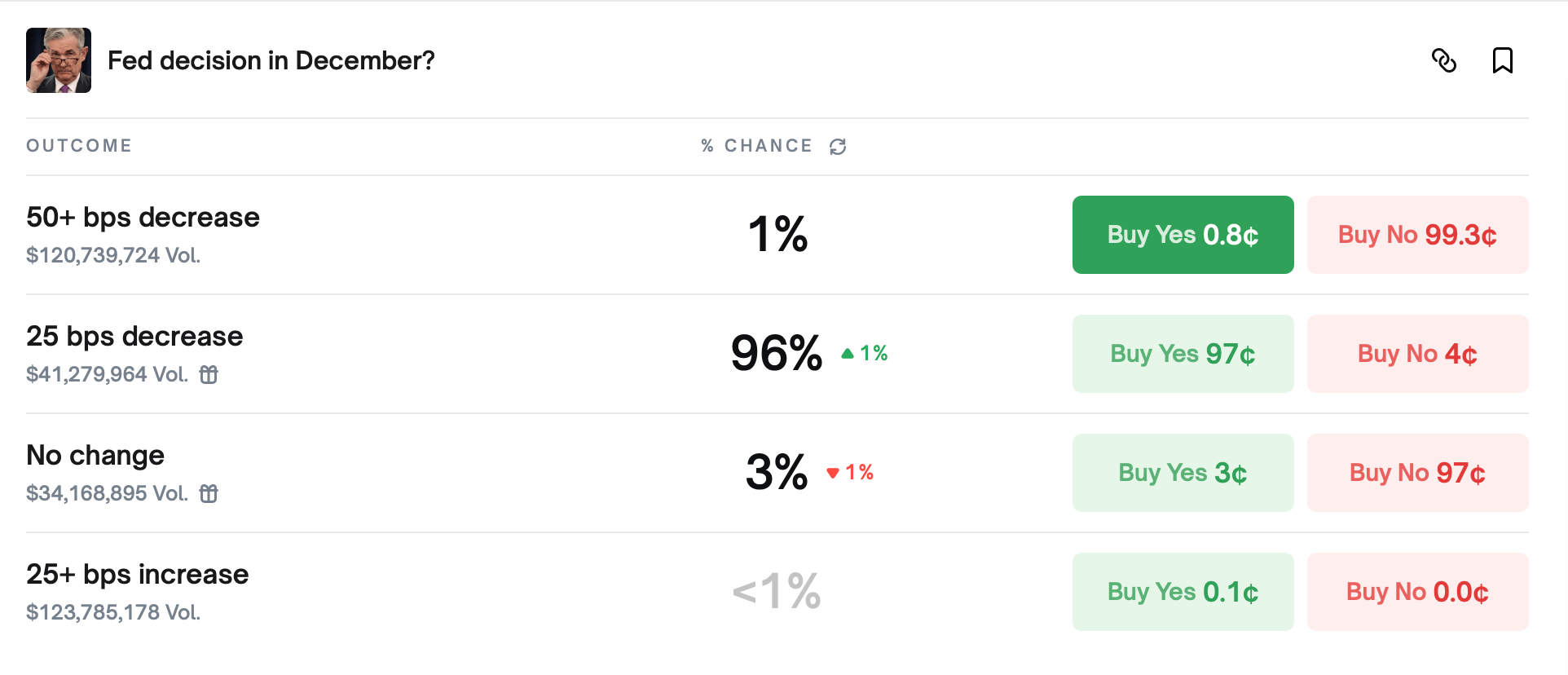

In other words, the futures market isn’t just tilting toward a trim, it’s effectively treating it as a completed trade. Polymarket traders do not hesitate to emphasize the Fed’s early decision. As of 12:30pm ET on December 9th, the platform was pricing in a 25bps rate cut by a high 96%, effectively treating it as a default outcome.

Polymarket December Fed bet on December 9, 2025.

Polymarket forecasts show a deeper 50bps cut would be barely 1%, with “no change” at 4%. What about surprise hikes? Traders are pushing the results into the rounding error column as less than 1%. Mr. Kalsi’s traders are similarly convinced that the Fed is reaching for the scissors.

In the U.S. prediction market, the probability of a 25bps cut has increased slightly to 95%, while the percentage of those in the “firm” category has decreased to 5%. Deeper than standard cuts have very little flicker on the board at less than 1%. Add it up, and the Calci and Polimarket order books, along with CME futures, paint a picture of inevitability. The 1/4 point cut is the market baseline and all other results are just background noise.

Also on Tuesday, White House economic adviser Kevin Hassett echoed President Trump’s push for easy monetary policy, arguing there is “plenty of room” for the Federal Reserve to continue lowering interest rates. Hassett, speaking at the WSJ’s CEO Council, signaled that he would welcome a rate cut beyond the 25 basis points expected at the current Fed meeting, as long as economic data remains positive.

read more: Eight AI chatbots offer wildly different Bitcoin price predictions — which one will hit on December 31, 2025?

At this point, the only thing still acting like there’s suspense is the calendar. Traders are writing the script, theme music is blaring in futures markets, and forecasting platforms are already handing out popcorn. However, if asset prices rise before the announcement, it could turn into a selling news event faster than you can say “dot plot,” so it pays to be a little cautious.

Frequently asked questions ❓

- What kind of interest rate movements does the market expect from the Fed?Traders are overwhelmingly pricing in a 25 basis point rate cut by the FOMC in December.

- How are prediction markets reacting to the possibility of a rate cut?Platforms like Polymarket and Kalshi are showing near-consensus odds in favor of trim.

- What does CME FedWatch say about the Fed’s next decision?According to FedWatch data, the probability of a rate cut is almost certain, and the probability of it being maintained is minimal.

- Could an increase in asset prices trigger a sell news reaction?Indeed, if the price rises before the announcement, it increases the risk of a pullback as soon as the decision is made.