The uncertainty of the increase over signs of interest rate cuts and slowing economic growth has been overwhelming with Bitcoin (BTC) as they struggle to gain momentum a few weeks after reaching record highs in mid-July.

In addition to uncertainty, in response to the continued purchase of Russian oil in South Asia, following Trump’s August 4 tariff threat against India on August 4 will cool institutional demand and further increase geopolitical tensions.

BTC price forecast

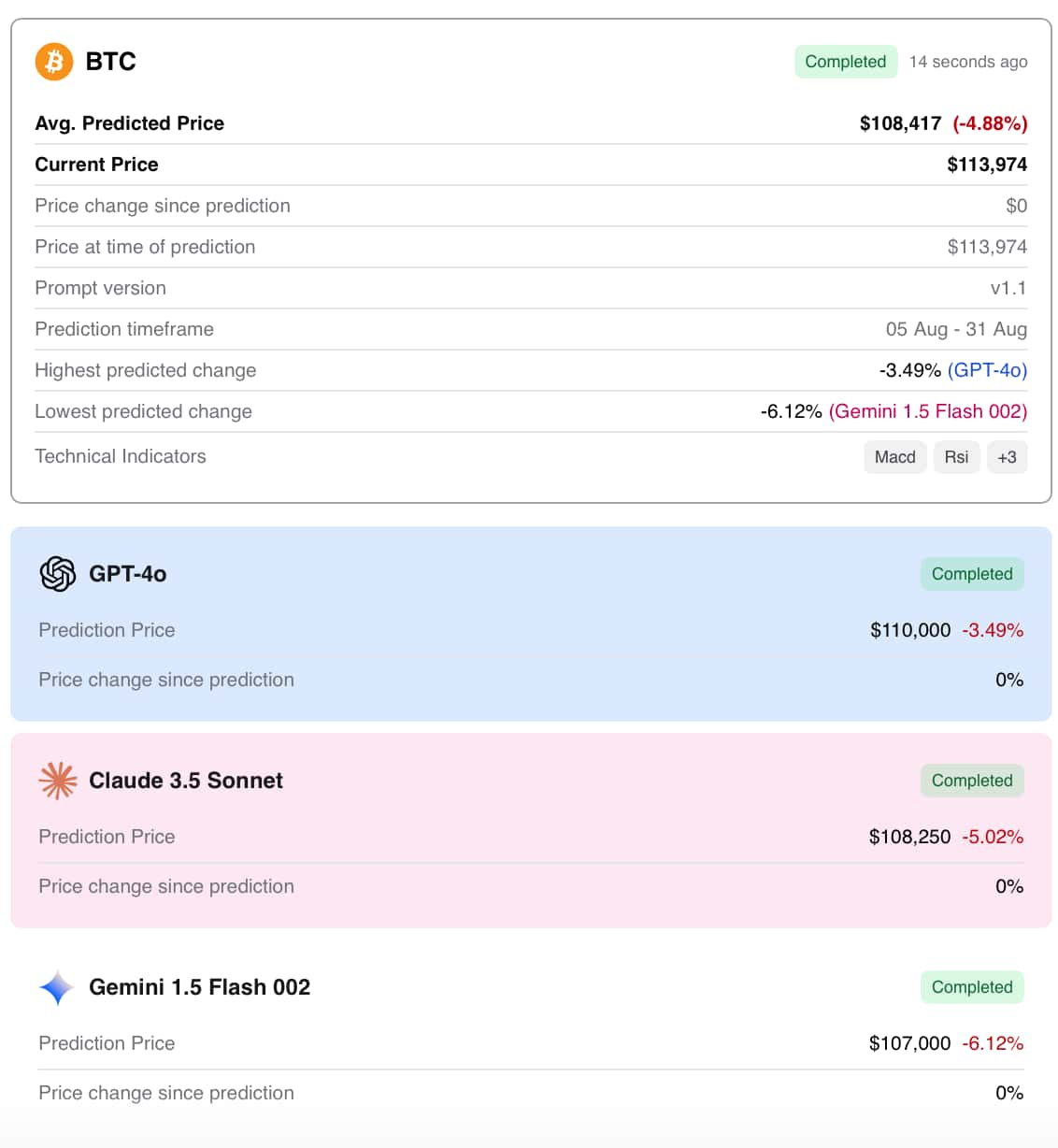

To see where Bitcoin is by the end of the month, Finbold’s AI prediction agent used multiple LLMs to generate average predictions to improve accuracy, while incorporating momentum-based metrics into its context. You can try out existing prompts or create your own. Try it now here.

To make that prediction, AI analyzed many technical indicators, including moving average convergence/divergence (MACD), relative strength index (RSI), probabilistic oscillators, and 50-day moving average (MA).

The results show that Bitcoin is during the recession period, with an average forecast price sitting at $108,417, meaning a downside of 4.88% from the current price of $113,974.

Of the three LLMs used in the forecast, ChatGPT -4o is the most optimistic, with the forecast price of $110,000, suggesting a downside of -3.49%.

The Claude 3.5 Sonnet and Gemini 1.5 Flash 002 are slightly bearish, with the former projecting a price of $108,250, suggesting a loss of -5.02%, while the latter set at $107,000, hinting at a downside of -6.12%.

Bitcoin August price possibility

As mentioned earlier, institutional flows, evolving chain dynamics, and changes in US regulations all have become increasingly complex pictures when it comes to Bitcoin.

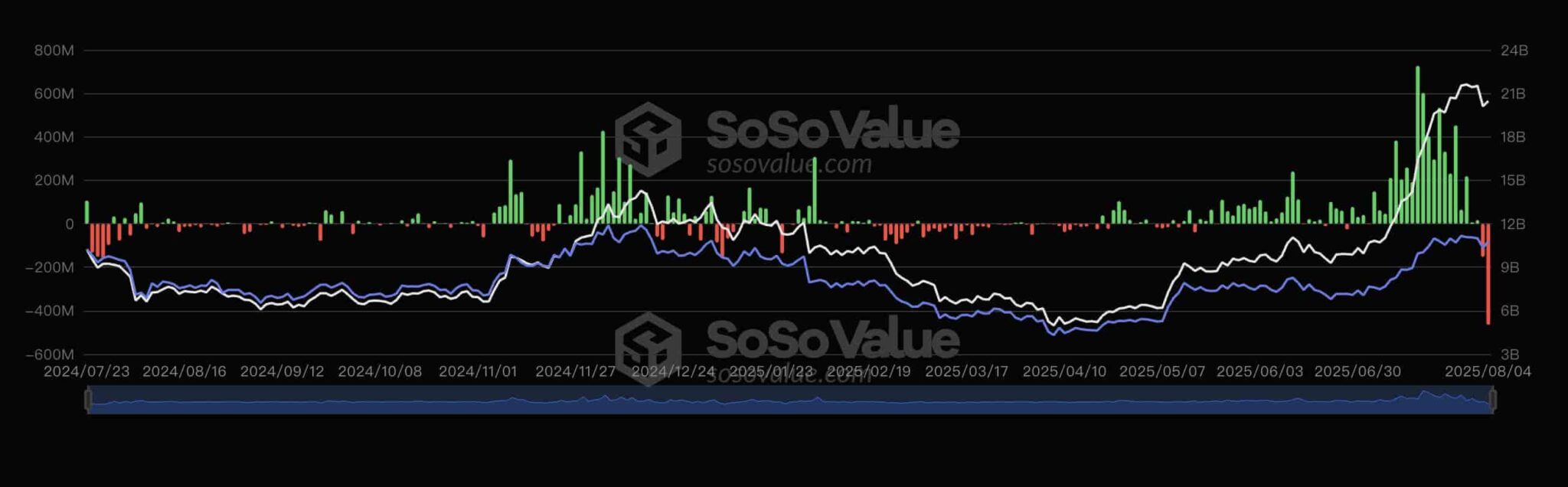

US Spot Bitcoin ETFS shook the market on August 5th, seeing a net leak of $333 million led by BlackRock (IBIT).

Housepassed digital asset market clarification can provide long-term regulatory certainty by classifying most crypto tokens as commodities based on Commodity Futures Trading Commission (CFTC) surveillance.

Still, there remains a lot of uncertainty following the Securities and Exchange Commission (SEC) decision to delay the recognition of politically sensitive and true social ETFs until September 18th.

Meanwhile, the CME FedWatch tool currently looks at a 92% chance of interest rate cuts in September, which could lead to rising demand and prices.

Featured Images via ShutterStock