LSK has been one of the breakout tokens of the past day, rising over 70%. The token has rebounded after years of decline and is now trying to make a comeback.

One of the legacy chains, Lisk, is trying to make a comeback. Its native asset, LSK, rose by up to 79% in the past day after months of decline. Despite the absence of an altcoin market, events like the LSK breakout are impacting some older tokens and reawakening them in derivatives trading.

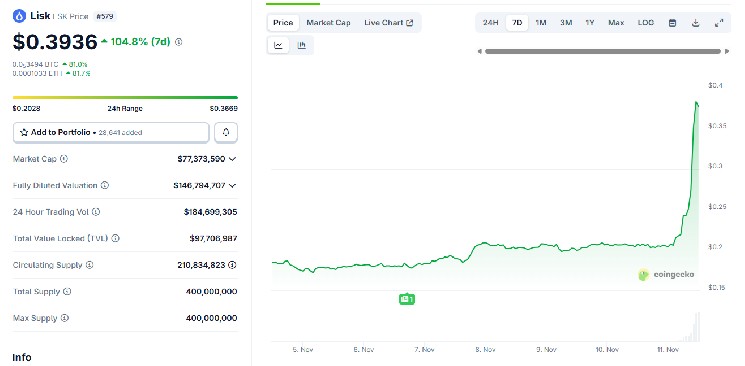

LSK traded at $0.37, rebounding from the bottom of a long slide over the past year. In late 2024, when it first announced its comeback, LSK had an even bigger breakout to $1.40. The current rally has not yet shown its sustainability, and it is unclear whether the Lisk team is close to its goal.

LSK broke out, boosted by Upbit’s trade against the South Korean won. |Source: Coin Gecko

The Lisk project is also making a comeback with an enhanced Web3 app. As of November 2025, LSK was left with minimal funds due to the downturn in the altcoin market. mind sharebased on data from Messerli. This dino chain has been around for a long time with almost no app, but it also failed to gain traction during meme season.

Lisk tried to break out as an L1 with a sidechain and JavaScript SDK to attract app teams. Now, Lisk has moved to the OP stack chain and joined the superchain along with Base and Optimism. the chain just secures $9.1 million Value is locked and contains versions of Morpho and Velodrome DEX.

LSK open interest reaches all-time high

The LSK breakout provided plenty of direction for the derivatives market. Open interest rose to an all-time high of more than $22 million.

In previous bull markets, LSK relied primarily on spot trading, losing positions to other popular assets.

The LSK assets were also completely transformed. At the ICO stage, LSK was an Ethereum-based token. LSK then moved to a native chain leveraging 100 validators. The Lisk team returned to Ethereum as the chain had relatively low usage during two bear markets.

LSK is currently traded in tokenized form with Binance as one of its main markets. So far, LSK has not confirmed any Hyperliquid activity.

LSK trading rises due to Upbit activity

LSK’s trading volume has shifted to Upbit, one of South Korea’s major markets. This token is an anomaly, with over 81% of its trading volume being against the Korean won.

Despite the recent downturn in the Korean market, LSK benefited from its traditional market. The token ranks among the top five most traded assets on Upbit, even surpassing Solana’s trading activity.

The LSK spot market is further supported by derivatives trading on Binance. Approximately $13.7 million in LSK open interest has been accumulated on Binance and the rest on Bybit. Based on the liquidation heatmap, the hike to $0.37 liquidated all available short positions, followed by an almost immediate drop to $0.35.

The previous day’s rally was also due to a short squeeze, with short-term liquidations of $1.4 million and long-term liquidations of only about $370,000. The LSK position is almost balanced after liquidation.