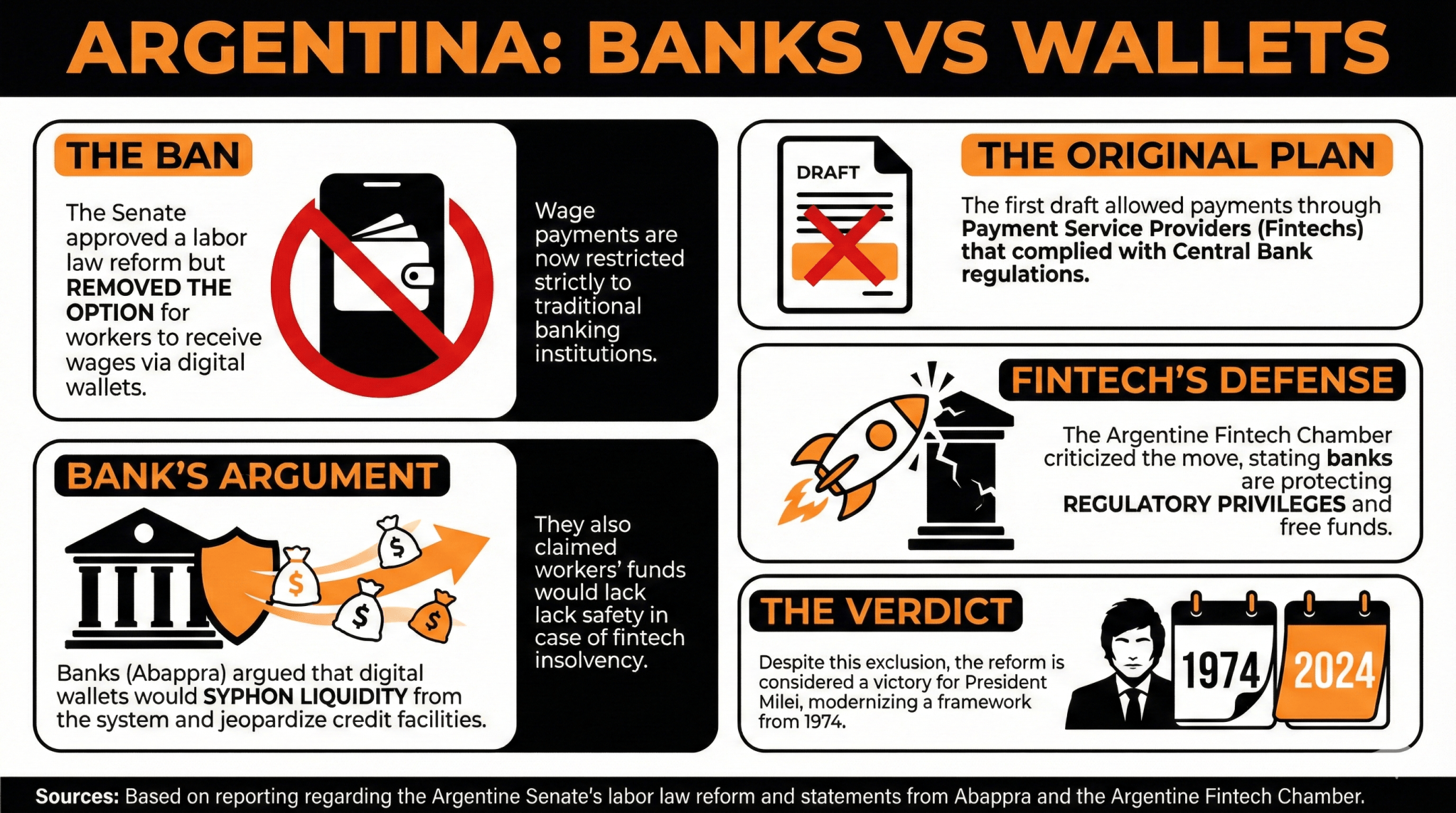

Amid debate over new labor law reforms in Argentina, a proposal to allow workers to receive their wages in digital wallets managed by payment providers was defeated as banks pressured lawmakers to rule out the option.

No choice: Digital wallets excluded from eligible payment options under labor law reform

Argentina has failed to make progress in providing workers with more options for receiving wages.

The option to receive wage payments through digital wallets managed by payment providers was ultimately removed from the labor law reform provisions approved by the Senate. The article only allows wage payments to be made through traditional banking institutions, leaving fintech companies out of the loop and is strongly opposed by opposition parties.

The first draft included an article declaring:

“Cash remuneration payable to a worker must be paid only through a deposit into an account opened in the worker’s name with a bank or public savings institution, subject to penalties of invalidity, or through a payment service provider that complies with the regulatory requirements established by the Central Bank of the Republic of Argentina (BCRA) for such activities.”

Nevertheless, banks opposed this, stressing that it would siphon liquidity from the banking system to fund their operations. Marcelo Mazon, executive manager of the Association of Public and Private Banks (Avapra), stressed that this measure “endangers the liquidity of the system and the existence of productive credit facilities.”

Additionally, Abapura argued that approving this provision would increase the risk to users, given that they do not have the same protections as banks regarding the safety of their funds. “In the event of bankruptcy, workers’ funds will be incorporated into the bankruptcy estate without priority,” it declared.

Argentina’s FinTech Chamber criticized the consequences of this measure, warning that this expedient reaction does not protect the safety of users’ funds, but the availability of these free funds to fund banks’ business models.

“Their business models rely on maintaining regulatory privileges rather than providing better services than fintech companies,” the Chamber concluded.

Still, the approval of the reform is seen as a victory for President Javier Millay’s government, given that it modernizes the framework established in 1974.

FAQ

What decisions has Argentina made recently regarding wage payment options?

Argentina’s Senate removed the option for workers to receive wages via digital wallets and restricted payments to traditional banking institutions.What was originally proposed in the Labor Law Amendment Draft?

The draft included a provision allowing wage payments through compliant payment service providers alongside bank accounts, but this was ultimately removed.What concerns did banks express about the proposed participation of fintech companies?

Banks argued that introducing fintech would drain liquidity from the banking system and expose customers to increased risks without the same protections as traditional financial institutions.How does Argentina’s FinTech Chamber view the results of the reforms?

The chamber criticized the decision, arguing that it prioritizes banks’ profits over the safety of users and limits competition from fintech companies.