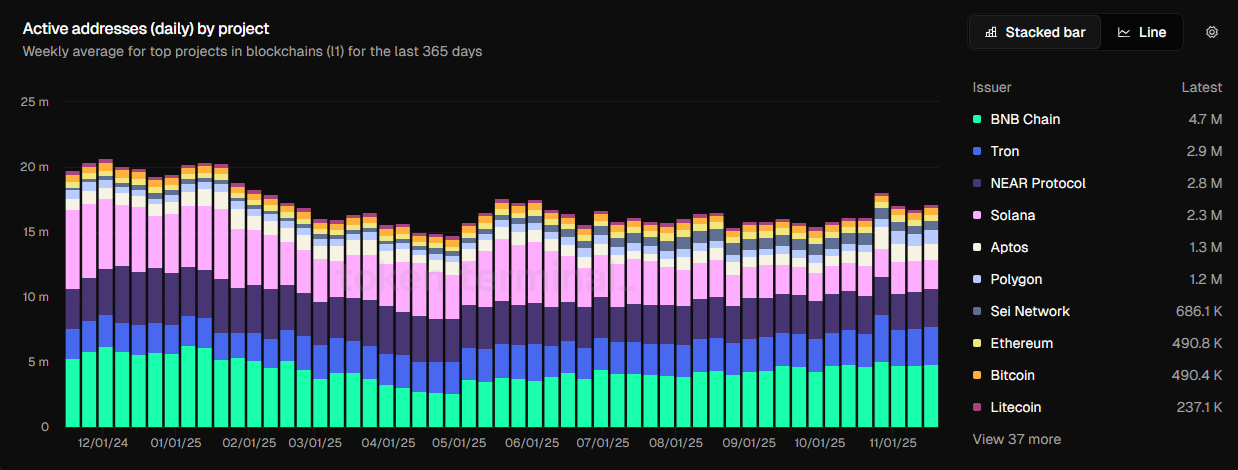

Despite a significant amount of movement, on-chain activity has slowed down. Major L1 exchanges have seen an outflow of active wallets.

Major L1 chains such as Solana, BNB Chain, and Ethereum are showing a slowdown in overall activity. This slowdown is notable compared to the last few months of 2024, when enthusiasm brought on-chain users. Solana has dropped from 2.3 million to 1.7 million daily active wallets after almost reaching its peak. 32M It will become an active wallet in September 2024.

While on-chain activity slowed in major chains, value transfer remained strong in the most liquid networks. |Source: Token Terminal

The BNB chain receives a boost from interest in PancakeSwap and Aster, select memes, and has approximately 4.7 million daily active users based on: data By token terminal.

Ethereum maintains around 600,000 active addresses every day. The L2 chain Polygon is hovering around 86,000 wallets and has a high baseline thanks to the use of Polymarket. Basically, we have a fixed number of 600,000 to 800,000 active users, but the transaction volume is increasing.

L1 activity was slowest in Solana

Last year, Solana lost the biggest part of its operation. Activity declined further due to a slowdown in low-cost activities such as NFTs, DEX swaps, and meme minting and trading.

Solana remains the leader in terms of fee production and still has plenty of liquidity. But the chain has seen an exodus of retail users and a shrinking community. Solana’s activity is currently supplemented by whales, large investors, and more recently ETFs.

The slowdown in on-chain transactions and active wallets also reflects the lack of user-oriented technology with low-cost entry points into cryptocurrencies.

L1 activity also relies on short-term incentives such as point farming. The slowdown of certain airdrops based on activity also impacted the L1 chain.

L1 chain retains value

The L1 chain maintains value transfer and economic activity despite wallet outflows. Ethereum, for example, has over $6 billion in value transferred per day. $3.8 billion In November 2024.

Solana also increased DEX trading volume from approximately $4 billion at the end of 2024 to $14 billion in November 2025. The recent exodus of microtransactions has been replaced by fee-paying users and increased value activity. Solana’s stablecoin transfer amount in October was $1.8 billion, below the abnormal range. $233 billion In December 2024.

The drop in traffic also suggests that some of the L1 chain’s traffic was not completely organic. Current L1 activity reflects the most active app usage and shows no signs of intentional volume increases.

As of November 2025, BNB Chain holds the largest number of daily active users. PancakeSwap is the main driver of fees and paid activity. As with BTC and other chains, raw activity is meaningless and has been replaced by value-driven transfers, whale activity, and the use of apps with available liquidity.