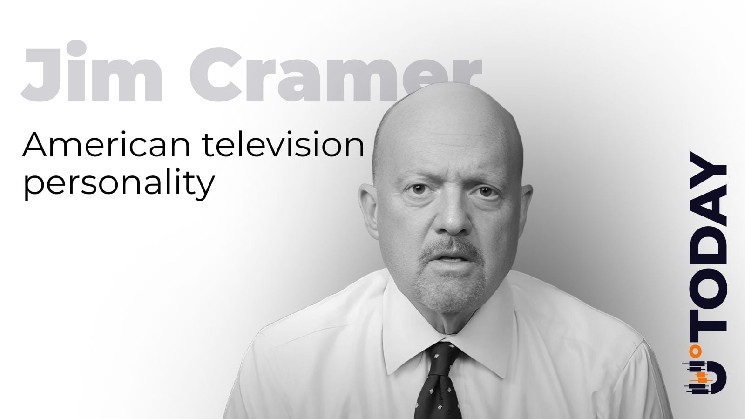

It was invented by longtime CNBC anchor Jim Cramer. harsh criticism Bitcoin fell after a sharp decline over the weekend.

Despite being a self-proclaimed asset holder, Cramer argued that the wild price movements of the past 48 hours were conclusive proof that Bitcoin cannot function as a stable medium of exchange.

“The demonstration of what can happen with Bitcoin over the weekend shows that Bitcoin cannot be trusted as a currency in the short term,” Cramer wrote. “And I’m writing this as someone who owns Bitcoin.”

“entertainment”

In another social media post, Cramer urged investors to stop obsessing over price movements in non-yielding assets and focus on a company’s fundamentals. He cited the crypto panic and the precious metals market as similarities.

“We get worried when gold and silver skyrocket, we get worried when gold and silver crash, and we should probably just worry about the bottom line,” Cramer said. “I’m not saying these are sideshows. They’re not, but not all events/prices/sudden movements are created equal…”

However, he noted that this particular crash could be targeted. Michael Saylor’s Strategy, formerly known as MicroStrategy, is scheduled to report earnings this week, but Cramer believes Wall Street bears can smell blood.

“Saylor’s report date is this week, February 5th, so the shorts are probably trying to break Saylor down before then,” Kramer warned. “Your regular defender will be on TV and give you a really good story, but that might not be enough because you could be short against a convert.”

$82,000 in lost bounces

Previously, Cramer predicted that Bitcoin bulls would be able to defend the $77,000 level and that the cryptocurrency’s rally would return to $82,000. But that didn’t happen.

Following the price crash on January 31st, kramer It called for silence from the industry’s biggest bulls.

“Where are the usual Bitcoin defenders? I think they have to get back to $82,000 by Monday so they can claim a double dip. I say that as a long-time Bitcoin owner!!! Oh??”

He was genuinely surprised by the fact that Whale allowed such a major technical failure to occur during weekend trading volume conditions.

“It always amazes me that the people who stand to lose the most from a Bitcoin decline (the $80,000 line in the sand) don’t protect their Bitcoin over the weekend.”