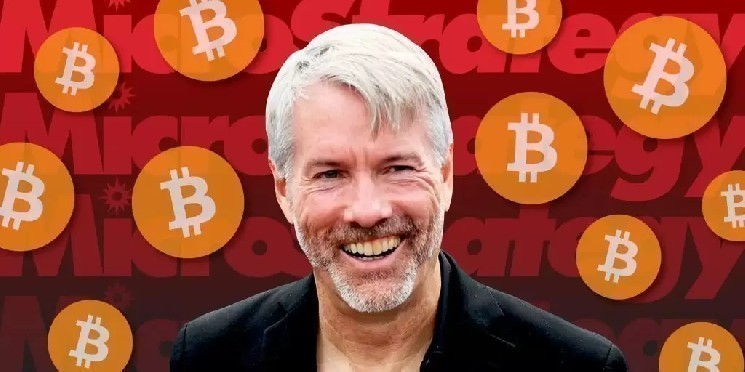

Michael Saylor announced that the company will not withdraw its buying strategy despite Bitcoin (BTC)’s rapid fluctuations. “We are not selling Bitcoin. We will continue to buy it every quarter and forever,” Saylor said.

With the price of Bitcoin fluctuating below $70,000, Saylor said the company made approximately $90 million worth of new Bitcoin purchases. Despite the market volatility, Thaler described Bitcoin as “digital capital” and signaled that he maintains a long-term view.

According to Thaler, Bitcoin is two to four times more volatile than traditional assets such as gold, stocks, and real estate. But this also means performance could be improved by a factor of two to four, he claimed.

“Volatility is a characteristic, not a flaw,” Thaler said, adding that Bitcoin will form the basis of new financial products in the coming years, especially “digital credit” products.

Recalling that Bitcoin reached an all-time high four months ago, Saylor said that it is traders who take a short-term (less than four years) perspective, not investors. According to Saylor, Bitcoin outperforms alternative capital assets by a factor of two to three over a four-year horizon.

Saylor also noted the decline in the company’s stock. Strategy stock has fallen about 60% over the past year. He said this has to do with Bitcoin’s downward trend over the past four months, explaining that the company is designed like a “leveraged Bitcoin,” meaning it rises faster when Bitcoin goes up and fluctuates more violently when it goes down.

One of the most debated topics in the market is whether Strategy will be forced to sell if Bitcoin prices fall further. Saylor called those concerns “unfounded.”

Saylor said the company’s net leverage ratio is about half that of a typical company with an investment-grade credit rating, and its balance sheet includes 50 years’ worth of dividends in Bitcoin and enough cash to cover 2.5 years’ worth of dividends and debt payments.

“Even if Bitcoin were to fall 90% and remain at that level for four years, we would still refinance the debt,” Saylor said, insisting that the credit risk was “minimal” (negligible).

Saylor referenced the oft-cited argument within the Bitcoin community about the $60,000 minimum miner cost, suggesting that miners’ influence on price trends is now a third-tier factor. He argued that the impact of large banks introducing Bitcoin-backed loan products and Wall Street giants issuing new Bitcoin funds would be 10 times stronger than the impact of miners.

Thaler declined to give a firm price prediction for the next 12 months, saying what really matters is long-term performance.

“Bitcoin will double or triple the performance of the S&P 500 over the next four to eight years. That’s all we need to know.”

*This is not investment advice.