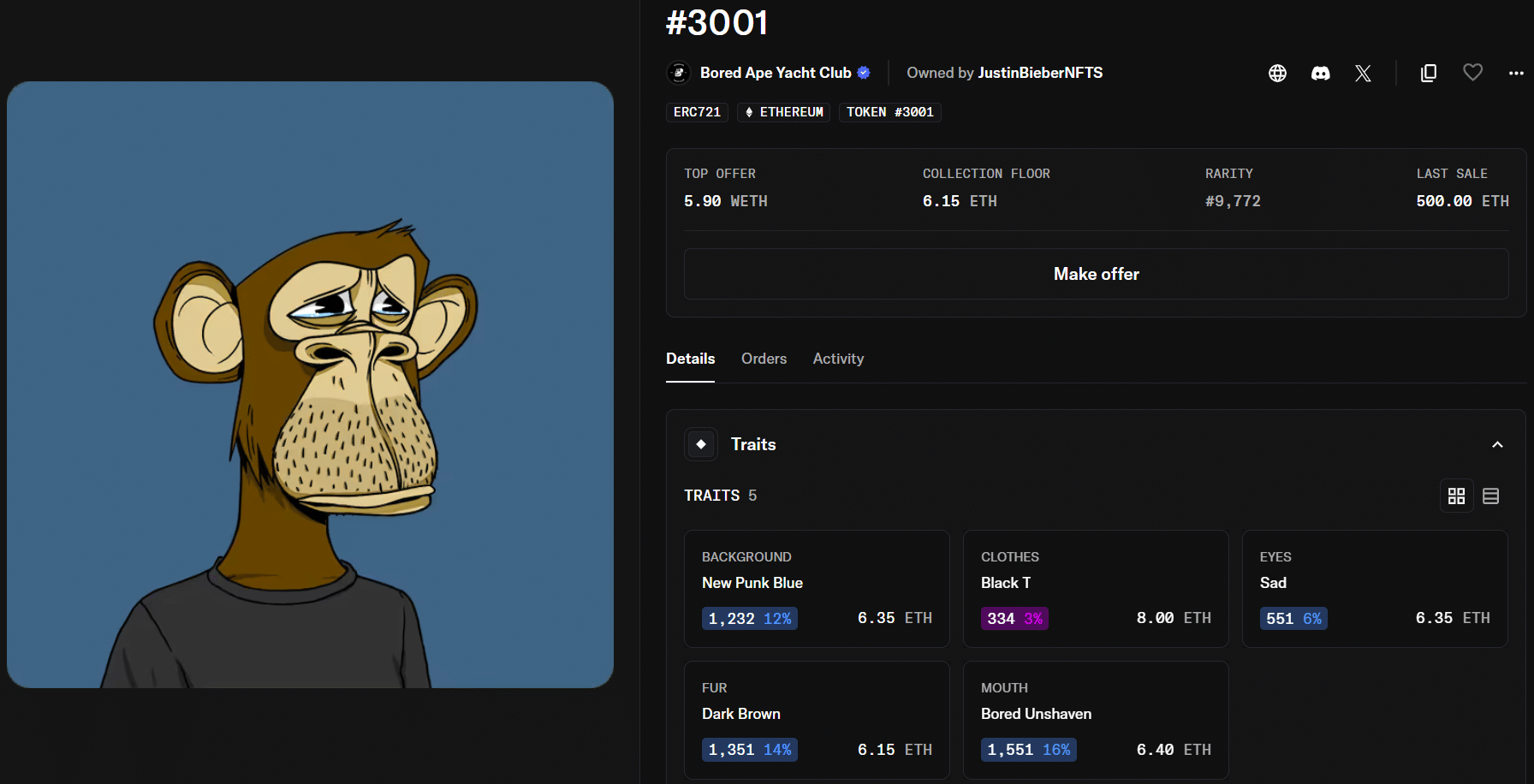

Justin Bieber’s Bored Ape #3001 sells for a staggering $500 $ETH By early 2022, that value had evaporated to about $12,000, reflecting the near complete disappearance of the initial $1.3 million investment.

A pop star who has become one of the most recognizable celebrities $NFT At the height of my enthusiasm for this field, I purchased digital collectibles. Analysts at the time noted that Mr. Bieber was paid well above prevailing rates, with comparable assets in the collection trading between $200,000 and $300,000.

The highest bid price was 5.9 $ETH And the collection floor is floating around 6:15 p.m. $ETHEthereum trading around $2,000 means investors who entered during the 2022 bull market are facing even larger losses in dollar terms.

Bored Ape Yacht Club (BAYC), a 10,000-piece generative art series created by Yuga Labs, debuted in April 2021 at a mint cost of 0.08. $ETH And it sold out in half a day. By May 2022, the lowest price reached $128-145 $ETHwhich equates to approximately $350,000 to $420,000 at prevailing exchange rates.

Bieber owns at least one addition to this series, Ape #3850, which he purchased shortly after his first purchase for approximately $470,000.

After the speculative bubble burst, $NFT Although trading volumes and floor prices have fallen significantly from their 2022 highs, the sector has not disappeared. Instead, development has shifted to applications focused on utilities such as in-game assets, access passes, identity tools, and tokenized real-world items.

Ethereum continues to dominate in high-value NFTs, but Solana and Polygon are gaining market share with lower fees and improved scalability.