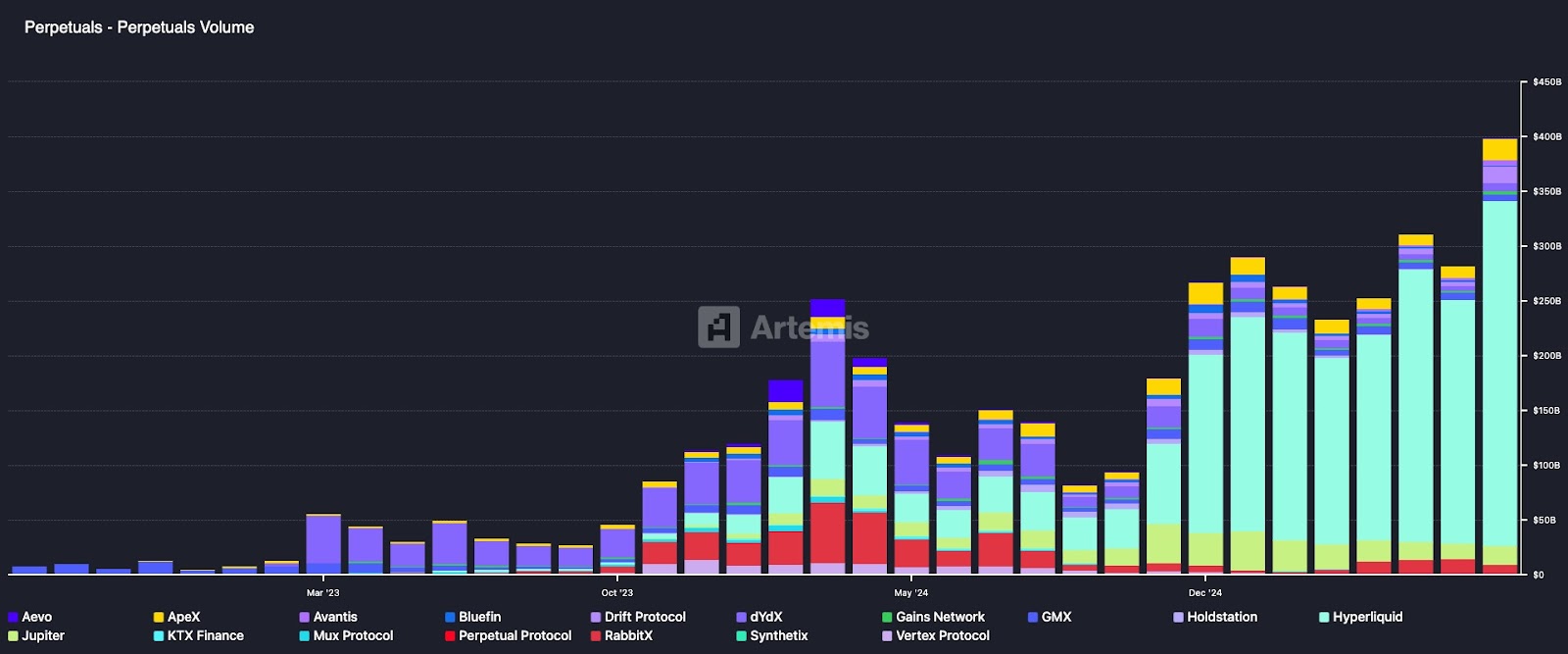

Onchain Perpetual Futures was one of the 2025 breakout market segments, and in July it hit another highest record.

According to the Analytics platform Artemis, the decentralized permanent protocol processed a trading volume of $399 billion in July, 28% ahead of its previous record high of $311 billion in June.

Decentralized Permanent Volume – Artemis

This sector is led to high lipids, which account for almost 80% of the Onchain Perpetuals volume, followed by protocols such as Apex, Drift, and Dydx. High lipid volumes skyrocketed after the Token Generation Event (TGE) in November 2024. Before the tokens were released, the exchange excluded volumes of $2.5-35 billion per month, while post-to-volumes ranged from $160-$315 billion.

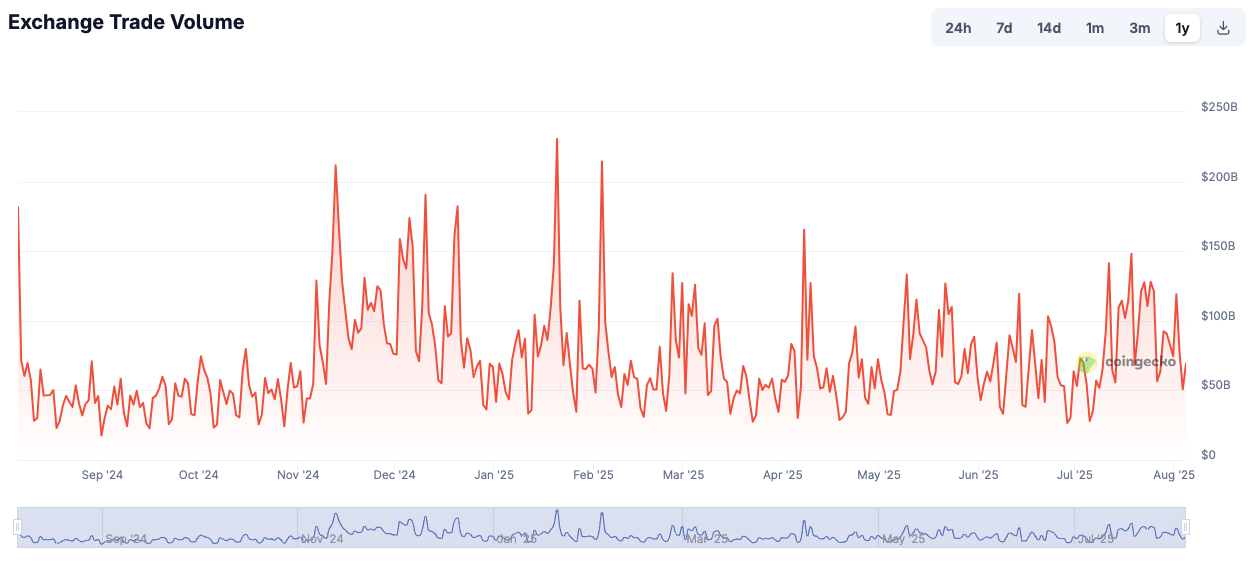

Hyperliquid’s growth is on track to adoption of defi, but the main centralized exchange (CEXS) continues to dominate the entire permanent market. Binance, the world’s leading crypto exchange, processes between $30 billion and $200 billion a day.

Binance Perpetuals Volume-Coingecko

The expansion of the market sector is attributed to US-based brokers and exchanges such as Coinbase and Robinhood deploying their own permanent products in a more friendly regulatory environment.

Coinbase launched its first US-regulated permanent platform in July, and Robinhood announced in May that it would offer permanent derivatives to its European-based customers in 2025.