Joe Lubin, one of the orchestrators of Ethereum Treasury Strategy at Sharplink Gaming, hopes that his company will stack ether as quickly as possible for shareholders.

“The company’s chairman told Bloomberg Television Monday.

Sharplink accumulates “everyday” “everyday” to expand ether (ETH) reserves through market facilities, but at the same time, it has acquired existing holdings and earned yields, exacerbating its position.

Joe Rubin spoke on Bloomberg TV on Monday. sauce: Bloomberg TV

Bitmine Immersion Tech is currently heading the ETH Ministry of Finance

Lubin’s Sharplink has become the leading Ethereum finance company, Tom Lee’s Bitmine Immersion Tech.

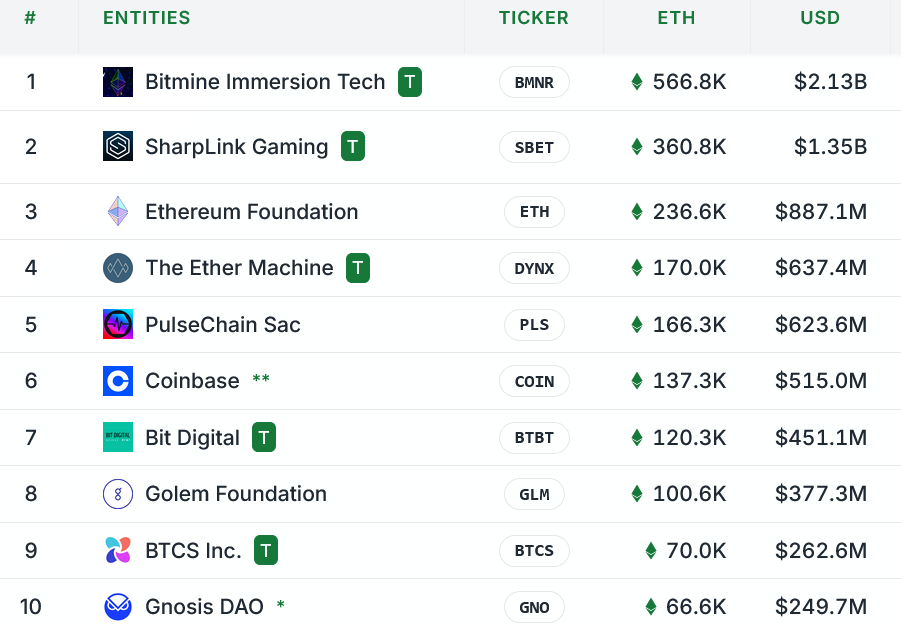

Lee’s company is currently leading the way with a $2.13 billion ETH, while Sharplink is second in the 360,800 ETH, worth $1.35 billion.

Ethereum Foundation, Ether Machine and Pulsechain concluded the top five, while Coinbase, Bit Digital and Golem Foundation each hold over 100,000 ETH.

The largest Ethereum finance company by ETH Holdings. sauce: StrategeThreserve.xyz

Stacking ETH is to drive demand pressure

The ETH Treasury’s adoption trend is seen as actively promoting demand for ether, helping them catch up after chasing things like Bitcoin (BTC) and Solana (SOL) early in this bullish cycle.

As a result, ETH has grown 110% to $3,800 over the past three months, but many of its competitors have made modest double-digit profits, Coingecko data shows.

“What we’re looking at is an institutional FOMO of scale. The key players competing to establish dominant positions before the potential approval of ETFs creates more demand pressure.”

“This competition examines the paper that in fact ETH is becoming an institutionalized infrastructure,” Ye added.

szr news on sz: Bitmine Immersion Technology $bmnr buys 137,515 ETH and overtakes Sharplink Gaming to become a #1 holder in sZOR with a massive 300,657 ETH.

Tom Lee vs Joe Lubin -$ ETH Accumulation Race is on. pic.twitter.com/9sponxipm6

– Fabda.eth (@fabdarice) July 17, 2025

Sharplink to adopt a low-risk approach

According to Lubin, Sharplink will take a conservative approach when it comes to leverage.

Lubin said Sharplink currently has no leverage, but it is exploring the funding methods that Michael Saylor’s micro-tactics have repeatedly used to hold Bitcoin.

Related: Evolving ETH futures data suggests a potential gathering to $5K

“No matter what we do, we’re going to keep leverage very low,” Rubin said.

“(We’re) remaining wise in terms of risk levels,” Rubin said, adding that its shareholders will benefit over time.

magazine: Robinhood’s tokenized stock has stirred up legal wasp nests