The story of “Ethereum is dead” is growing, is that true? While not as flashy as it once was, some analysts argue that Ethereum has evolved into the backbone of the entire crypto industry, and many people are not aware of this change.

Ethereum jumped nearly 40% last week, jumping from $1,800 to $2,500. However, Ethereum’s Defi market has declined significantly, with its total value locked above 88% from its highest point. At the same time, Solana went ahead with active users and transaction numbers because it was faster and cheaper.

Higher gas prices have driven out many users, and Defi and NFTs have moved to cheaper and faster chains. Still, it remains the most secure, trusted and established blockchain. Quietly, Ethereum has been improved, including account abstraction, rebuilding, and other tools that make it easier and more useful for developers.

Ethereum: Selection of major players

One of the biggest changes is the rise of tokenized real-world assets (RWAs), such as the US Treasury Department, real estate, and carbon units, currently worth more than $56 billion. More than half of this value is associated with an Ethereum or Ethereum-based rollup. Major players like BlackRock and Franklin Templeton have launched tokenized products on Ethereum. Ethereum is where big players want to build.

Furthermore, Ether still controls the Stablecoin market, with over 50% of the value of Stablecoin (over $120 billion) tied to Ethereum or its rollup. These stability is required for chain transactions, lending, and real-world use cases such as payroll, remittances, and savings apps.

What seems like a slow infrastructure is actually a stable, long-term demand, placing Ethereum as the basis for everyday cryptographic use. Not only is Ethereum chasing trends, it is building an infrastructure that could withstand the next wave of blockchain growth. This becomes a chain where real money flows, even if it’s not hyped every week.

Set the stage for something big?

It doesn’t surge rapidly to its highest ever high, but its usefulness grows through innovation. Features like staking and EIP-1559 can help reduce supply, but demand from new users is key to price growth.

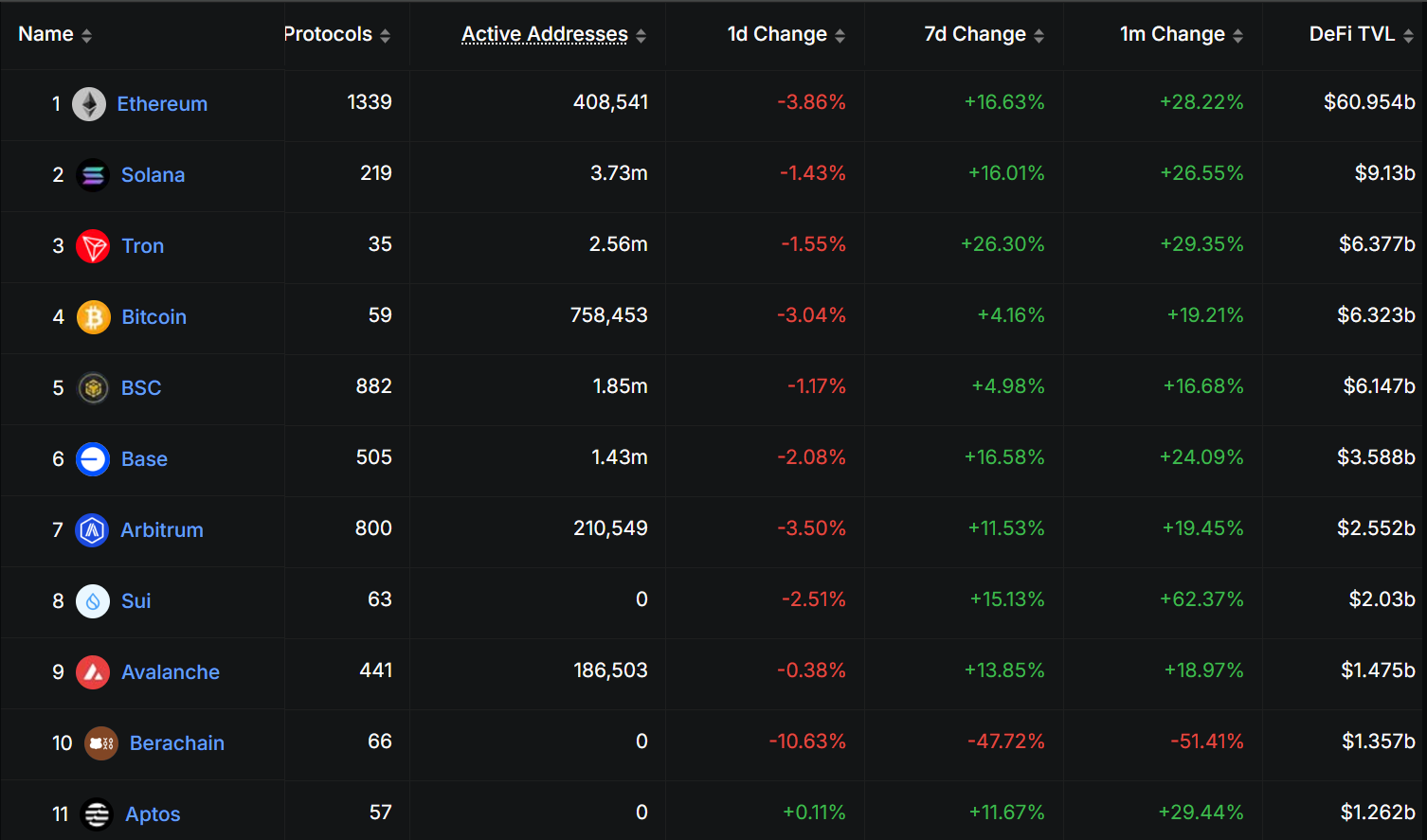

Despite the recent decline, Ethereum dominates $60.95 billion from a TVL standpoint, while Stablecoin Supply dominates $124 billion according to Defilama data. Ethereum’s developer base remains the largest and continues to lead the decentralized blockchain space. However, Solana leads the number of active addresses and 24-hour DEX volumes by $4.2 billion.

The Ethereum Foundation recently took steps to improve its culture and engagement with developers. However, to stay competitive, you need to find a balance between scalability, decentralization, and value capture.

However, price increases require actual demand. Not only do they use apps built on it, they also buy and keep ETH. The good news is that when the market surges again, all this quiet progress could put Ethereum in a strong position.