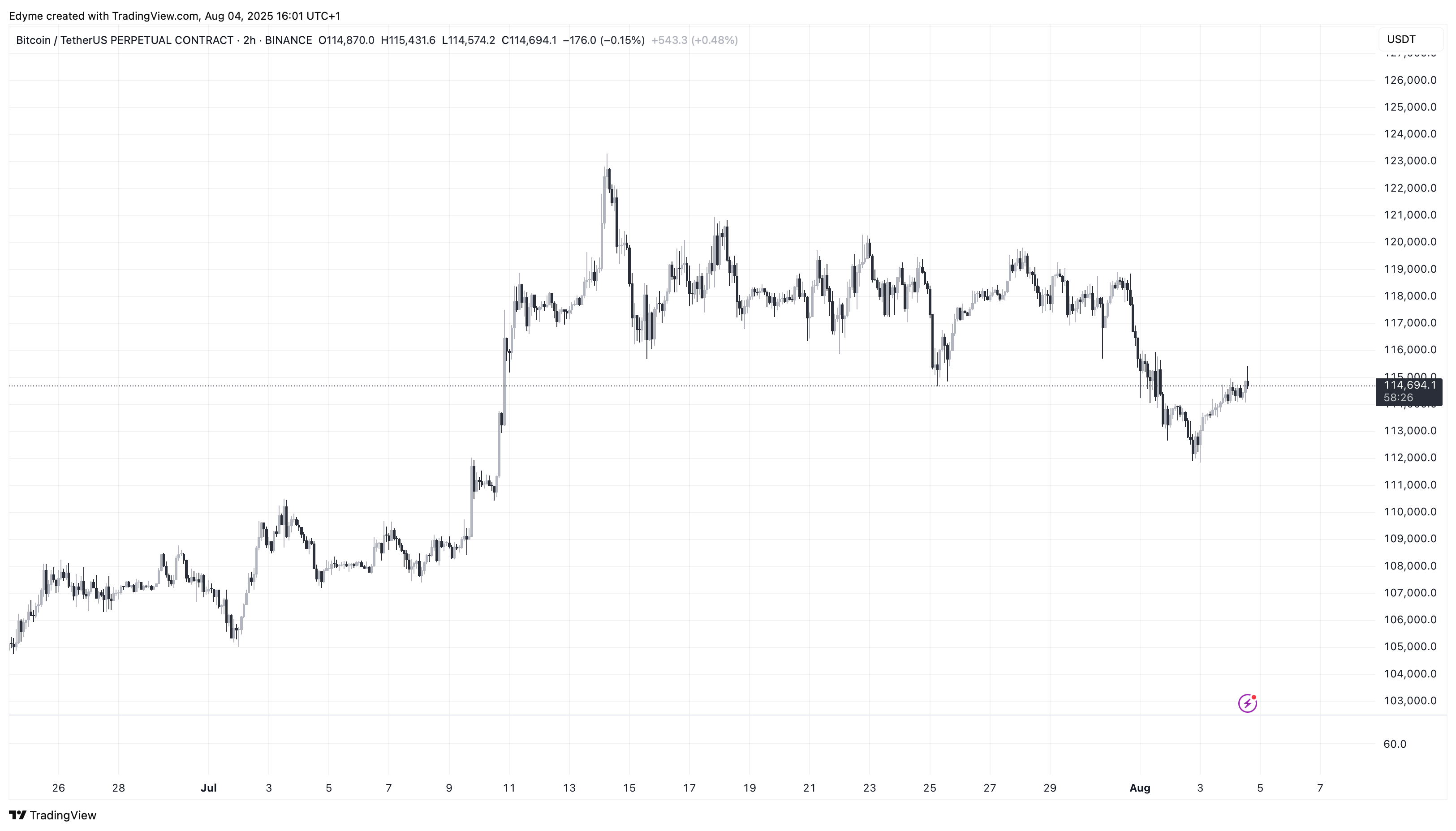

Bitcoin (BTC) has experienced a steady price drop in the past week, falling about 3.7% as trading activities show signs of a potential sale or profit.

After peaking above $123,000 before last month, major cryptocurrencies have been trading within the $113,000 to $114,000 in the past day. At the time of writing, BTC is valued at $114,420, reflecting uncertainty in market momentum.

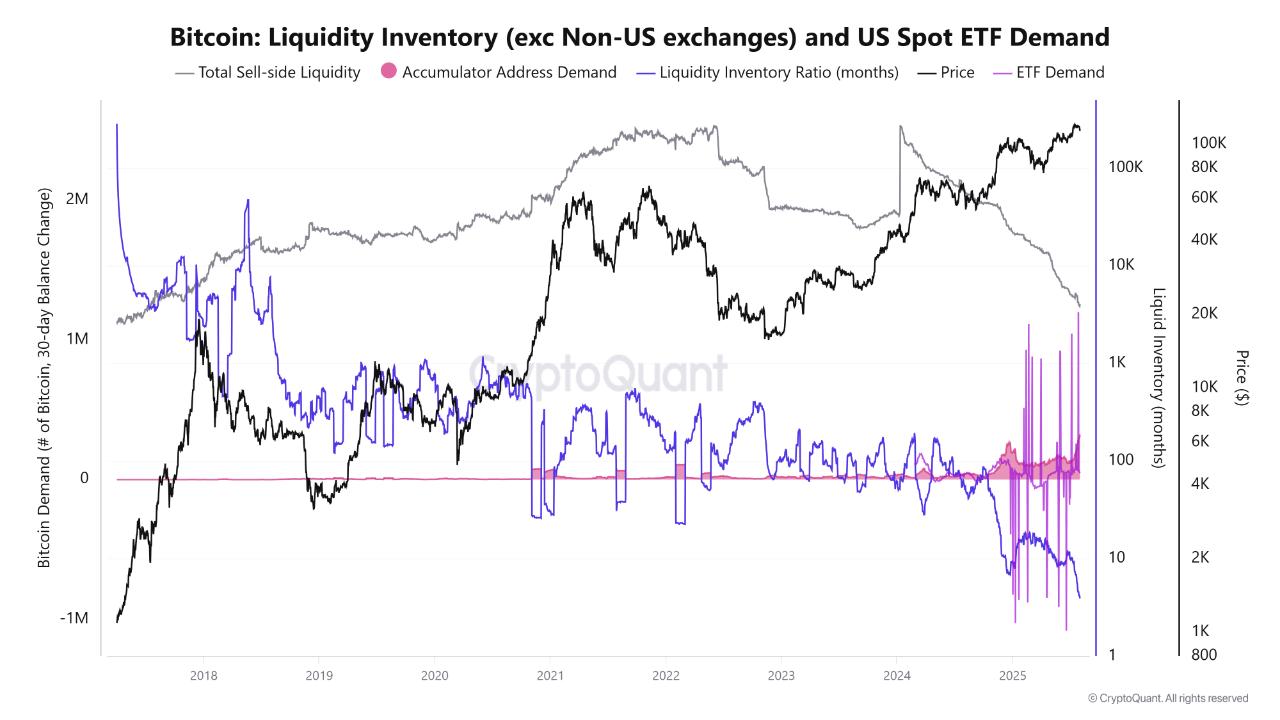

Market analysts point to a key factor contributing to price declines is weakening demand for institutions that are not liquid and inconsistent. A recent analysis shared by Arab chains that contributed to Cryptoquant’s Quicktake platform highlights several chain dynamics that limit Bitcoin’s ability to maintain price stability despite a decline in available supply.

Liquidity constraints and market vulnerability

An analysis of Arab chains showed that a sharp collapse of liquidity inventory ratio began in mid-July, dropping to levels representing just three months of available supply on major trading platforms.

This metric tracks the amount of Bitcoin that can access sales compared to the pace of market activity. Typically, a decrease in supply leads to upward price pressure. However, Arab chains point out that insufficient new demand makes the market vulnerable and, as a result, have the opposite effect.

“If there is little liquidity and there is no consistent purchasing activity from large investors and ETFs, even small sell orders can lead to a significant price drop,” the Arab chain explained. This behavior reflects “thin market” conditions. Under these conditions, the limited depth of the order form increases volatility and makes prices more susceptible to sudden downward movements.

The analysis suggests that market vulnerabilities can persist unless new demand can enter the market. Historically, the period of constrained liquidity combined with a large buyer shortage has led to a long-term revision of Bitcoin’s price trajectory.

Volatility and weak accumulation of ETF demand

Another factor affecting the recent decline is the unstable demand for exchange sales funds (ETFs) of Bitcoin Links. The Arab chain observed a rapid fluctuation in ETF inflows, followed by a rapid surge followed by a strong outflow, with no consistent institutional support to stabilize prices.

This inconsistent participation from the ETF has been a major driver of Bitcoin demand since its approval, and has contributed to a decline in price resilience during the sale.

Furthermore, on-chain data showed that “smart portfolios,” or high-value addresses, usually associated with strategic accumulation, only exhibited modest purchasing activity during the recent recession.

Although accumulation shows long-term trust, its slow and limited pace failed to offset sales pressure in real time. This lack of immediate demand further weakened market support.

Additionally, investors are closely monitoring long-term holder activity for liquidity conditions, ETF flows, and signs of potential rebounds. Analysts suggest that sustainable institutional purchases or increased accumulation from large addresses could help restore stability.

Until then, Bitcoin could remain vulnerable, with price movements heavily dependent on shifts in demand and available liquidity.

Special images created with Dall-E, TradingView chart