US investors poured more than $31.77 billion into US crypto exchange-traded funds in 2025, despite a downturn in the crypto market towards the end of the year.

US Spot Bitcoin (BTC) ETFs accounted for the majority of investor interest, with net inflows reaching $21.4 billion in 2025, according to data from Farside Investors.

However, this will be down from the $35.2 billion net inflow in 2024.

Inflows into Spot Ether (ETH) ETFs have quadrupled since 2024, attracting $9.6 billion in investor funds that year. Ether ETF was launched in July 2024. In other words, 2025 was the first full year that the ETF could be traded.

The Spot Solana (SOL) ETF is one of the new crypto products coming to the U.S. market in 2025, and has totaled $765 million since its launch in late October.

Institutional adoption has been boosted this year by a more crypto-friendly administration, including new Securities and Exchange Commission leadership that is accelerating the approval of new crypto products.

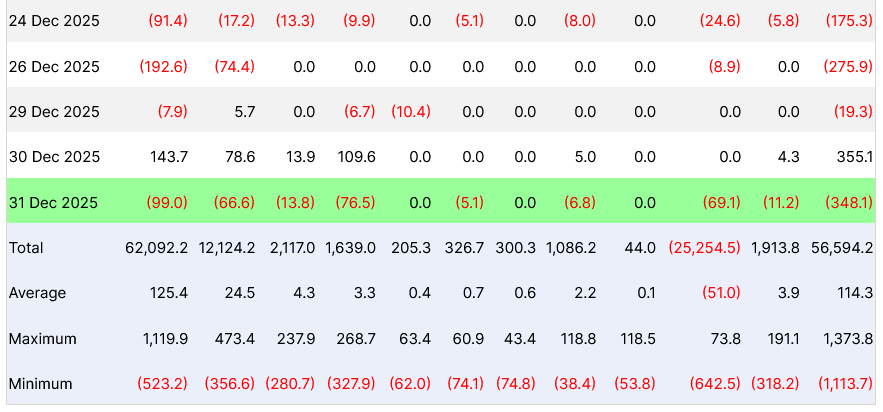

BlackRock’s IBIT inflow is 5x that of FBTC

BlackRock strengthened its dominance in the crypto ETF market in 2025, with its iShares Bitcoin Trust ETF (IBIT) recording an impressive $24.7 billion worth of inflows by the end of the year.

IBIT’s flow aggregate is currently 5x that of its closest competitor, Fidelity Wise Origin Bitcoin Fund (FBTC).

Bloomberg ETF analyst Eric Balchunas noted in mid-December that IBIT ranks sixth among all ETFs in terms of net inflows, trailing only broad index funds and government bond ETFs.

“If we can get to $25 billion in a bad year, imagine the flow potential in a good year,” he said, noting that Bitcoin is down slightly from $93,500 at the start of 2025.

Excluding IBIT from the equation, the other nine Spot Bitcoin ETFs saw a total annual outflow of $3.1 billion.

While most other spot Bitcoin ETFs saw slight increases in net inflows, the Grayscale Bitcoin Trust ETF recorded outflows of approximately $3.9 billion.

Spot Bitcoin ETF flow data from December 24th to December 31st. source: far side investor

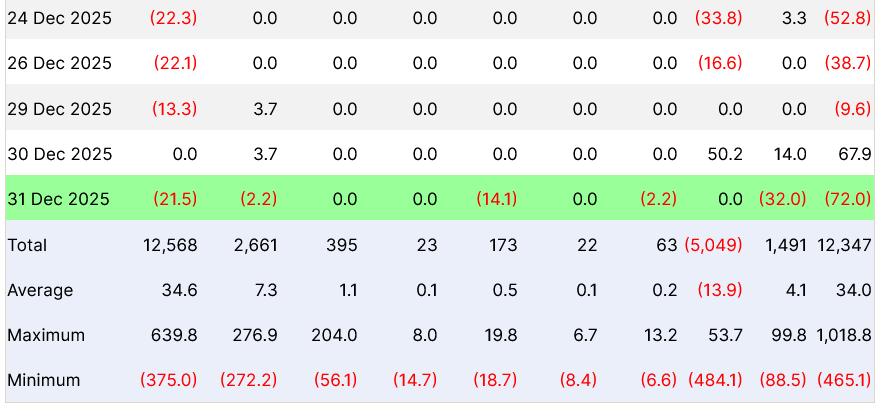

Meanwhile, BlackRock’s iShares Ethereum Trust ETF (ETHA) continues to dominate the Ethereum ETF market despite not registering any inflows in the past 12 trading days.

Inflows into ETHA currently stand at approximately $12.6 billion, with Fidelity Ethereum Fund (FETH) and Grayscale Ethereum Mini Trust ETF (ETH) rounding out the top three with $2.6 billion and $1.5 billion, respectively.

Spot Ether ETF flow data from December 24th to December 31st. source: far side investor

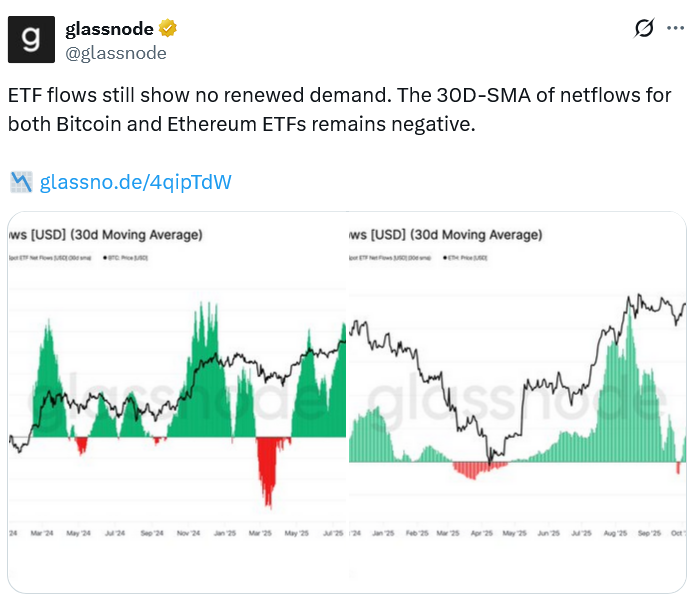

Data from Glassnode shows that Bitcoin and Ether spot ETFs have shown little to no new demand over the past month, suggesting these crypto products could be off to a slow start in 2026.

sauce: glass node

Litecoin (LTC), Solana, and XRP (XRP) ETFs were also launched in the second half of this year, giving investors easier access to major altcoins through regulated investment vehicles.

More crypto ETFs will appear in 2026, but not all will stick around.

Industry analysts expect an explosion in the number of crypto ETPs approved in 2026 based on the SEC’s new generic listing standards, which will eliminate the need to evaluate each application individually.

Related: 2026 will be a red year for Bitcoin, but payment technology will improve: BTC OG

Crypto asset management firm Bitwise has suggested that more than 100 crypto ETFs will launch in 2026, a prediction echoed by Bloomberg analyst James Seifert, who said many will not last beyond 2027 due to lack of demand.

“There will be a lot of liquidation in crypto ETP products. It could happen by the end of 2026, but probably by the end of 2027,” Seifert said in December.

magazine: Quantum Bitcoin attacks are a waste of time: Kevin O’Leary