After last week’s flash crash, Bitcoin prices have fallen to similar depths again, albeit with a more stable price correction. Notably, major cryptocurrencies fell below $105,000 on Friday as crypto liquidations exceeded $1.2 billion. However, underlying investor buying activity paints an encouraging picture of a potential bullish rebound.

Bitcoin net taker volume reaches $309 million despite price decline

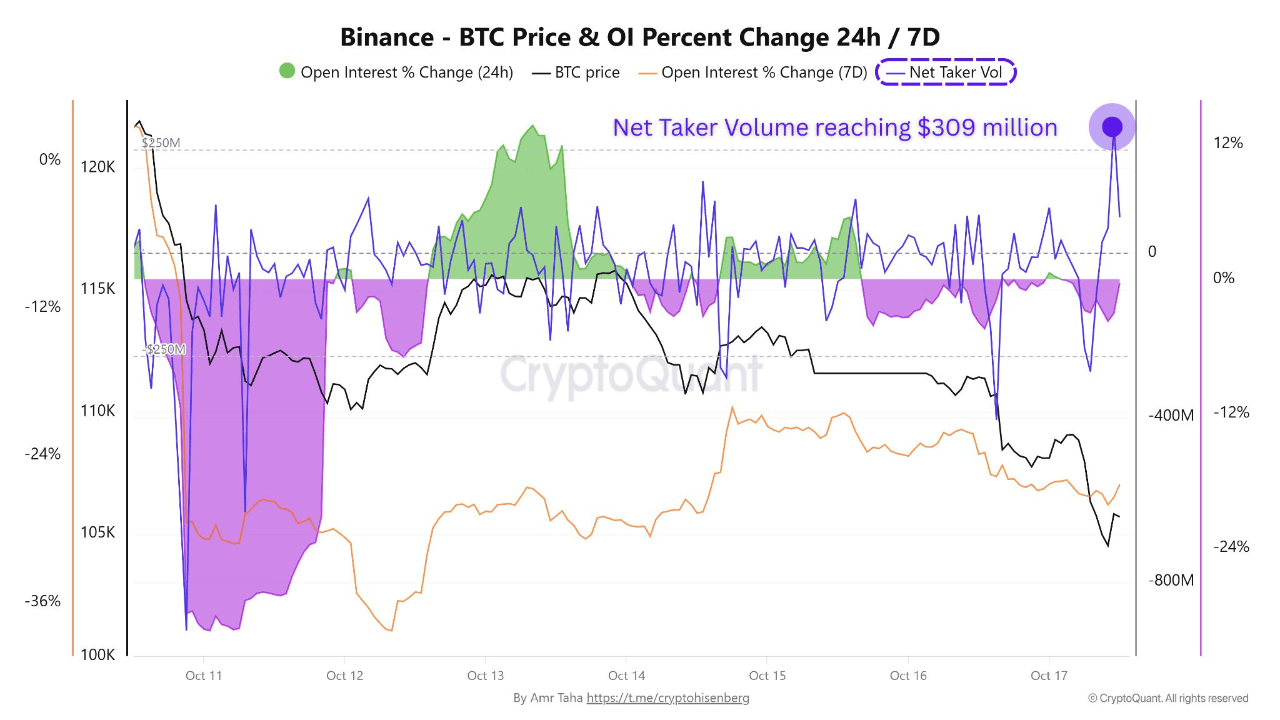

In a QuickTake post on X, popular analyst Amr Taha shares the latest on currency trends in the Bitcoin market, which is in the midst of a significant price correction. Experts are reporting a significant increase in buying pressure, suggesting investors may be quietly accumulating cash despite the current price weakness.

Notably, Bitcoin’s plunge below $105,000 coincided with a spike in Binance’s net taker volume to around $309 million, the first time it has been in positive territory since October 10, according to on-chain data. In trading terminology, buy-taker volume represents orders that actively hit the ask, i.e. traders willing to buy immediately at the market price rather than wait for a better entry.

The move shows that despite short-term volatility, a deep undercurrent of bullish belief remains among Bitcoin holders and traders. This high accumulation activity during price demand typically precedes a local bottom formation as aggressive buyers absorb selling pressure and set the stage for a parabolic price rebound.

Additionally, while taker volume surged, open interest (OI), which measures the total number of outstanding futures and perpetual contracts, failed to rise in tandem, Amr Taha reported. This divergence suggests that trading activity is concentrated in spot markets rather than leveraged derivatives, supporting the fact that investors are actively participating in current market conditions.

In summary, the prominent crypto analyst sees this development in trading activity as a potential bullish undercurrent. Taha explains that spot accumulation around key liquidity levels, such as the $105,000 zone, often serves as a foundation for future price recovery after selling pressure subsides.

Bitcoin rebound is evidenced by soaring gold prices

In other news, a market analyst with the username Crypto Jebb agrees that the price of Bitcoin could rebound significantly. However, experts predict that the premium cryptocurrency could fall further before eventually finding a bottom near $92,000.

In line with the growing concept, Jeb makes a bullish case for the potential for capital to circulate from the gold market to Bitcoin when it reaches a new market peak. In particular, gold currently maintains impressive bullish momentum, becoming the first asset to surpass $30 trillion in market capitalization.

Jeb predicts that capital circulation will eventually occur as the gold market begins to correct, and that potential inflows will push the price of Bitcoin to around $150,000 in January. At the time of writing, Bitcoin was trading at $107,053, down 0.74% over the past day following modest recovery efforts.

Featured image from Flickr, chart from Tradingview