- Injective has announced new research that positions its blockchain as a full-stack platform for regulated real-world asset tokenization.

- Adoption is increasing as the amount of tokenized RWA increases and there is consistent on-chain activity across Injective’s ecosystem.

Injective releases new research outlining how its blockchain is structured to support real-world assets tokenization At the organizational level. of report Tokenization is framed as a direct evolution of traditional securitization, where ownership claims for assets such as stocks, bonds, government bonds, real estate, and fiat financial instruments are moved onto programmable blockchain rails.

Research shows that tokenization is a more advanced version of traditional securitization models that integrates programmability with fast and near-instant payments, reducing the need for intermediaries. As a result, issuers will be able to automate corporate activities and compliance logic on-chain. Investors benefit from immutable records and transparent payment flows.

In addition, singular word Regain the structural advantage of liquidity. Fractional ownership allows for small capital investments, and 24/7 trading eliminates time zone limitations common in traditional markets.

According to the report, these capabilities will enable more efficient distribution of assets without compromising the overview provided by auditors and regulators. Injective claims that these features solve real frictions that have long existed in capital markets, rather than simply putting existing systems on blockchain rails.

Permitted token standards have built-in compliance at the time of issuance

According to the report, the permissioned token standard is central to the injective model because it essentially embeds access rules within smart contracts. Publishers can implement whitelisting and transfer restrictions without off-chain enforcement. The study observes that such strategies have multiple asset classes and are flexible across jurisdictions.

Injective also offers direct integration with custody and compliance providers. This design choice aims to minimize onboarding friction for banks, asset managers, and other regulated entities entering the tokenization market.

Once issued, assets can flow into different liquidity environments. Public liquidity networks utilize automated smart contracts, while institutional networks employ professional market makers to facilitate larger trades.

Demand for tokenized assets increases

Injective’s research cites an organization’s operational history as a sign of its readiness. Injective has processed over 1.1 billion transactions since its mainnet launch in 2021 and has yet to experience any downtime or security breaches. In 2024, the ecosystem expanded with the integration of more stablecoins and tokenized financial products. The report considers this an indicator of institutional readiness.

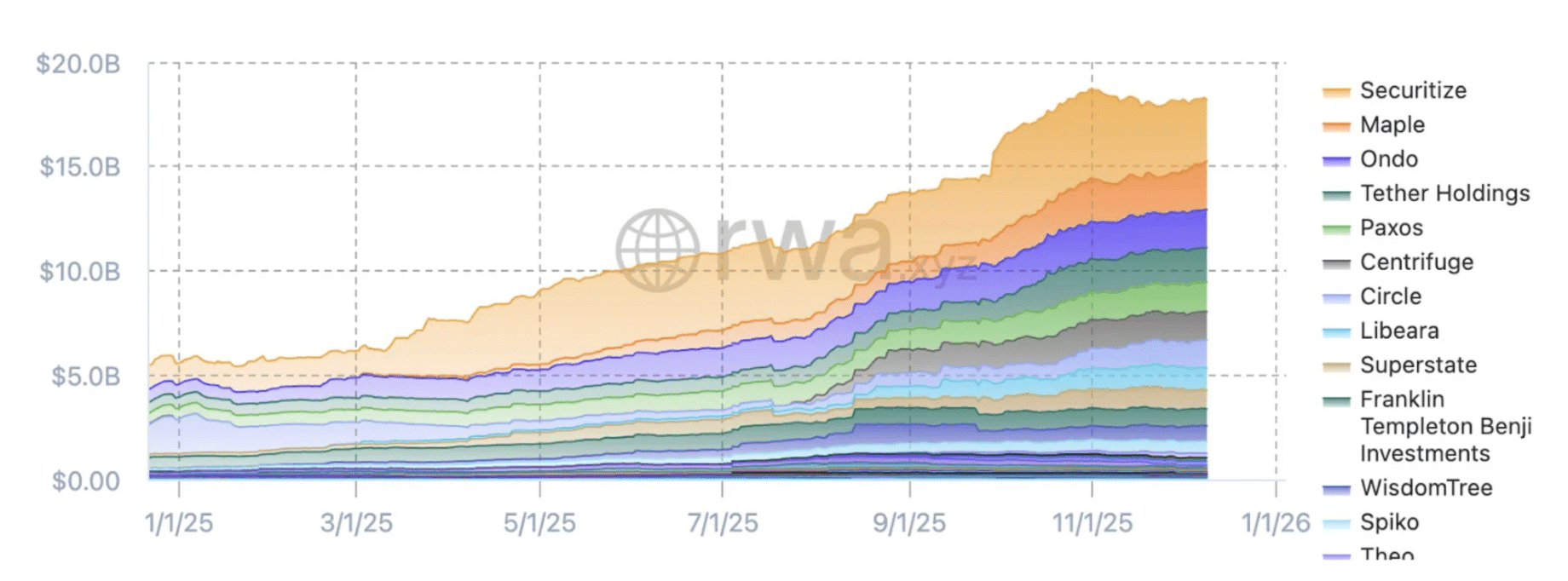

According to Securitize, the cumulative asset value of tokenized real-world assets is over $20 billion. The sector, excluding stablecoins, grew from about $5.5 billion at the beginning of the year to $18.2 billion by the end of 2025. Over the same period, tokenized government debt increased from $4 billion to $9 billion.

Source: Securitization

Separately, Messari reported Its injectives reached $6 billion in real-world perpetual asset trading volume. At the time of writing, INJ is trading around $5.64, up 9.74% over the past 24 hours and 2% over the past 7 days.