Bitcoin is located near $113,000 as of September 23, 2025, and has recovered from the monthly medium-term revision. The broader narrative of US policy has changed dramatically this year after President Trump’s executive order created a strategic Bitcoin sanctuary in March.

The reserve already has around 198,000 BTC on the assets that have been confiscated, but if Congress passes the law to codify and expand it, a critical moment will come.

We used OTC data on advanced chain prompts, market context, BTC supply, and CHATGPT to predict Bitcoin’s price response to various legislative outcomes. The analysis shows what mathematics is telling us, and which markets should traders watch.

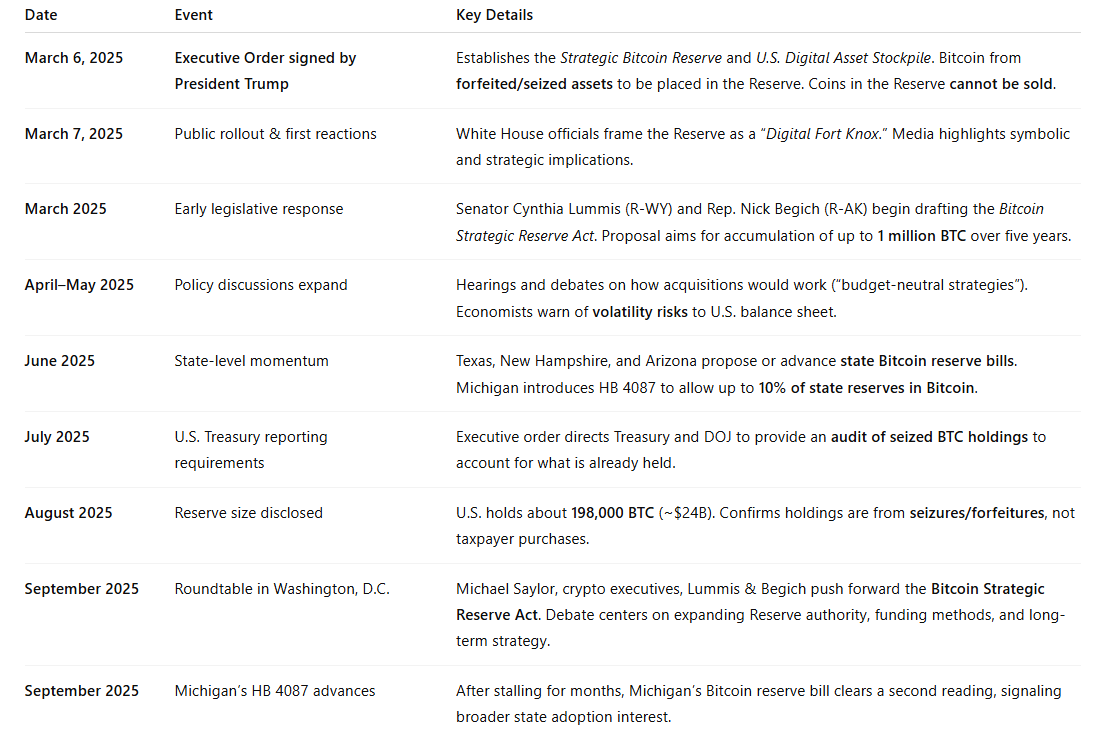

US Bitcoin Reserve Timeline

What Congress is discussing

- Executive Order (March 2025): It established a strategic Bitcoin reserve and a US digital asset stockpile, placing seized Bitcoin in permanent federal custody and banning sales.

- Pending Invoices: Senators Cynthia Ramis and Nick Begich introduced it Bitcoin Strategy Preparation Methodsome drafts suggest accumulation 1 million BTC over 5 years.

- Important differences: Executive orders are reversible by future presidents. The law could potentially be locked up in reserves, define reporting rules and require new purchases.

Why Mandatory Bitcoin Purchases Change Everything

New Bitcoin issue after harving 164,250 BTC (~450/day) per year. Parliamentary duties to purchase 200,000 BTC per year (~550/day) It exceeds the new supply.

Government requests must deduct coins from the exchange balance with OTC unless the long-term holder or miner is actively sold.

- OTC Supply: It was estimated to be close to 155,000 BTC in August 2025, and it has dropped sharply since 2021.

- Exchange Balance: It hoveres and drops around 2.9 million btc.

- result: Large government programs will strengthen liquidity and enforce higher liquidation prices.

Four Bitcoin Reserve Scenarios to Consider

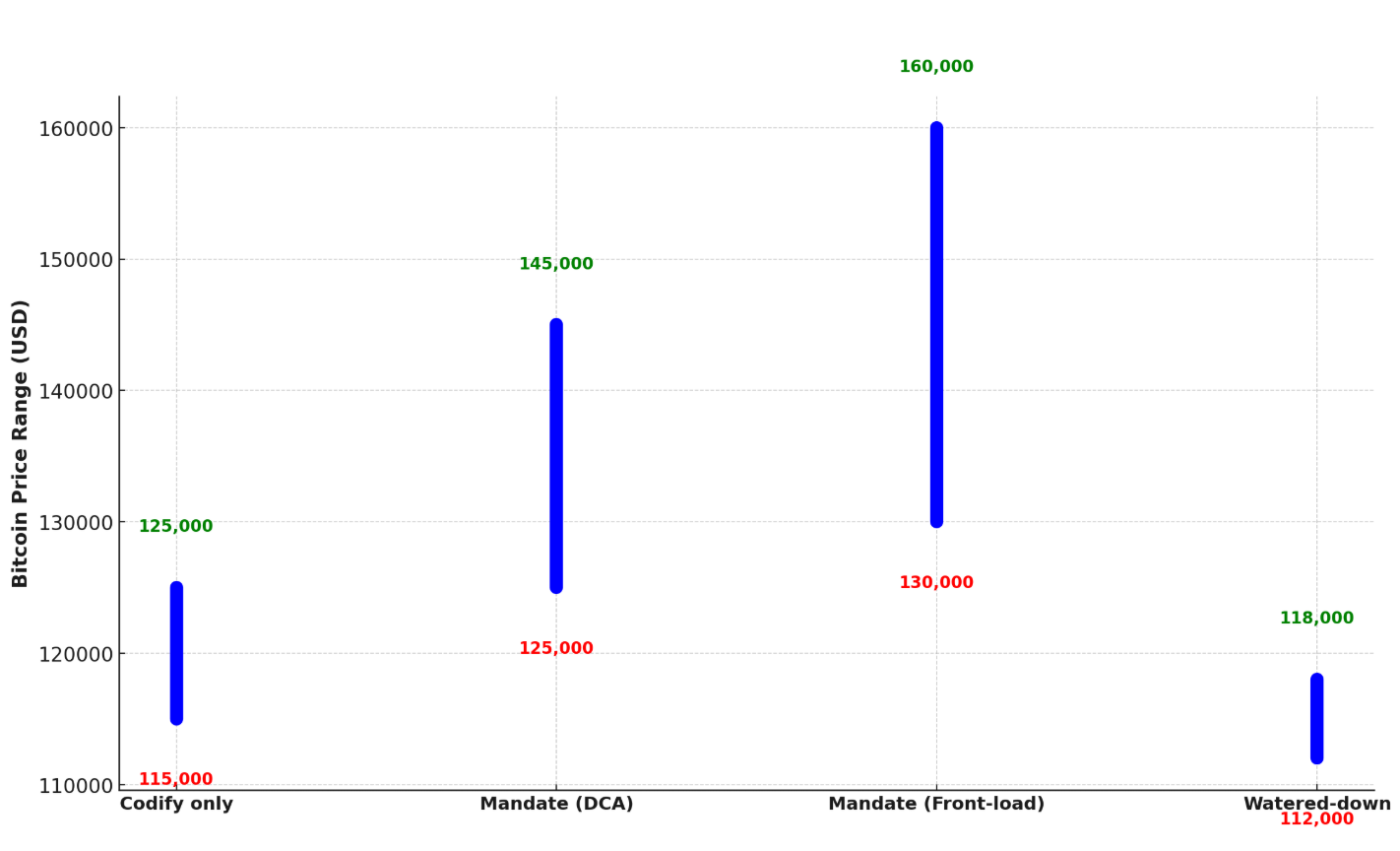

A. Only system

If Congress simply turns executive orders into law without a purchase obligation, then the reserves will be difficult to rewind politically. this is:

- Lowers the US regulatory risk premium.

- It supports stable inflows to Spot ETFs and the Ministry of Corporate Finance.

- It can cause more modest grinding, but not a structural supply shock.

B. DCA slow order

If the law requires ~200k BTC/year a year and the Ministry of Finance is gradually implemented via OTC and ETF, Bitcoin will have greater demand daily demand than new issuance. Expected:

- Permanent upward drift separated by sharp meetings on the run.

- Thinning of the OTC inventory, forces the flow to gradually move to exchange.

- As structural demand continues, pullbacks become a purchase opportunity.

C. Delegation by purchasing front road

The front-loaded accumulation plan quickly emits OTC stocks and drives the Treasury into the direct exchange market. this is:

- Volatility spikes and wide sliding trigger sharp re-ricks higher.

- It could attract imitation bids from businesses, pensions and sovereignty.

- The risks and subsequent integration of creating unsustainable short-term spikes.

D. Boning Compromise

If the law is symbolic, but you avoid buying funding or targets, the first headline can cause a short pop. but:

- Traders will likely debilitate their movements.

- Market impacts are similar to “selling news” behaviour.

Important trading signals to monitor

- Invoice text: Look for explicit purchase goals in the final version.

- Financial Guidance: Start date and rhythm of the purchase program.

- ETF Creations: A sustained net inflow of over $300 million per day confirms structural demand.

- OTC Chat: Spreading and delays in procurement refers to supplying stress.

- Replacement depth: Reducing the depth signal for orders by 1% increases the risk of slipping.

BTC price level to watch

- support: $110,000 (post-liquefied basis), $100,000 (psychological anchor).

- resistance: $116,000 (September High), $125,000 (Breakout Level), and $150,000 (Psychological Magnets if Mandate Passes).

Potential Bitcoin Price Range US Reserve Legislative Scenarios (2025)

Macro Overlay

Federal Reserve policy, US dollar strength, and gold correlations remain important. Dubu feeding and weaker dollars amplify upside down from the reserve law, but the hawk surprise can blunt its effectiveness.

If Congress passes Codification onlyBitcoin should benefit from lower policy risk and strong ETF flows, and could maintain an upward grind.

If the lawmaker passes Mandatory accumulation programflow mathematics is clear. As government demand outweighs new supply and OTC reserves already thin, Bitcoin liquidation prices must rise to withdraw sellers.

The final text of the law is subject to modest policy tailwind and full supply shock.

Traders need to be prepared for both results. However, in either case, US law regarding strategic Bitcoin reserves will demonstrate a historical change in Bitcoin’s global role as a sovereign protected asset.

PostAI forecasts BTC prices if the US Congress passes the Bitcoin Reserve Act.