Bitcoin’s correction took an even sharper turn last week as the price retested the psychological $100,000 price range, triggering a heavy wave of liquidations. The premier cryptocurrency has since seen some rebound, but its current market price is still 19.02% off its all-time high of $126,198. Hoping for a sustained recovery, the popular analyst under the username X PlanD outlined the critical market situation.

Bitcoin’s 50-week EMA maintains bullish structure – Analyst

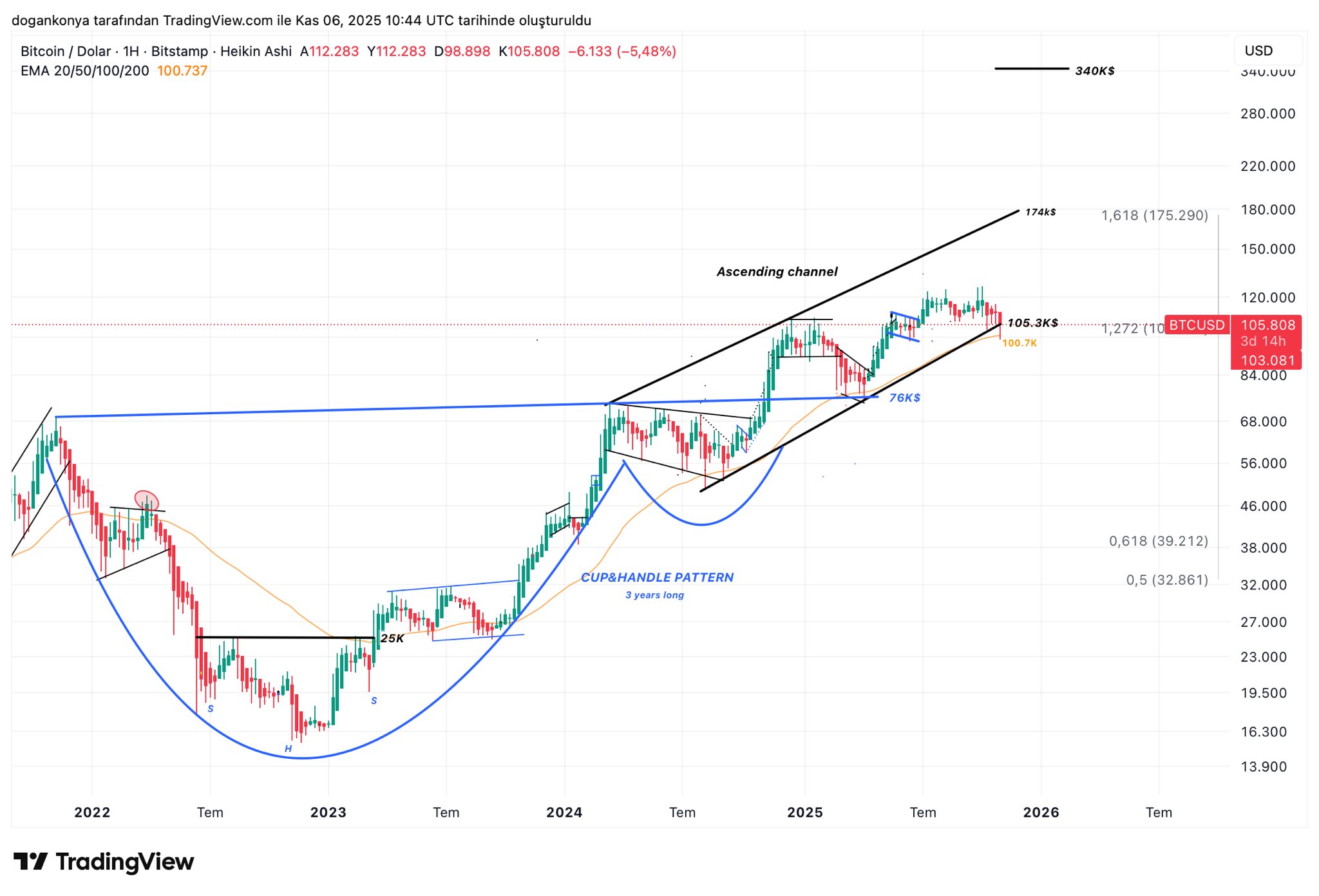

In a November 7th post on X, PlanD shares an insightful analysis of Bitcoin’s latest price movements. A prominent market expert points out that Bitcoin’s rebound to $100,700 may have confirmed the formation of a bottom. While a price decline below $100,700 is still possible, PlanD emphasized the importance of watching for a bullish weekly close above this important support level.

In particular, the significance of the $100,700 price zone comes from its coincidence with Bitcoin’s 50-week exponential moving average (EMA). Since 2022, this indicator has served as an important indicator, and price crosses often indicate changes in market trends. During the current bull market, Bitcoin has decisively retested the 50-week EMA three times, each time resulting in the price bouncing back to higher levels.

Bitcoin famously reached this support zone again during the recent correction, and PlanD explains that this is important to maintain a bullish structure for a possible rebound. As long as market bulls maintain price points above this indicator, analysts predict further bullish price action in the near term with a potential target between $116,000 and $120,000.

Following a steady recovery, further analysis from PlanD suggests that Bitcoin maintains strong upside potential, with current momentum consistent with an ascending channel that began in late 2024 and predicted to potentially move towards $176,000. In parallel, a broader cup-and-handle formation has developed since 2023, suggesting an even larger long-term target of around $340,000, reinforcing the bullish outlook for the asset.

Bitcoin price overview

At the time of writing, Bitcoin is trading at $102,277, reflecting a slight loss of 0.23% over the past 24 hours. At the same time, the weekly and monthly losses of 6.98% and 16.23% indicate that bearish sentiment still prevails even though the price bounced slightly from $100,000.

Bitcoin’s retest of the $100,000 level has proven to be pivotal in the ongoing correction and triggered several adverse developments. This included investors’ realized prices dropping to less than $50,000 and losses for top buyers amounting to approximately $160 million per hour.

All these events, including the subsequent price rebound, highlight the psychological importance of the $100,000 zone in the current market structure.

Featured images from iStock, charts from Tradingview