Hyperliquid achieves another milestone in establishing its key position $BTC trading base. Perpetual Futures Market and Spot Market Exceed Depth on Binance $BTC pair.

HyperLiquid achieved the largest top-of-book market depth and delivered the most favorable buy and sell prices. $BTC. One basis point from Mid-Depth on HyperLiquid amounted to $3.1 million on HyperLiquid, but $2.3 million on Binance. This means the hyperliquid market can absorb more selling without slippage.

Over time, the hyperliquid market has become the most liquid place for price discovery of cryptocurrencies, both among centralized and decentralized markets. It noted that Binance’s perpetual futures came in second place despite the exchange’s high trading volume. Jeff YangFounder and technology leader of Hyperliquid.

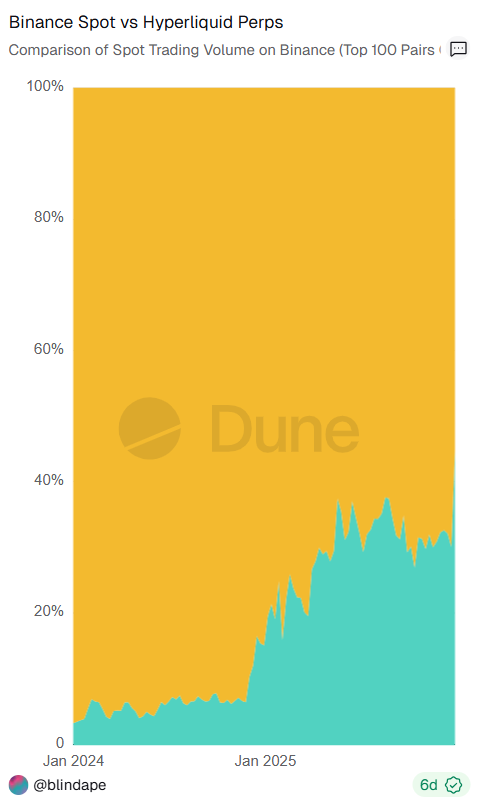

Hyperliquid takes over more market share from Binance

Increasing market depth is just one indicator in the competition between Binance and Hyperliquid. The two trading venues have been tracked for several months, showing changes in trader behavior.

HyperLiquid is increasing its market share and is already catching up to Binance’s spot market. Binance remains the leader in centralized perpetual futures trading. |Source: Dune Analytics

HyperLiquid remained the leader in perpetual futures trading, still outperforming rival Binance-backed exchange Astor. Recently, Hyperliquid also gained market share against Binance’s spot market as a benchmark for cryptocurrency activity.

Binance still holds 86% of the perpetual futures trading volume, while HyperLiquid holds 13.9%. However, Hyperliquid’s trading volume is comparable to the top 100 pairs on the Binance spot market.

As of now, Hyperliquid is still the smallest exchange, but it is still experiencing strong growth. The market has $7.9 billion in open interest and is aiming to recover from deleveraging in October 2025.

Beyond the general trading venue, HyperLiquid is still an exchange used by prominent whales, and positions are considered indicators of market sentiment. The recent market recovery has also seen the exchange’s native token HYPE rise to a one-month high of $33.55.

HIP-3 sales record boosts Hyperliquid’s position

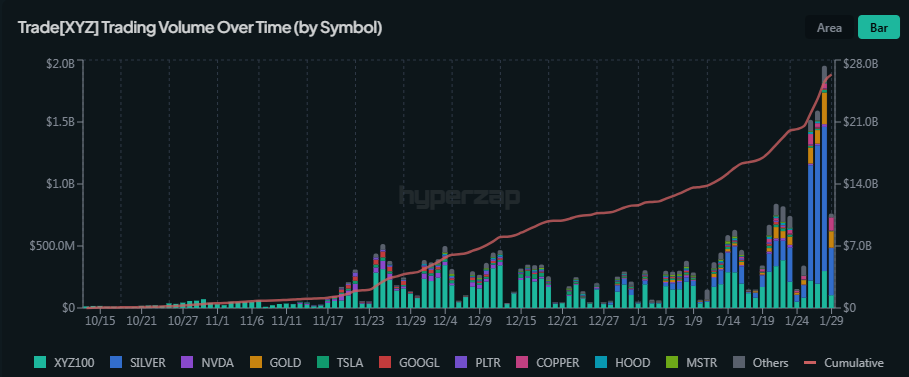

Perpetual futures DEX liquidity is not limited to: $BTC. The HIP-3 platform, which carries user-generated pairs, has demonstrated the ability to build extremely deep and liquid markets.

According to researcher Shonda Devns, HIP-3 has a more robust silver market compared to Binance. What the HIP-3 pair offers $33,000 The liquidity of trading pairs on Binance is $24,000, while the liquidity has increased just a few days after launch.

Recently, HIP-3 set records for trading volume and open interest. The platform’s trading volume reached $29.35 billion, a record in the past day. More than 72,000 active traders joined the platform every day.

HIP-3 peaked in trading volume due to sudden interest in a new silver-based perpetual futures pair. |Source: HIP-3

The recent expansion in HIP-3 liquidity is related to the launch of a silver trading pair, which reached record leverage in the past day.

Trade XYZ is one of the most active deployers of trading pairs and has recently expanded its influence in position trading in metals and stocks. Overall, HIP-3 has expanded its influence; 35% Percentage of total volume of Hyperliquid ecosystem. Competition among deployers to tap demand markets and attract liquidity will only intensify.