Decentralized Perpetual Exchange and Layer 1 Blockchain Hyperliquid announced two new features in pre-alpha: Portfolio Margin and BLP Earn Vault.

Founder Jeff Yang announced the changes on the Hyperliquid Discord, saying, “In the initial rollout, we intentionally kept the cap low as a safety measure, with HYPE as the only collateral asset and USDC as the only borrowable asset. Future upgrades will add USDH as a borrowable asset and BTC as collateral.”

Portfolio Margin integrates users’ spot and perpetual trading accounts, increasing capital efficiency. The pre-alpha phase is limited to accounts with a constant trading volume of more than $5 million, with an initial $1 million USDC global borrowing limit and a $1,000 USDC unit borrowing limit.

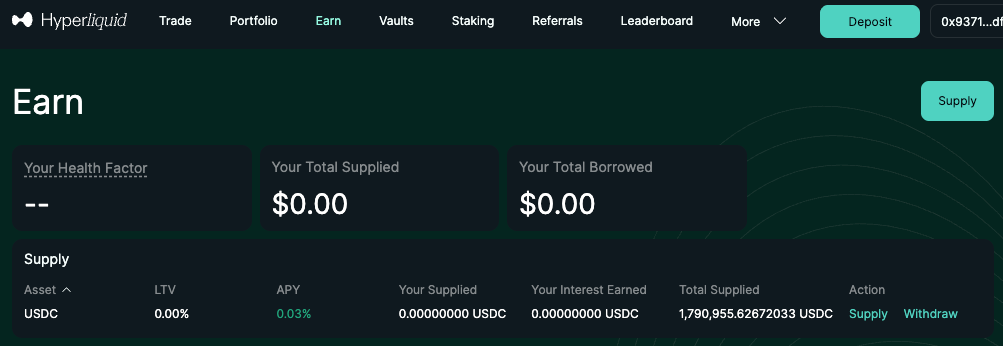

Earn money with Hyper Liquid – Hyper Liquid

The BLP Earn feature allows users to earn yield on stablecoins or borrow their HYPE holdings to increase their purchasing power on Hypercore DEX.

HYPE is down 3% today, matching the rest of the market as BTC and ETH are down 2% and 4%, respectively. However, the token is trying to shake off a months-long downtrend, with HYPE falling from an all-time high of $59 in September to just $24 currently.