The decentralized crypto differentiation native token reached a new peak price level on Thursday as Altcoins outperformed with Fed rate reductions.

High lipids (hype) reached an all-time high of $59.29 during early trading on Thursday.

Assets with a market capitalization of just under $16 billion have skyrocketed almost 40% in the past month, significantly surpassing the top three cryptocurrencies by market capitalization: Bitcoin (BTC), Ether (ETH), XRP (XRP).

High lipids are decentralized exchanges with permanent futures and are closed to derivative contracts that have no expiration dates, allowing speculators to take leverage positions of crypto assets without owning them.

Bitmex founder Arthur Hayes first commented on Thursday’s milestone, calling it “the hype so far.”

In August, Hayes said it was the opposite of a potential 126x token, with Stablecoin expanding bringing DEX annual fees from $1.2 billion in current annual revenue to $258 billion.

Hype prices hit an all-time high. sauce: Nansen

Traders cash out hype

Nansen highlights traders who have long positions leveraged in hype and have a position value of $30 million.

The Analytics platform reports that traders currently hold unrealized profits of $1.39 million and are still adding to the position. They first start to admire them three hours ago, adding around 123 hypes to their positions every 30 seconds.

Hype is one of today’s top altcoin performers, with only avalanches (avax) getting better in the top 40 with a gain of 9.5%.

Binance boss promotes rival Aster

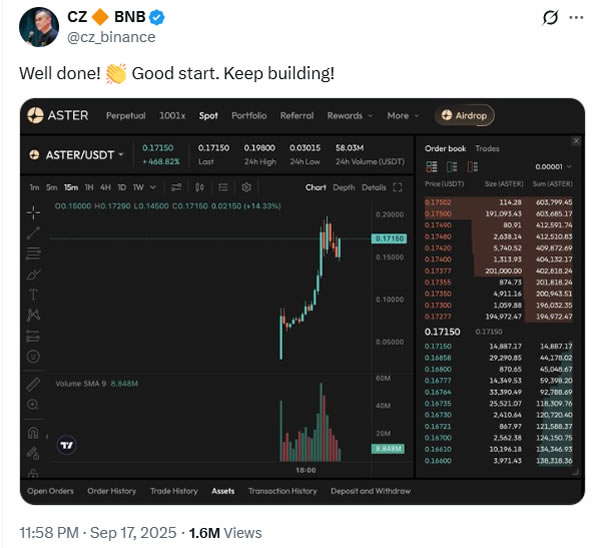

Hours before the hype peak, former Binance CEO Changpen Zao posted a chart of Aster, the native token of rival derivative dex.

Launched as an Aster chain in July, Aster is a new crypto derivative exchange supported by CZ-related YZI labs, supported by the previous BNB chain’s leading Dex Pancakeswap, as a direct competitor for high lipids.

Native tokens that began trading on Wednesday have already spiked to an all-time high of over 350%, at $0.50, according to CoinmarketCap.

sauce: Changpeng Zhao

“CZ rarely shares charts. But he posted Aster, because it’s a direct lipid rival and high liquids continue to steal Binance’s market share,” commented Hunter of Web3’s founder, “Langerius.”

In April, Cointelegraph reported that high lipid trading volumes had been reduced to Binance’s share. However, according to Coingecko, DEX has a long way to go to use its current volume of $790 million, compared to Binance’s $34 billion.