HSBC, the world’s megabank, is doubling down on tokenization over stablecoins as global banks rush to keep pace in the stablecoin race.

HSBC Holdings plans to start offering tokenized deposits to corporate customers in the United States and United Arab Emirates in the first half of 2026, according to a Bloomberg report on Tuesday.

Manish Kohli, global head of payments solutions at HSBC, said HSBC’s Tokenized Deposit Service (TDS) allows customers to send money domestically and internationally in seconds, 24 hours a day.

“The topic of tokenization, stablecoins, digital money, digital currencies is obviously gaining a lot of momentum. We are making big bets in this space,” Kohli said.

Tokenized deposits and stablecoins

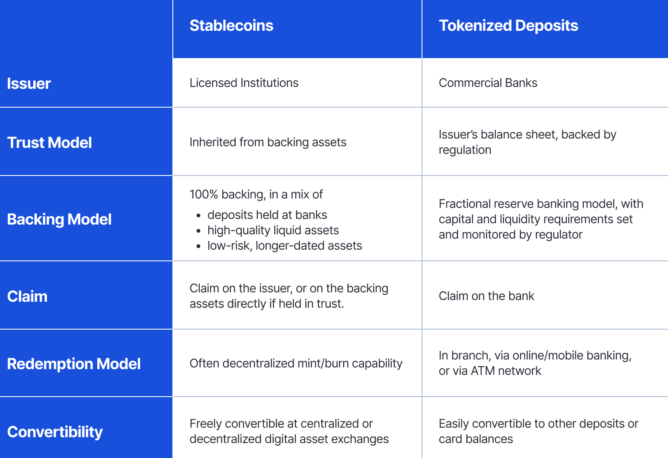

Tokenized deposits are digital representations of bank deposits issued on blockchain by regulated banks, allowing for instant transfers and programmable payments 24/7.

Unlike stablecoins, which are often tied to fiat currencies such as the US dollar and backed by assets such as government debt, deposit tokens are created using the issuer’s balance sheet.

Although stablecoin issuers like Circle are not allowed to pay yield on stablecoins held by users, tokenized deposits offer interest payments as one of their primary features.

Stablecoins and tokenized deposits: Source: Fireblocks

Kohli said HSBC plans to expand use cases for tokenized deposits in programmable payments and autonomous treasuries, systems that deploy automation and AI to independently manage cash and liquidity risks.

“Almost every large company we talk to is facing big themes around financial reform,” said the HSBC executive.

The possibility of launching HSBC stablecoin cannot be denied

The product’s expansion in the US and UAE is the latest following HSBC’s launch in Hong Kong in May, with Ant International becoming the first customer to utilize the TDS solution.

Since then, the bank has expanded its services to multiple markets including Singapore, the UK and Luxembourg.

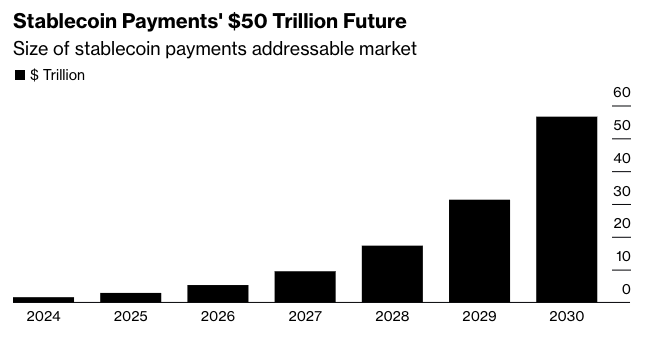

Source: Bloomberg Intelligence

HSBC’s choice to move forward with tokenized deposits comes as major banks like JPMorgan double down on the technology.

Related: How TradFi Bank is driving a new stablecoin model

On November 12, JPMorgan launched JPM Coin, a deposit token representing banks’ US dollar deposits. The company opposes the token to traditional stablecoins, with JPMorgan blockchain executive Naveen Marella stressing that the deposit token will operate within the framework of a traditional bank.

While HSBC promotes tokenized deposits, it has not ruled out the possibility of issuing stablecoins.

“This is something we will continue to assess,” Kohli said, adding: “There are some things that need to be done, and that is the legal framework needs to be more clear.”

magazine: Saylor denies Bitcoin decline, XRP ETF debuts on top chart: Hodler’s Digest, November 9-15