If the US is officially participating in the Israeli-Iran war, short-term losses could be seen sharply in Bitcoin and the broader crypto market.

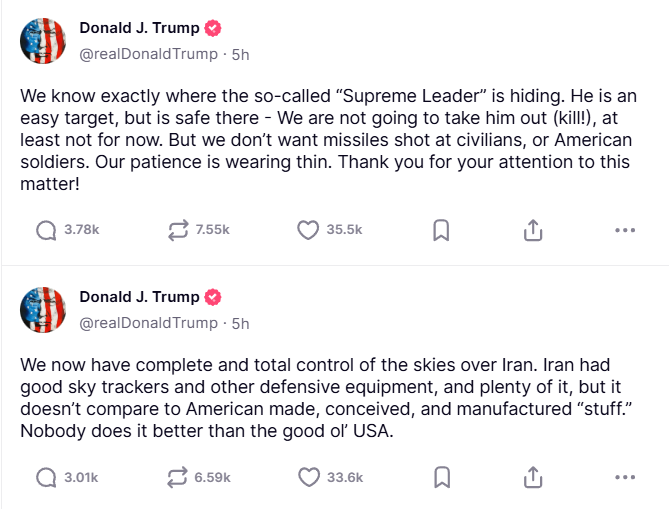

Based on President Trump’s recent posts and geopolitical rumours, the United States may decide to enter the conflict. Market analysts hope that risk-off sentiment will dominate global assets, separating liquidity from volatile sectors such as cryptocurrency.

When we enter into conflict, Bitcoin faces immediate downsides

Bitcoin, currently trading nearly $104,500, could drop by 10-20% in a few days, based on patterns from previous geopolitical shocks.

In the early stages of a large conflict, investors usually flee to traditional safe havens, such as US troops, dollars and gold.

From June 17th, 2025, US President Donald Trump’s warning about conflict. Source: Truth Social

Despite some claims that it is a hedge, Crypto has consistently acted like a high-risk asset during such episodes.

For example, during the 2022 Russia-Ukraine War, Bitcoin fell by more than 12% within a week of its first invasion. It later recovered partially, but closely followed the stock market throughout the escalation.

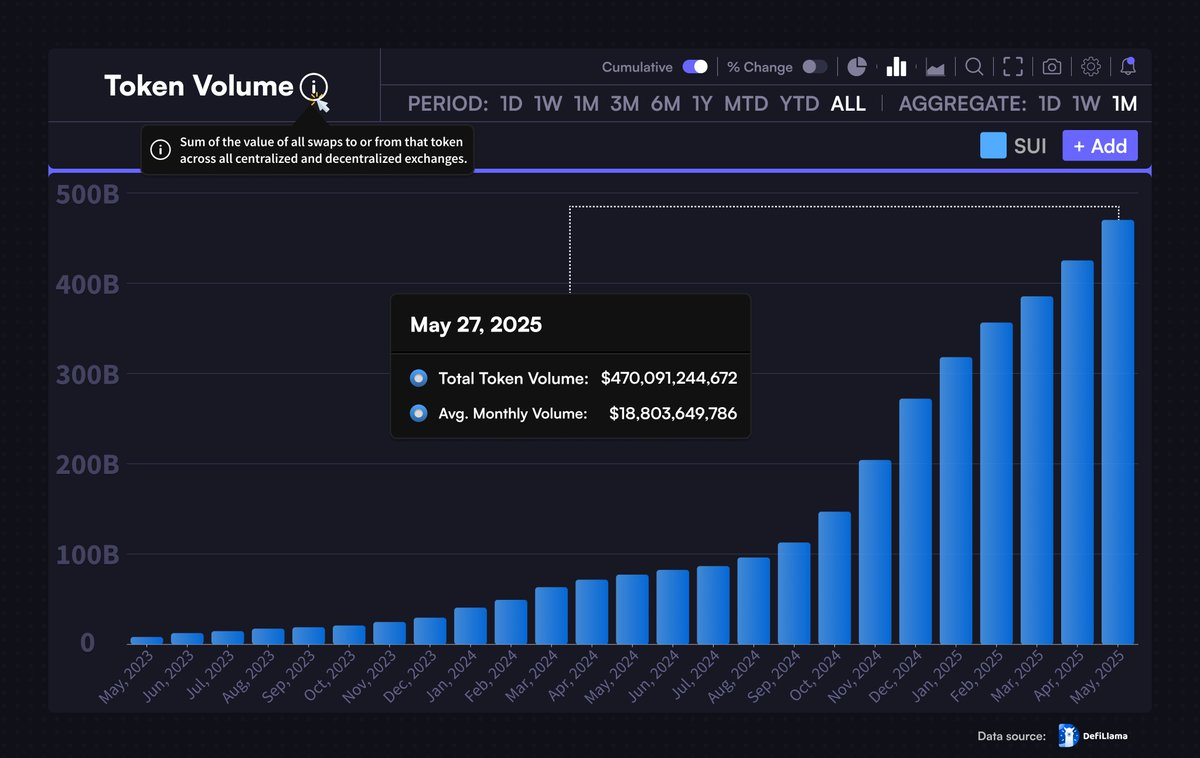

Chain activity often reflects this risk aversion. Leverage tends to fall, exchange inflows rise, and trade volumes tend to decrease during periods of geopolitical stress.

These metrics praise investors’ flights and risks.

The dollar and bitcoin chart when the Russian-Ukraine war began. Source: Sky News

Macrocatalysts exacerbate volatility in the crypto market

If US military action in Iran leads to wider regional conflicts, it could also spike oil prices and inflation expectations. It would either slow down the Federal Reserve cuts or put pressure on them to consider tightening again.

The higher the energy price, the more likely the consumer inflation rate will exceed the Fed’s 2% target. In particular, WTI crude has already shown sensitivity to Middle Eastern headlines.

War-driven supply shocks can disrupt shipments and increase input costs worldwide.

In that scenario, the Fed will face a difficult trade-off between economic stability and inflation control. The long-term attitude of Hawkish drives actual yields and suppresses code evaluations.

The US Treasury yield is already nearly 4.4% in a 10-year note, and could increase even further as war spending expands the fiscal deficit. The US national debt exceeds $36 trillion, causing long-term debt repayment risks.

Meanwhile, the US Dollar Index (DXY), which is currently hovering around 98.3, could be further strengthened as global investors seek dollar-controlled security.

The high dollar has been historically bearish for Bitcoin and altcoin, especially in emerging markets where capital outflows continue to rise in the dollar.

The crypto market also tends to suffer when traditional stock volatility rises.

The benchmark fear gauge VIX usually rises during periods of war or crisis. This tightens the risk budget and causes margin calls across crypto exchanges.

The long-term route depends on the duration of the battle and the Fed’s response

If US intervention is concise and leads to a quick ceasefire, the market could bounce back. Bitcoin has historically recovered within four to six weeks of its initial shock, as seen in past conflict-related slumps.

However, if the war is dragged or spreading in the region, crypto could face long-term volatility, reduced liquidity and price suppression.

Investors’ desire for speculative assets may remain low until geopolitical clarity returns.

That said, persistent inflation from war-related turmoil could revive Bitcoin’s narrative as a long-term hedge against Fiat’s weakness.

However, this bullish case is directly competing with stricter monetary policies, limiting the rise in risk-on assets.

Institutional influx may suspend or decline under such conditions. CME futures positioning, Stablecoin Supply, and L2 on-chain flow will be key indicators of emotional change over the coming weeks.

Important levels to monitor include $100,000 psychological support for Bitcoin and $2,000 zone for Ethereum.

If it breaks, technical sales could promote downward pressure on all major tokens.

USD index for the past 6 months. Source: MarketWatch

What do you see now?

Investors need to track closely:

- Oil price movements and forward contracts.

- FED statement on inflation and pricing policies.

- The results of the Ministry of Finance auction and bond yields will expand.

- Exchange cryptographic leaks and use them.

- VIX and Global Risk Indicators.

If the US participates in a conflict, the short-term future of Bitcoin may be determined by macro conditions rather than by cryptographic fundamentals.

Traders need to prepare for volatility, maintain hedges and monitor geopolitical developments in real time.