table of contents

what happens $ETH Will the price chart appear now? Where is the key? $ETH Support level?Why? $ETH Downturn despite record network activity? How will institutions and large holders be affected? $ETH Price? What’s going on with BitMine and why does it matter? Are ETFs adding more downward pressure? Is someone accumulating? $ETH How low is it now? $ETH You can navigate here Resources FAQ

Ethereum If selling pressure continues and demand remains weak, we could see a decline towards the $1,500 to $1,800 range. $ETH teeth Trades for less than $2,000 After losing about 30% in the last 7 days. This decline is occurring even as the Ethereum network is recording its highest activity levels ever, creating a clear gap between usage and price.

what happens $ETH Will the price chart be visible now?

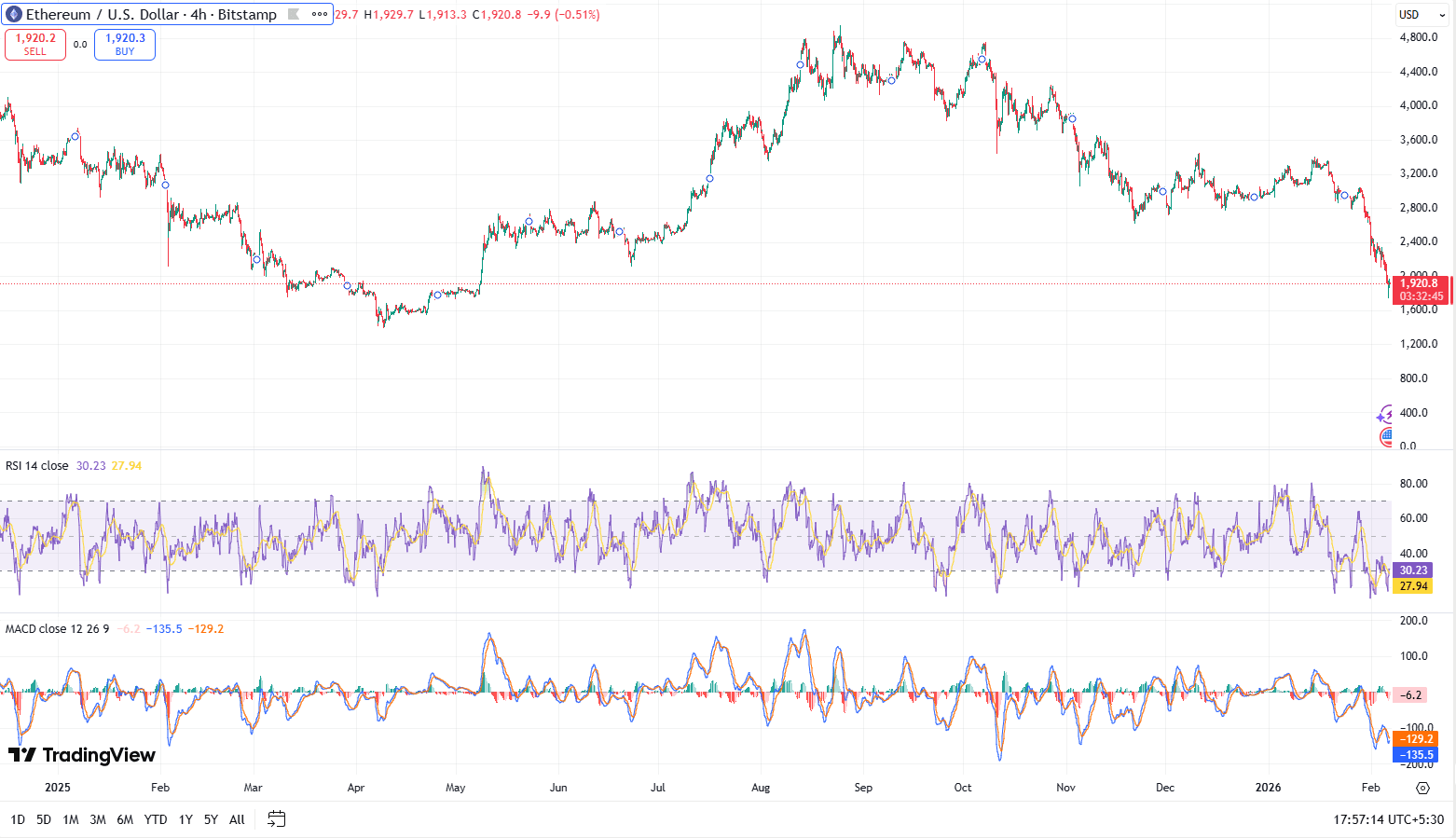

On the 4 hour chart, $ETH The steady downward trend continues. The price fell below the $2,000 support zone but was unable to regain it despite multiple attempts.

$ETH Price chart (Image: TradingView)

Momentum indicators continue to support weakness.

- RSI is near 30, indicating oversold conditions, but no bottom confirmed

- MACD remains negative, indicating bearish momentum remains active

- Market structure continues to form highs and lows

Oversold numbers alone do not signal a reversal. In past drawdowns, $ETH It remains oversold for an extended period of time as liquidity continues to drain from the market.

where is the key $ETH Support level?

Based on historical trading activity and liquidation data, several price levels stand out.

- $1,800: Psychological levels and previous support zones where the price has reacted multiple times

- $1,650 to $1,700: Congested area from early accumulation stage

- $1,500 to $1,550: High-risk liquidation zones flagged by derivatives data

Liquidation risk still exists between $1,509 and $1,800. A move within this range could trigger forced selling from leveraged positions and increase downside volatility.

why is this so $ETH Decline despite record network activity?

Ethereum is currently in its most active phase on-chain.

According to cryptoquantThe number of Ethereum transfers, measured on a 14-day moving average, reached an all-time high of 1.1 million this month. Transfer count refers to the total number of token movements on the network and is often used as a proxy for usage.

This data shows strong network adoption. However, prices are determined by capital flows, not just usage.

Retail demand fell sharply. Many traders close positions instead of opening new ones. This shift was also visible in the derivatives market, where open interest in futures fell from $26.3 billion to $25.4 billion in one day.

The combination of high activity and weak demand often leads to price compression rather than a quick recovery.

What impact do institutions and large holders have? $ETH price?

Large holders are increasing short-term selling pressure.

Trend research, sales 170,033 $ETH ($322.5 million) in the past day, still holding 293,121 $ETH ($563 million), According to on-chain data. Analysts are linking the move to a sale and loan repayment.

Other notable sales include:

- Aave founder Stani Kulechov said: Sales 4,503 $ETH Average price is $1,857

- Vitalik Buterin Sales 2,961.5 $ETH $6.6 million in 3 days, average price $2,228

These trades are not a sign of panic, but they do increase circulating supply when demand is weak.

What’s happening at BitMine and why does it matter?

BitMine Immersion Technologies is the largest financial company specializing in Ethereum. Holds approximately 4,285,000 pieces $ETHor approximately 3.55% of Ethereum’s circulating supply.

The company has accumulated $ETH Estimated cost is $15.65 billion. At current prices, that position is worth about $9 billion, with $6 billion to $8 billion remaining. unrealized loss. BMNR stock has fallen 88% from its July high.

Important details provide context.

- $ETH The holdings were acquired through stock issue rather than debt.

- Approximately 2.9 million $ETH staked and generates an estimated $188 million in annual staking revenue

- BitMine has $538 million in cash and added $41,788 $ETH last week

CEO Thomas Lee said unrealized losses during economic downturns are part of a long-term financial strategy, similar to index funds during market downturns. Still, large government bond holders remain a risk factor if liquidity conditions worsen.

Are ETFs adding further downward pressure?

yes. spot $ETH There has been a consistent outflow of funds from US exchange-traded funds (ETFs) since January 20th.

SoSoValue data show spot $ETH The ETF recorded net outflows of $80.79 million on February 5th. Of this amount, Fidelity’s FETH accounted for $55.78 million.

ETF outflows represent passive selling rather than discretionary trading, adding steady pressure without a rapid reversal.

Is anyone saving money? $ETH Now?

Some long-term investors and whales are piling up money $ETH selectively.

On-chain data shows that accumulation is seen during price declines while short-term traders continue to exit. This pattern is often seen during mid-cycle corrections rather than the market’s final bottom.

Accumulation can limit long-term declines, but cannot stop short-term drawdowns.

how low $ETH You can go from here

Based on the current chart structure, derivative data and on-chain flow, $ETH If selling pressure continues, the pair could test the $1,500 to $1,800 range. Momentum remains bearish, demand is weak and large holders are adding supply to the market.

At the same time, Ethereum network activity is at record highs, liquidity supply continues to dwindle due to staking, and some long-term investors are piling up capital. While these factors can help stabilize the market over time, they cannot prevent further declines in the short term.

For now, $ETH Prices react to liquidity conditions, not network usage.

resource

Ethereum on TradingView: $ETH price action

Report by CryptoQuant: Ethereum Transfers Surge: A Historic Warning Sign?

Arkham’s Vitalik wallet data: For details $ETH movement

Report by Benzinga: Tom Lee’s Bitmine drops $6 billion in Ethereum, but here’s why he keeps buying