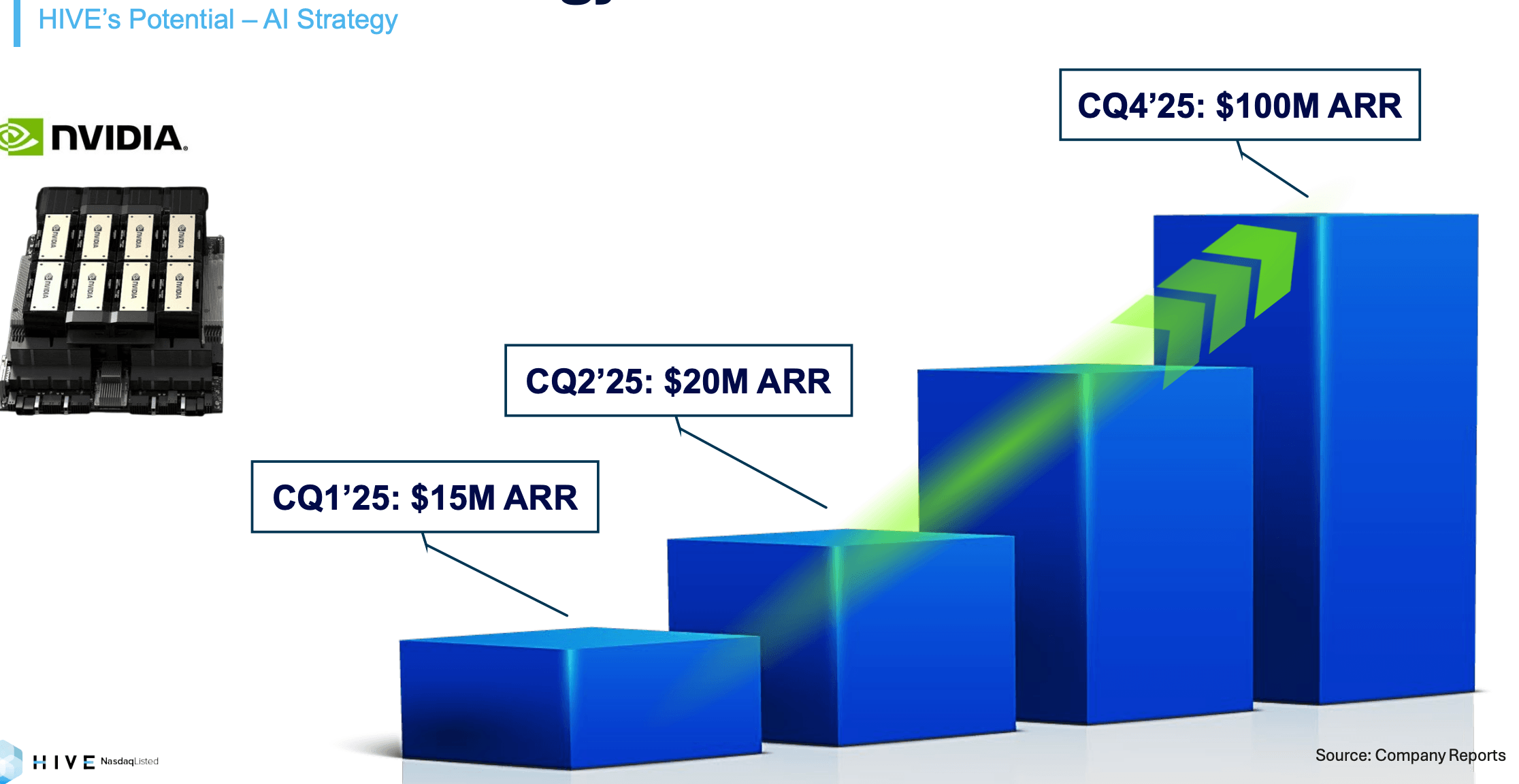

Hive Digital plans to increase its hash rate four times by September 2025, potentially placing the size into the top 10 public Bitcoin miners. At the same time, HPC has an ARR target of $100 million. Is this small miner an opportunity that is often overlooked?

Hive Digital aims for expansion and HPC revenue

The following guest posts are posted by bitcoinminingStock.io, a one-stop hub for all of Bitcoin Mining Stocks, Educational Tools and Industry Insights. Originally published on February 27, 2025, it was written by Cindy Feng, author of bitcoinminingstock.io.

For a long time, the biggest name in Bitcoin mining has attracted all the attention, but what about small names? This year I’m launching a new series to spotlight small miners who often fly under the radar. Some of these companies could rise as future stars, while others struggle to survive. Understanding them now can help you uncover hidden opportunities and learn valuable lessons. This series breaks down the fundamentals of their business, financial, strategic orientation and market positioning. It gives you a clear, unfiltered view of their strengths, weaknesses and potential investments.

First: Hive Digital Technologya multilisted Bitcoin miner exposed to both mining and high performance computing (HPC).

Company overview

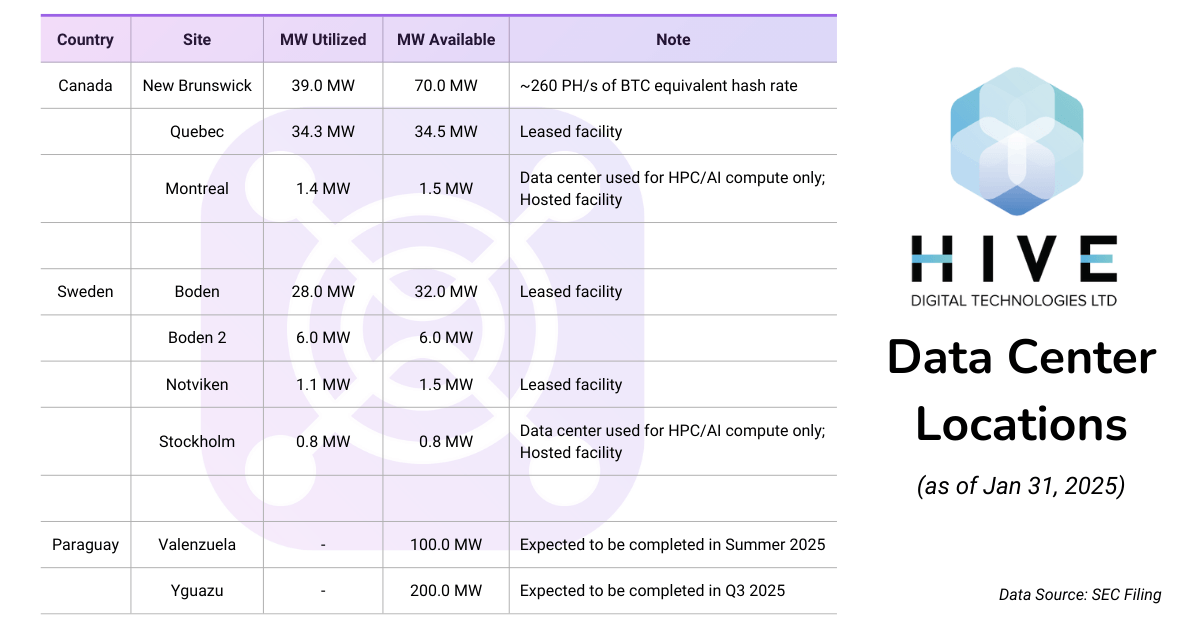

Hive Digital Technologies (TSX.V: HIVE; NASDAQ: HIVE) is a public data center operator focused on digital asset mining and HPC. In December 2024, we announced that our headquarters would be relocated. San Antonio, Texas, USA. The company has data centers based on multiple regions Canada, Sweden and soon Paraguay. It is known for that Commitment to green energy, It mainly utilizes hydroelectric power and geothermal power to promote its operation.

Business Arm

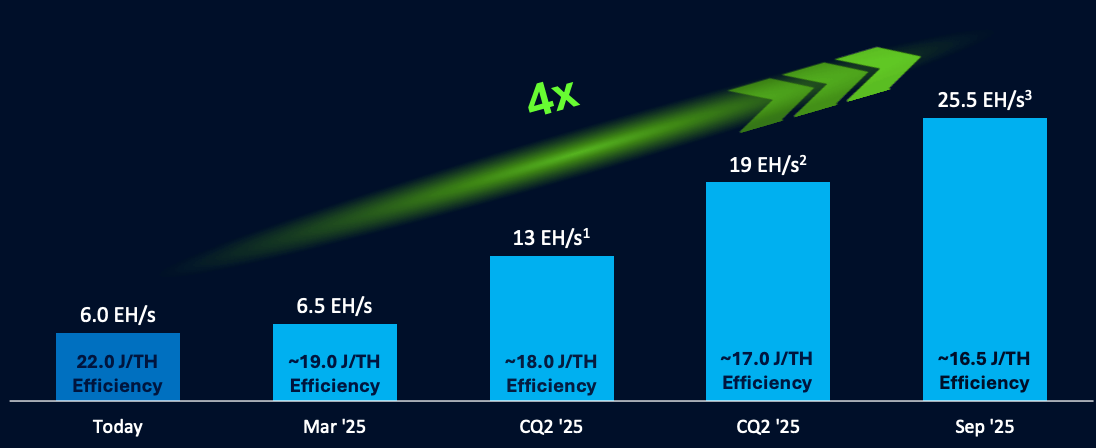

- Mining operations:We operate the total hashrate 6 eh/ss (as of January 31, 2025) there is an aggressive expansion plan to reach it 25 eh/s by September 2025.

Hive Plan for 4x Hashrate Growth by September 2025 (screenshots from company presentation)

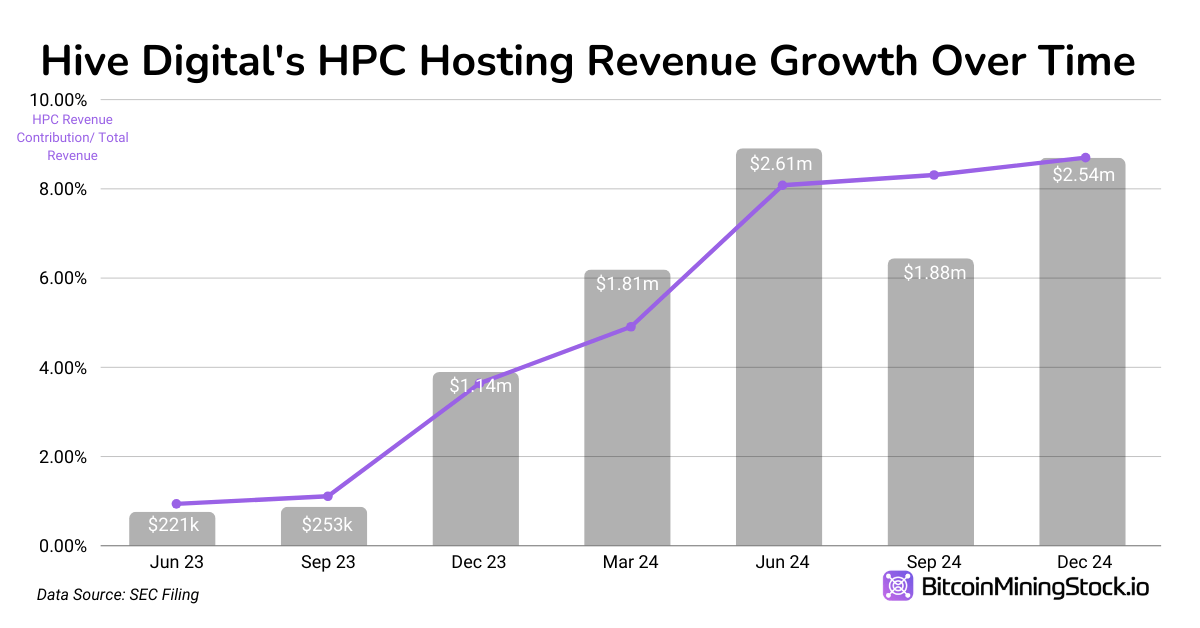

- HPC & AI Computing:Hive was one of the first public miners to pivot into HPC, leveraging their expertise in GPU-based Ethereum mining. As early as 2023the company reported revenue of $1.61 million from HPC Hosting. Today, HIVE continues to use existing data centres in Montreal (Canada) and Stockholm (Sweden) for HPC services. Additionally, the company will offer GPU server rentals through Marketplace Aggregators and explore new cloud service services.

Financial highlights: Declining revenue and increasing profitability

Note: Hive presents financial comparisons over various periods within it Latest Reports. Income and Loss Statement Following a typical comparison of the previous year (December 31, 2024, December 31, 2023), Balance sheet Meanwhile, it will be compared to March 31, 2024 Cash flow statement Use a 9-month comparison (December 31, 2024, December 31, 2023). To ensure consistency and promote meaningful analysis, this report focuses primarily on available year-over-year comparisons.

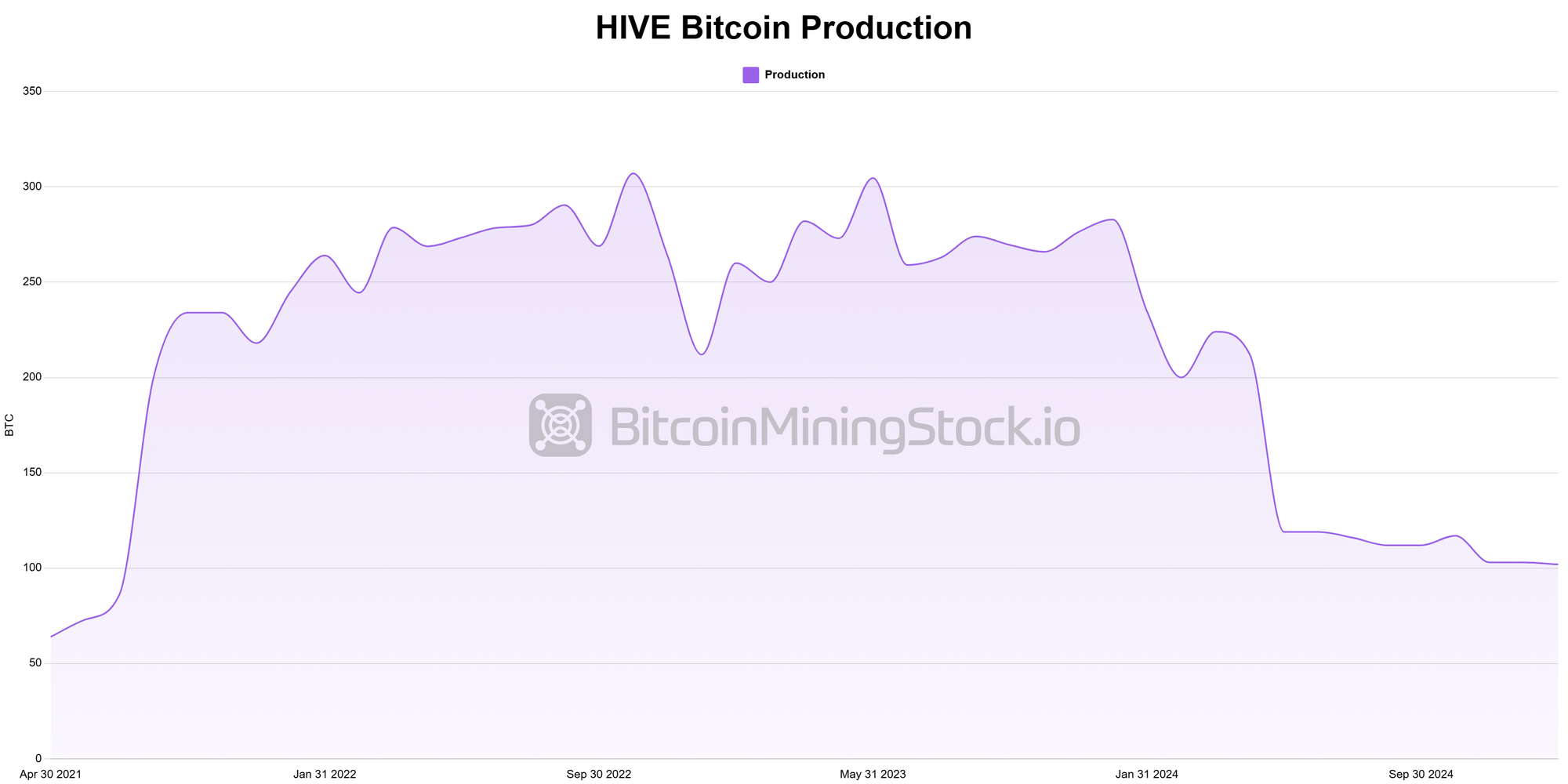

Hive Digital Technologies’ third quarter of 2025 (October 1 to December 31, 2024) saw a decline in revenue compared to the previous year. The main reason for the decline was low BTC production due to the Bitcoin Harving event in April 2024. However, the company has undergone a major shift in net profit ($1.27 million vs. $6.95 million), benefiting from rising Bitcoin prices, HPC business and cost optimization.

Key Income Statement Indicators

- Revenue: $29.2 million (-6.5% year-on-year) vs. $31.3 million for the third quarter of 2024. This reduction is Bitcoin mining revenue decline (previously -11.3%) Following Bitcoin Harving in April 2024, production is low (BTC vs. 830 BTC in the third quarter 2024). but, Bitcoin price rise And strong HPC Revenue Growth (+123.6% reached $2.5 million in the previous year) offset the decline.

- Adjusted EBITDA: $17.3 million (vs. ($17.4 million for the third quarter of 2024).

- Net profit: $1.3 million (vs. ($7.0 million net loss for the third quarter of 2024). The swing to profitability was driven by a A $6.9 million increase in asset sales, Forex profit of $5.7 millionimproving cost-effectiveness despite lower gross profit margins than last year.

- Total margin: 21% (vs. 36% of the third quarter of 2024))is affected by a Rapidly increasing network difficulty (99.9t vs. 64.1t Yoy) and Higher energy costs, In Sweden, especially, changes in tax policy have led to increased electricity costs.

- Bitcoin production: 322 BTC (-61% before) vs. 830 BTC for the third quarter of 2024 Bitcoin Harving Event Reduced mining rewards despite improved overall hashrate and efficiency of hives.

Public Bitcoin Miner historical data is available at bitcoinminingStock.io.

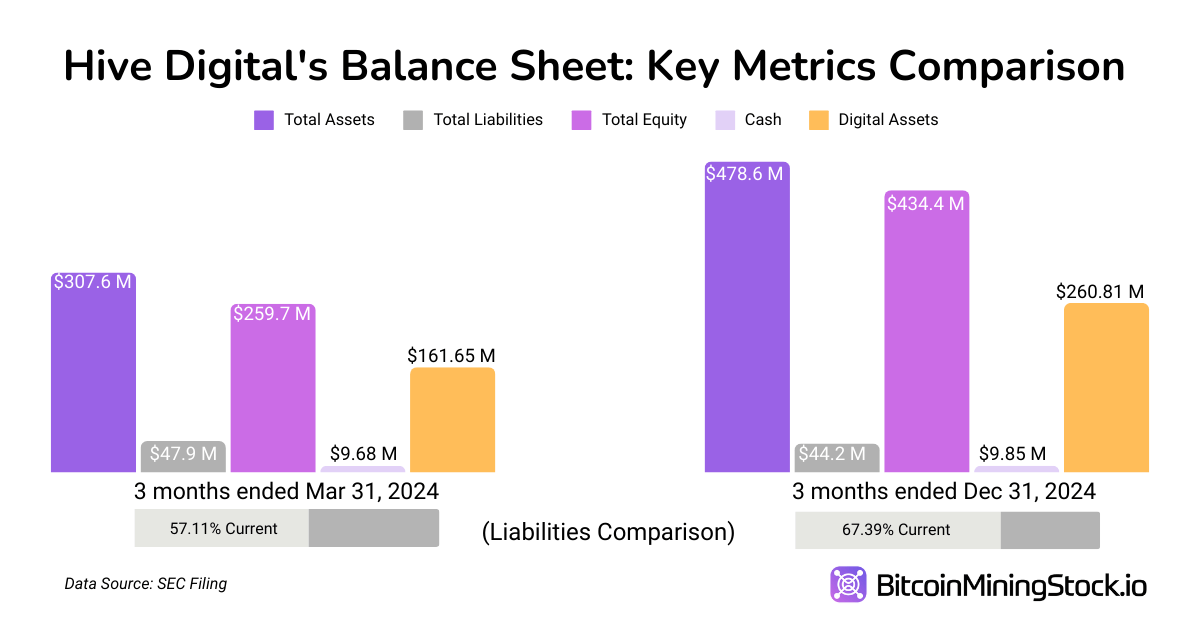

Key Balance Sheet Metrics (3 months ended December 31, 2024, 3 months ended March 31, 2024)

- Total assets: 478.6 million dollars (+55.6%) vs. $307.6 million. Increased was driven Higher Bitcoin Holding (2,805 BTC) and Continuous investment in mining infrastructurein particular Paraguay’s fleet upgrades and new data center expansion.

- Current Total Debt: 29.8 million dollars (+8.8% ) vs. $27.4 million. The increase is reflected Higher short-term obligations related to infrastructure investment.

- Long-term debt: 14.4 million dollars (-29.8%) vs. $20 million. The decline is due to continued debt repayments and improves the Hive’s financial stability while maintaining sufficient liquidity for expansion.

- Shareholder fairness: $434.4 million (+67.3%) Against $259.7 million. Equity growth was driven by successful stock offerings, higher asset valuations and sustained revenue.

- D/E ratio:0.10 (vs. 0.18). The company maintained very low leverage, Use Equity Raise Not debt to fund expansion.

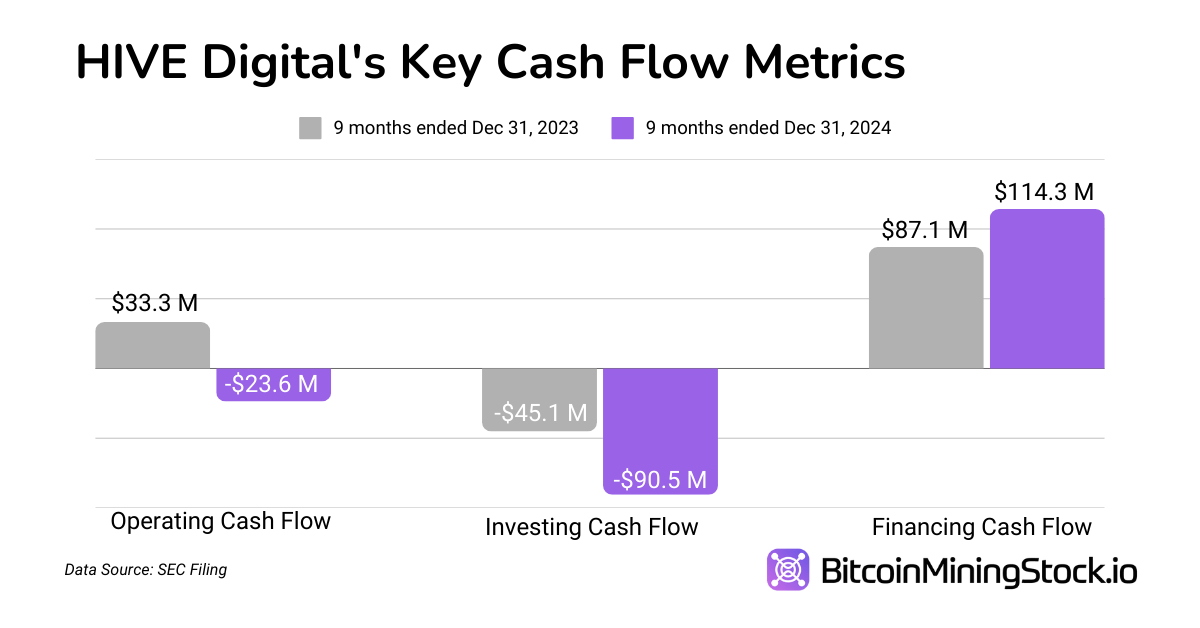

Key Cash Flow Metrics (9) (Months ended December 31, 2024, and 9 months ended December 31, 2023)

- Operating Cash Flow: $23.6 million outflow (vs. (Inflow of $33.3 million). This shift to negative operating cash flow was due to lower BTC sales and increased working capital needs.

- Cash flow investment: 90.5 million dollars of leaks (vs. – $45.1 million). Hive Double capital investmentallocates $59.6 million to new mining equipment and acquires Sweden’s Boden 2 data center as part of its long-term expansion strategy.

- Cash flow financing: $114.3 million inflows (vs. $87.1m). Hive raised $110 million through stock offerings, repaying $3 million in loans, and maintaining a strong cash job for future infrastructure.

Main metrics

Hive Currently, the market capitalization is $385.4 million. (Marketing closure on December 31, 2024)). To better understand that valuation, we compare it with key financial metrics.

- Enterprise Value (EV): $158.97 million (market capital + debt – cash and Bitcoin holdings). Hive trading EVs per mined BTC of $89,834close to the market price of BTC. Once Hive successfully executes its expansion and HPC strategy, current underestimation offers potential reassessment opportunities.

- EV/evits ratio: 7.6x ($158.97m/$20.7m)

- Issued shares: 140.20m (+32%)

- EPS: $0.00988 (Improved from previous – $0.0788)

- P/S ratio: 13.2x ($385.4m/$29.2m)

- BTC held per market capitalization: 67.5%, or most of that valuation, is directly linked to BTC reserves.

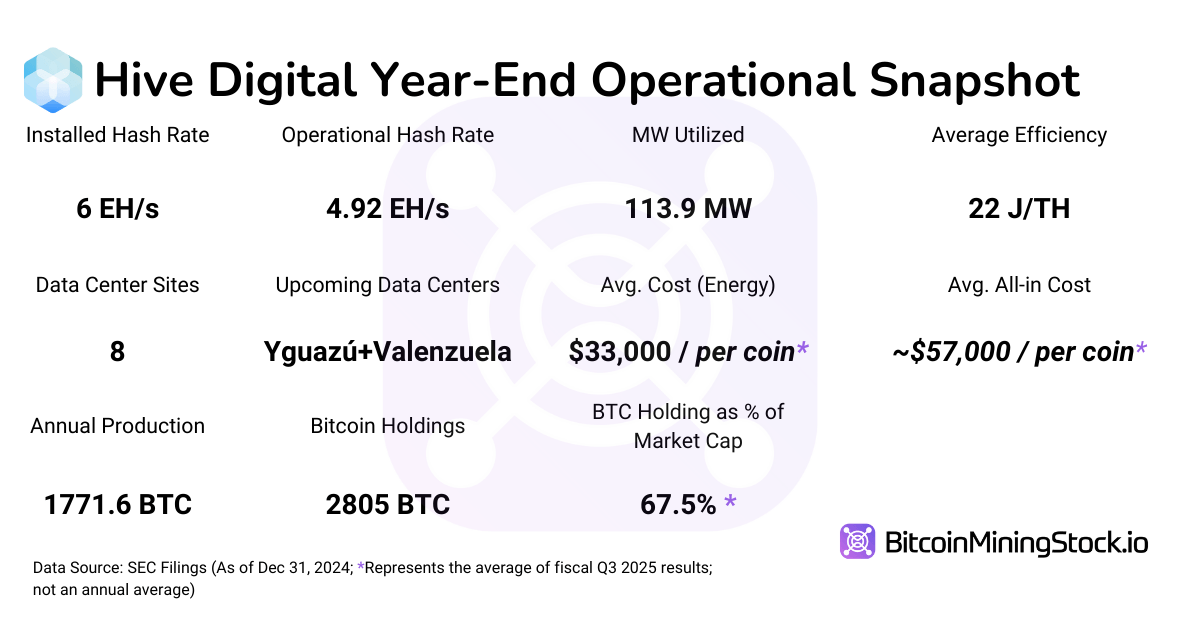

Operational Indicators: Hash Rates and Efficiency

Key hashrates and efficiency indicators:

- Hash rate: 6 eh/s, with target 25 eh/s by September 2025.

- Fleet Upgrade: The 11,500 units of Avalon A1566 ordered in October and November 2024 (6,500 of which were rolled out by February 11, 2025)

- Average efficiency: 22 j/thIt is expected to improve 16.5 j/th By September 2025.

- Direct energy costs per BTC: $33,000

- Total cost per BTC (including depreciation and financing): ~$57,000

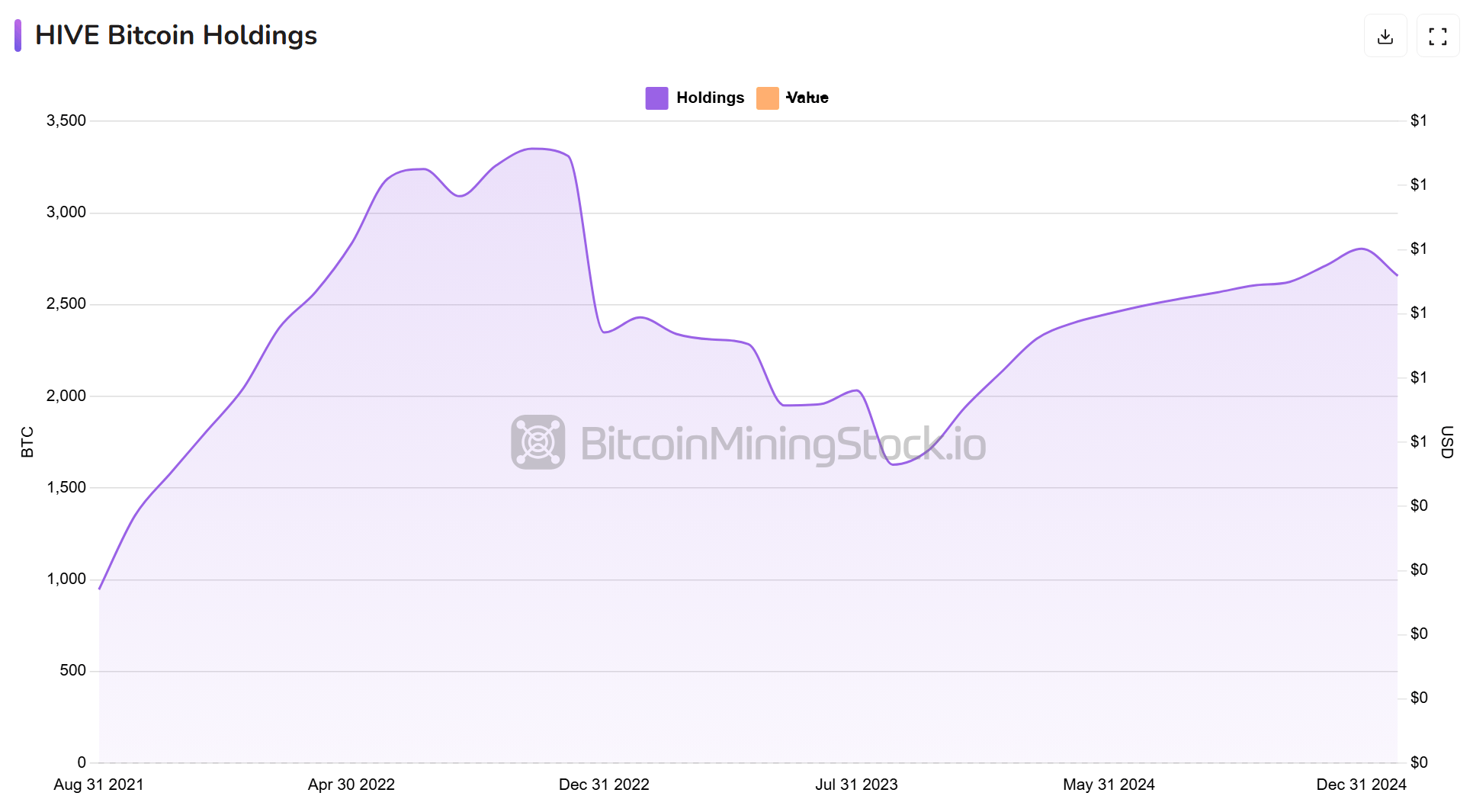

Key digital asset holdings and sales data:

- Total Bitcoin was retained: 2,805 BTC (mining with clean energy without being disturbed).

- BTC was sold during the quarter: ~$8.4 million vs 2023 ~$30.7m

- Funding work: Stock funding of $121 million, not excessive BTC sales.

- Coins are stored at FireBlocks Inc., not exchanged

- There is no pledge Or staking BTC Holdings

*Hive still has 371K worth other coins (such as + others)

Strategic moves

BitFarms Site Acquisition at Paraguay: Core Growth Engine

Acquiring the Bitfarm facility is “a formative step towards a strategy of having 25 EH/s by September.” Transactions include a 200mw Hydroelectric power generation Mining Site (still under construction) In Iguaz, ParaguayUpon completion, the operating capacity of the Hive in Paraguay will be summed 300MWIt will be one of the largest Bitcoin mining businesses in Latin America.

Management is also strengthening this Paraguay remains the main focus of scaling operations. As CEO Aydin Kilic said, “We see opportunities in the US for a more favorable regulatory environment, but our main focus is now relying on Paraguay’s scaling operations.”

Expansion Roadmap:

- 100MWYguazú Phase 1 (April 2025): Added 6 eh/s.

- 100MW Valenzuela (June 2025): Added 6.5 EH/s.

- 100MWYguazú Phase 2 (September 2025): Added 6.5 EH/s.

- Target Fleet Efficiency: 16.5 j/th by September 2025.

Paraguay’s HiveDigital Expansion Roadmap (Screenshots of the company website)

Investment in HPC and AI infrastructure: Small but growing

It’s still small, but AI/HPC revenue is Grows rapidly. The Hive has reached $2.5 million Revenue This is a project that is expected to reach the third quarter of 2025 (an increase of 124% from the previous year) from HPC operation. $20 million $100 million in annual revenues by the next quarter and the end of 2025.

Hive’s HPC/AI Revenue Growth Projection (screenshots of company presentations)

Current infrastructure:

- 4,000 GPUs in use (including NVIDIA A4000, A5000, A40, and H100)

- 508 NVIDIA H200 GPUs are expected in the first quarter of 2025 (added $9 million to topline revenue after rolling out)

- As preparation to position yourself for the next generation liquid-cooled nvidia blackwell GPU

- NVIDIA Cloud Partner status has been ensured and reliable.

Unlike peers that focus on partnerships with HyperSchoolers, HIVE plans to rent directly to end users for LLM calculations via on-demand marketplace aggregators, in addition to offering HPC hosting. This business segment continues to be developed and expanded.

Other notable changes:

- main office transfer To San Antonio, Texas. According to executive chairman Frank Holmes, “Hive feels it operates safer in the US given the changing government’s support for the independence of Bitcoin mining, blockchain networks and digital assets.”

- I will move to US GAAP Report At the end of the fiscal year on March 31, we will improve transparency and comparability with other Bitcoin miners. “Personally, I really like this move because it helps standardize financial reporting and make inter-company analysis more reliable.

For example, hive Latest Investor Presentations It emphasizes “best in class ROIC” and “lowest company G&A”, but my manual calculations give different results. The main difference is that Hive uses adjusted non-IFRS metrics, excluding costs such as depreciation, stock-based compensation, and Bitcoin fair value adjustments.

To ensure objective comparisons, this report excludes such metrics and focuses on standardized financial data. The move to GAAP should increase the clarity of investors who value the hive against their industry peers.

Final thoughts

Hive offers a Dynamic blending of Bitcoin mining and HPC servicesPlace it for both significant growth and inevitable volatility. From a balance sheet perspective, the company remains financially conservative with a low D/E ratio; It relies heavily on equity rises Funding the Capital Intensive Expansion Plan (four times by September 2025). Development in Paraguay could significantly increase mining capabilities, place them in the top 10 public miners in terms of scale, and increase industry visibility. This transition may be helpful in conjunction with the US transition to GAAP reporting and the relocation of headquarters to Texas Attract investors who want regulatory clarity and transparency.

Hive’s Bitcoin mining business demonstrates both strengths and challenges. The company is currently benefiting Lower average Bitcoin production costseven when compared to CleanSpark, one of the most efficient miners. Increased fleet efficiency, increased scale and reduced power costs in Paraguay could make its mining operations more competitive across the industry. but, Development of the Paraguay site It is subject to potential delays from unexpected circumstances, and Bitcoin prices remain extremely unstable. Given the current low gross profit, A drop in Bitcoin prices can put a lot of pressure on profitability.

At the same time, hive HPC Businessalthough he is still a small contributor, he has gained traction, A meaningful revenue driver. The company is actively expanding this segment by introducing new cloud services offerings and scaling AI computing operations. If Hive successfully attracts and reaches high-value AI customers A $100 million annual revenue target By the end of 2025, HPC business will provide a stable marginal revenue stream and help offset the volatility of Bitcoin mining. But this The target is very ambitiousthe company generated just $8.84 million from HPC in 2024, so it needs to grow nearly 10 times within a year.

For risk-resistant investors, particularly for investors who are optimistic about long-term Bitcoin price trends and the evolving AI ecosystem, this could be an attractive, high-risk, high-reward speculative opportunity. However, its success depends on Bitcoin Price, Effective execution The expansion plan In Paraguay,and Growth of HPC Business. Investors need to closely monitor these factors as they will be important in determining the future performance of the Hive.